Income Statement Loan Costs

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

However if a business took out a loan to purchase the company the interest they pay back on the loan will go on the company s income statement as an expense.

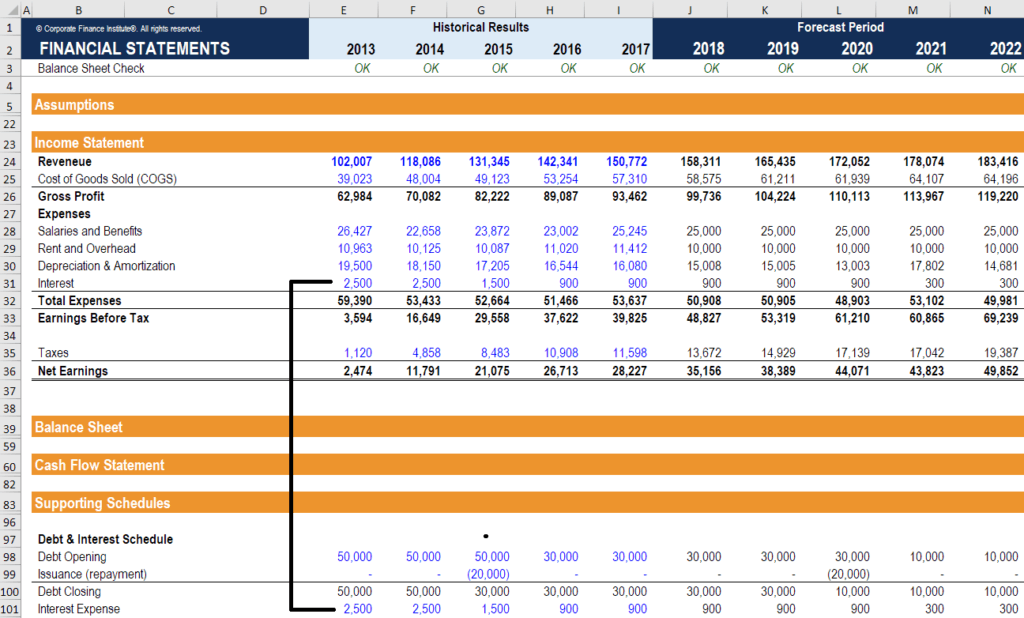

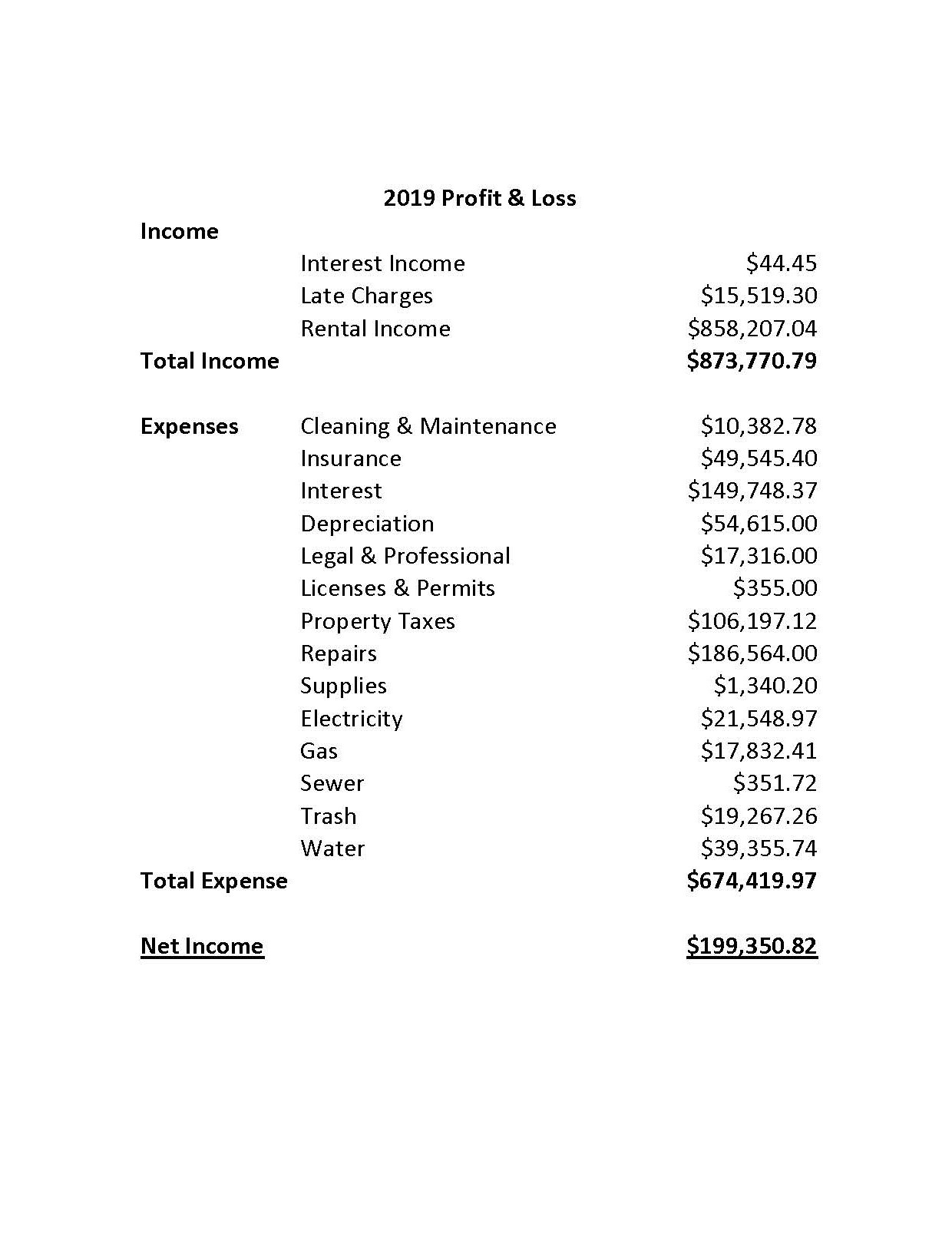

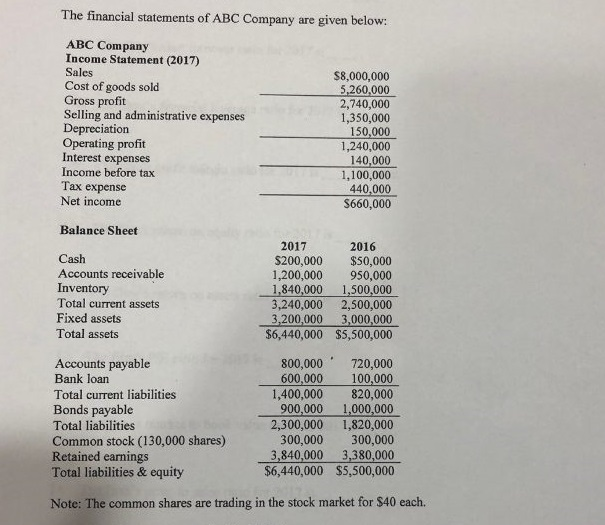

Income statement loan costs. The loan will begin on march 1 and the entire 4 million of principal will be due five years later. Example of a loan principal payment. Amortization of financing costs is the process of allocating financing costs over the life of the loan to the income statement. In this section we focus our attention on how this accounting is carried out in the balance sheet and income statement.

The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. The production process gives rise to many costs that do not exist in a merchandising company and some how these costs must be accounted for on the manufacturing company s financial statements. This practice runs counter to generally accepted accounting principles gaap and puts banks at risk of being out of regulatory compliance on call reports. Amortization and depreciation amortization is the process of transferring the cost of intangible assets over to expenses over an extended period of time.

This does not change the classification or presentation of the related amortization expense which over the term of borrowing will continue to be classified within interest expense on the income statement. You ve presented your operating results the very core results of your business and everything supporting it and now you show what s the extra bit you do with your funds. Both the receipt of the loan principal amount and the repayment of the loan principal will be reported on the statement of cash flows the interest on the loan will be reported as expense on the income statement in the periods when the interest is incurred. Financing costs are accumulated as an intangible asset in the other assets section of the balance sheet.

Monthly income monthly expenses 1. The practice of many banks is to immediately recognize loan origination fees and costs directly to income and expense at the time of loan origination. Include your spouse s income only if your spouse contributes to your household income. Your loan holder has the authority to determine if the claimed amount of any expense is reasonable and necessary.

Amortization of debt issuance costs shall be reported as interest expense. Example of amortizing loan costs. Let s assume that a company borrows 10 000 from. Before entering your monthly income and expenses carefully read the entire form including sections 5 6 and 7.

Financial expenses and income on your income statement are the last group of results presented just after the operating profit. Amortization is charged to one of the accounts in the capital costs section of expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/Screenshot2019-08-21at10.58.51AM-049e1ab335434a16ab7ddc69664758a7.png)

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)