Income Tax Rates Vancouver Canada

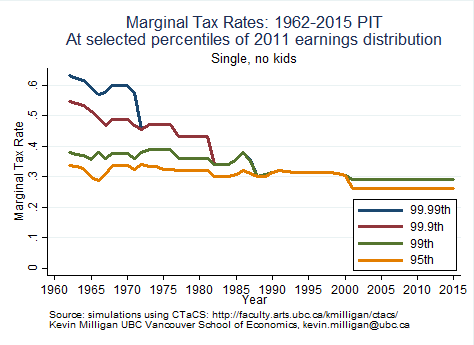

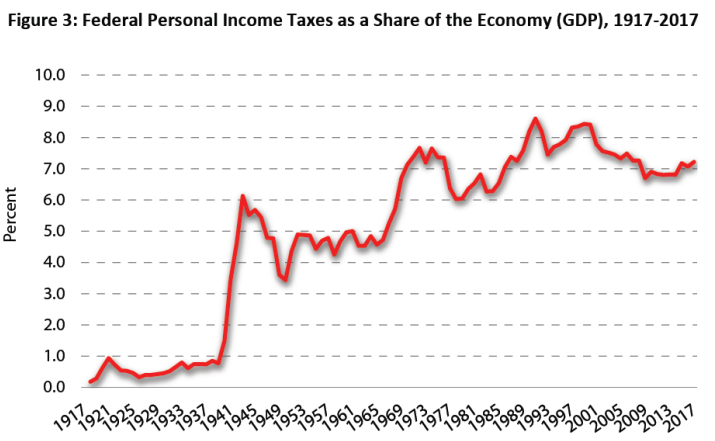

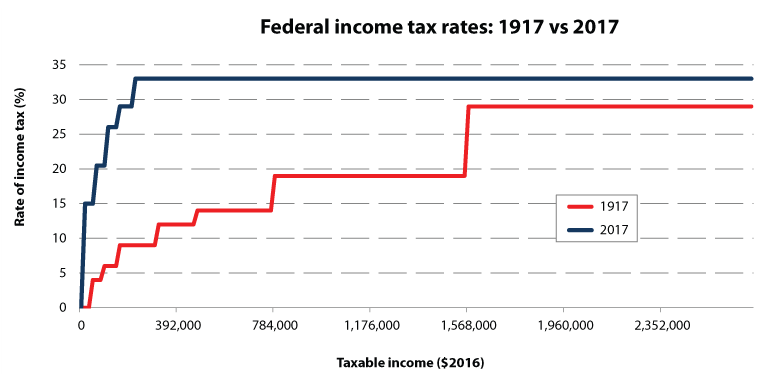

Among the changes for the 2016 tax year the federal government added a new income tax bracket raising the top tax rate from 29 to 33 percent on incomes over 200 000.

Income tax rates vancouver canada. Tax assessment year the tax assessment year is defaulted to 2020 you can change the tax year as required to calculate your salary after tax for a specific year. After tax income is your total income net of federal tax provincial tax and payroll tax. The basic personal tax amount cpp qpp qpip and ei premiums and the canada employment amount. This means that you are taxed at 20 5 from your income above 48 536 80 000 48 536.

