Unearned Interest Income Income Statement

Interest income is the amount of interest that has been earned during a specific time period.

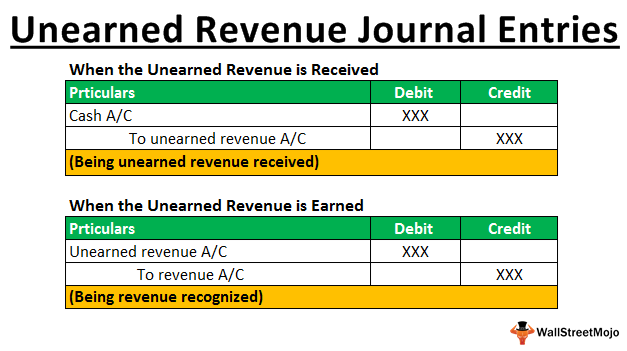

Unearned interest income income statement. Interest income is the revenue earned by lending money to other entities and the term is usually found in the company s income statement to report the interest earned on the cash held in the savings account certificates of deposits or other investments. Net refers to the fact that management has simply subtracted interest income from interest expense to come up with one figure. Interest income such as interest earned on checking and savings deposit accounts loans and certificates of deposit. To amortize prepaid interest the bookkeeper debits the unearned interest income account and credits the interest income account.

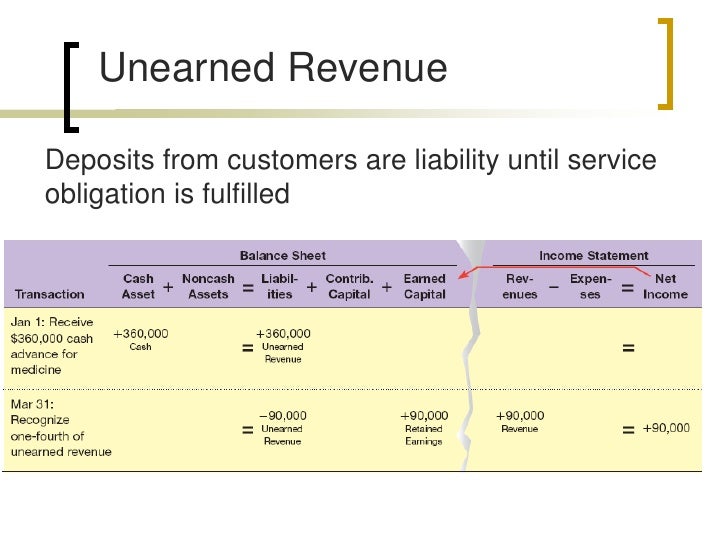

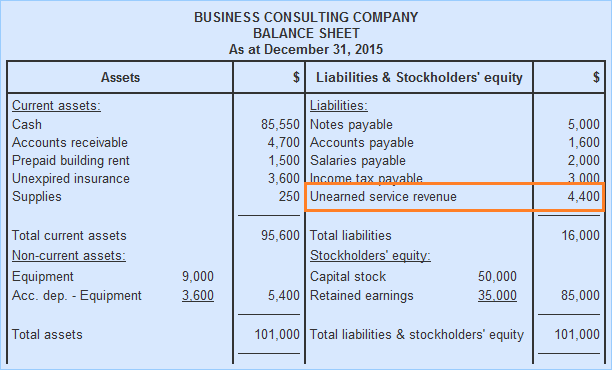

What is interest income. Unearned income consists of several income sources like pensions distribution from the retirement accounts interest income dividends passive income annuity payments etc. In the latter case interest income should only be recorded. Unearned interest is interest that has been collected on a loan by a lending institution but has not yet been counted as income or earnings.

On a larger scale interest income is the amount earned by an investor s money that he places in an investment or project. In income statement it is recording separately from operation if the. Since this interest is not a part of the original investment it is separately recorded. Example a bank lends 1 million to a borrower for ten years with an annual interest rate of 10 percent and also requires that the borrower post 50 000 financial guarantee to demonstrate solvency.

Instead it is initially recorded as a liability. Interest and dividend income are the most common types of unearned income. Interest income is the amount paid to an entity for lending its money or letting another entity use its funds. This amount can be compared to the investments balance to estimate the return on investment that a business is generating.

Investment here included short term deposit long term or fixed deposit saving account due credit charged to customers and similar kind. Interest come that record in income statement referred to non operating income that entities earned during the periods of time from their investment.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)