Income Tax Thresholds 2020 21 Gov Uk

240 per week 1 042 per month 12 500 per year.

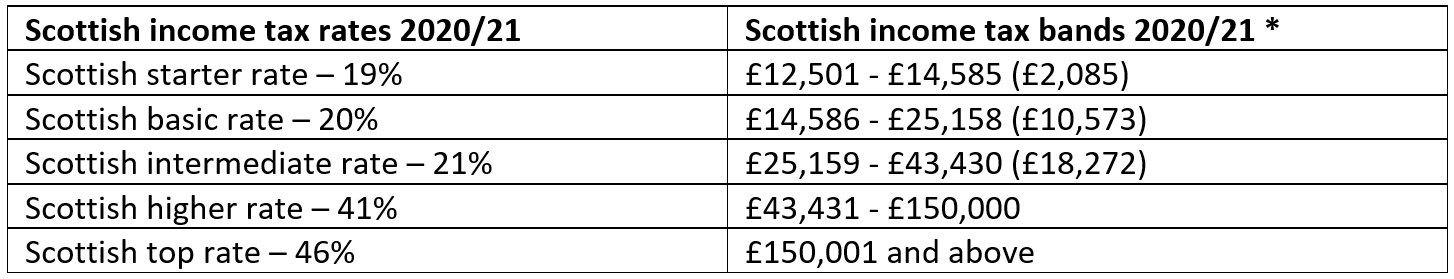

Income tax thresholds 2020 21 gov uk. These rates come into effect at the start of the new tax year on april 6th 2020. Tax rates and thresholds for years 2020 21. 20 on annual earnings above the paye tax threshold and up to 37 500 english and northern irish higher tax rate 40 on annual earnings from 37 501 to 150 000. 40 on income between.

20 on income between 12 501 and 50 000 1 you pay tax on 37 500. The personal allowance is 12 500. 20 on income between 12 501 and 50 000 1 you pay tax on 37 500. Basic rate tax the lowest level of income tax paid above the personal allowance.

Increase to 12 500 and 50 000 in 2019 20 and 2020 21 and have been. Employment income self employed income income from property rentals other untaxed income. English and northern irish basic tax rate. Band taxable income tax rate.

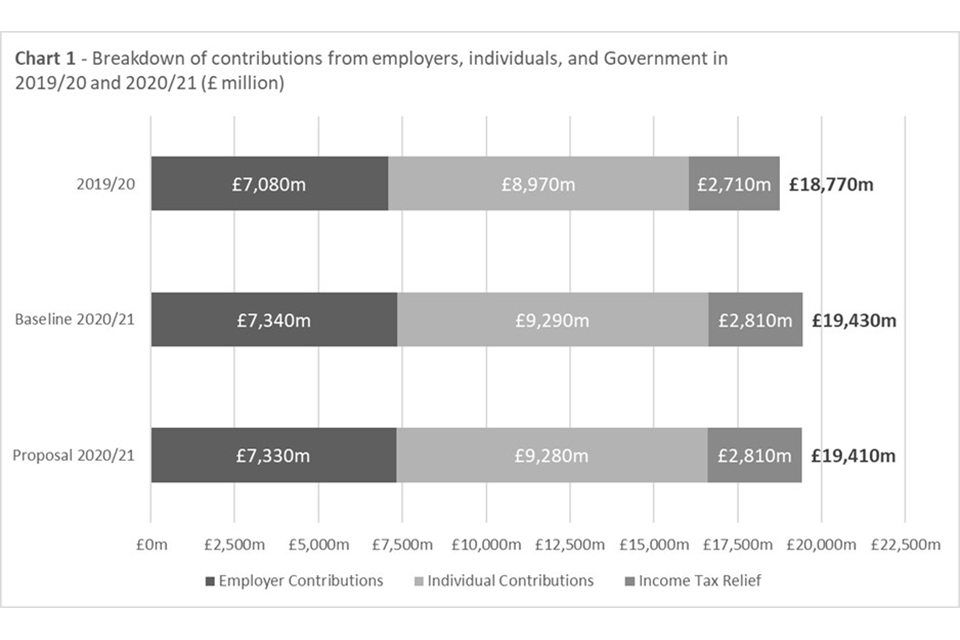

Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. Income limit for personal allowance. Tax year 2019 20 1. Paye tax rates and thresholds 2020 to 2021.

The figures for these measures are set out in table 2 1 of budget 2018 as personal allowance and higher rate threshold. Uk income tax rates allowances reliefs april 15 2020 ptc with the 2019 20 tax year coming to a close on 5th april 2020 and the new 2020 21 tax year beginning on 6th april 2020 we have put together this quick guide to help you understand the personal income tax rates allowances and reliefs that may be available to you. Higher rate tax the middle tier of income tax. Free income tax calculator to check what your take home pay should be including pension contributions and student loan repayments use our free income tax calculator.

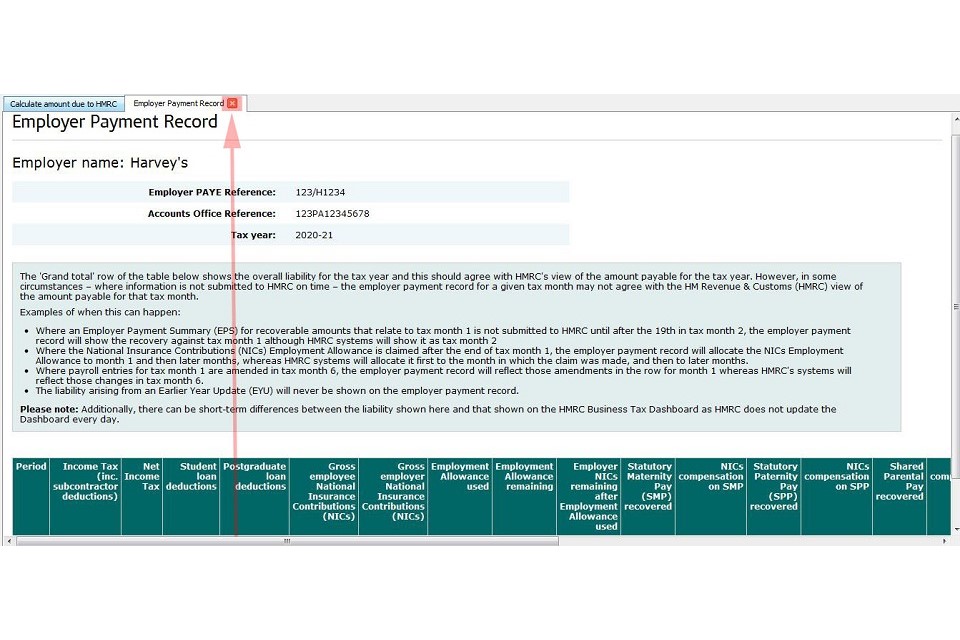

Uk paye tax rates and allowances 2020 21 this article was published on 03 03 2020 this page contains all of the personal income tax changes which were published on the gov uk site on fri 28 feb 2020.