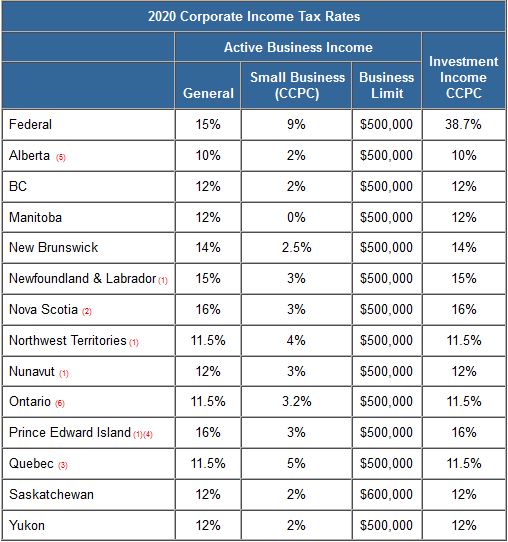

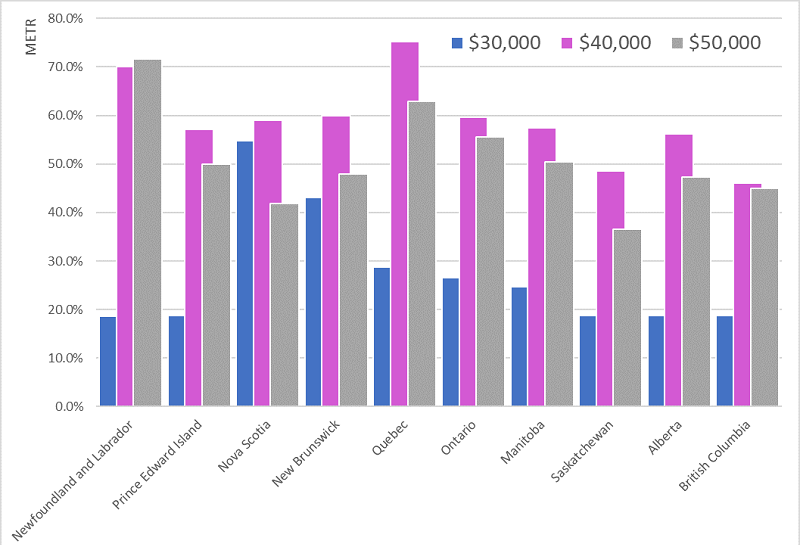

Any additional income up to 97 069 will be taxed at the same rate. Federal tax rates are progressive up to 33 for 2016 27 56 for residents of quebec. In december 2015 canada s new liberal government introduced changes to canada s personal income tax system. But how much is the canadian tax threshold.

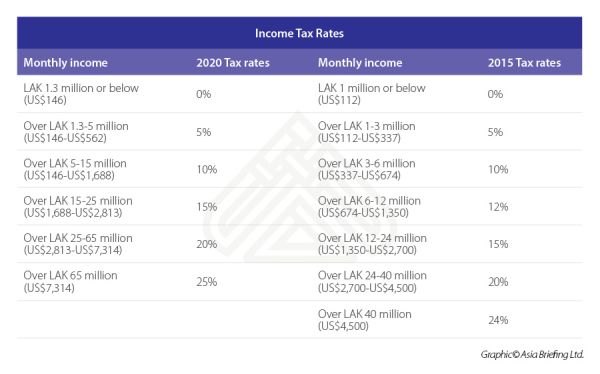

For example if your taxable income is more than 41 725 the first 41 725 of taxable income is taxed at 5 06 the next 41 726 of taxable income is taxed at 7 70 the next 12 361 of taxable income is taxed at 10 5 the next 20 532 of taxable income is. Budget 2020 proposes adding a new tax bracket for income above 220 000 at a rate of 20 5. Provincial territorial tax rates also are progressive with the maximum rate in the range of 11 25 25 75 for 2015. What are the taxes in vancouver.

These calculations are approximate and include the following non refundable tax credits. Number of children and number of children who qualify for dependents allowance. Vancouver s richest will have to pay more income tax as british columbia seeks to quell outrage over its prohibitive cost of living the canadian province will now tax income above c 220 000. You will find the provincial or territorial tax rates on form 428 for the respective province or territory all except quebec.

Up to 29 for 2015 24 215 for residents of quebec. You can earn up to 12 069 for 2019 without paying federal tax on your income provided you are entitled to personal tax credits. Rates are up to date as of april 28 2020. Your age you age is used to calculate specific age related tax credits and allowances in canada.

Advanced features of the canada income tax calculator. Tax rates are applied on a cumulative basis. Ontario also imposes a surtax of up to 56. For 2019 and later tax years you can find the federal tax rates on the income tax and benefit return.