How To Set Up Income Withholding For Support In Quickbooks

You can enter the rate as 50 if the new employee is supporting a current spouse or child who is not the subject of the withholding order.

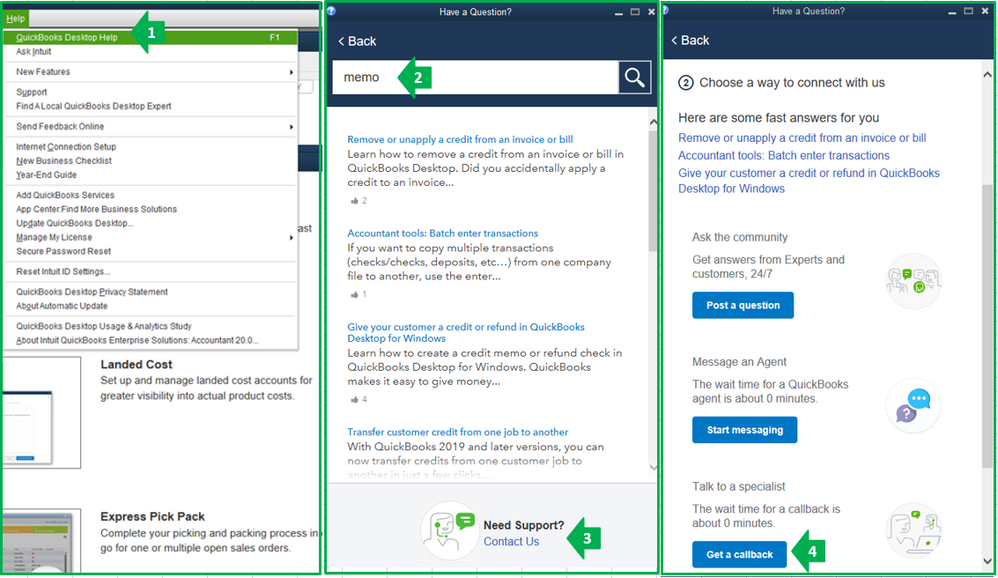

How to set up income withholding for support in quickbooks. Quickbooks displays the intuit quickbooks payroll page. Written instructions at the website above. Select edit beside pay. Assumptions you have the latest quickbooks and you have the latest.

To set up a garnishment deduction item with the help ez setup or customer setup. When you have employees that live in one state and work in another they may be subject to income tax in both states. On the nonres gp item do not check any w2 boxes check the fwt box only. Click the vendor eligible for 1099 checkbox.

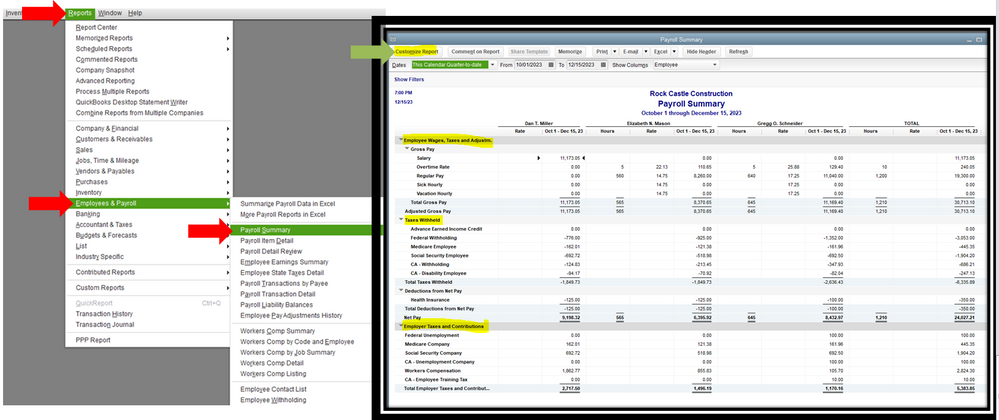

On the drop down select garnishment and garnishment type. As this web page indicates to set up quickbooks payroll the first step is choosing a payroll option. Snap the payroll item catch and select new. Also the federal consumer credit protection act ccpa limits garnishments to 25 of disposable income.

How do i set up withholding from two states on one pay check. On the employee information update main tab select single for the marital status and 1 exemption. From the lists menu click the payroll item list. If you don t see this checkbox you need to set up quickbooks for 1099 tracking.

Overview this article provides information about how to set up a foreign employee as a nonresident alien nra for federal income tax withholding. Choose edit to add a deduction. They were set to do not withhold for federal and state income taxes in the employee setup. On the wage withholding tab add a gp item as nonres to use for the amount from the table above.

I m here to lend a hand gblock1. Just locate the add a garnishment quickbooks online payroll section. To add a garnishment that is deducted from an employee s disposable income follow these steps. Add a garnishment quickbooks online payroll.

Royalty payments to corporations including a limited liability company llc that is treated as a c or s corporation are not subject to 1099 reporting requirements. An employee s preference should only be set to do not withhold if they explicitly claim exemption from withholding on their federal form w 4 or any applicable state form. Http bit ly qb wage garnish learn how to set up a wage garnishment like child support. Select ez setup or custom setup and snap next.

Go to workers or payroll menu then employees.