On A Firm S Income Statement Net Sales Consists Of

100 000 gross sales 5 000 sales returns 3 000 sales allowances 2 000 discounts 90 000 net sales.

On a firm s income statement net sales consists of. The statement is false. Operating expenses minus cost of sales b. Example of net sales. The net profit ratio is the most common ratio analyzed by all stakeholders of the firms.

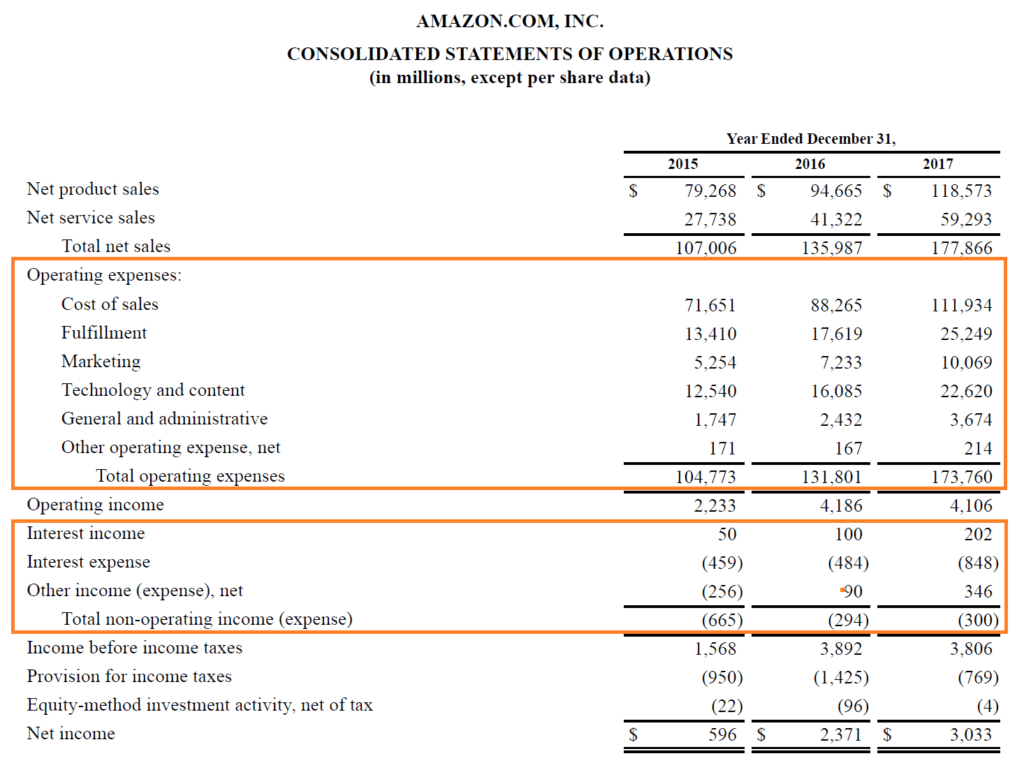

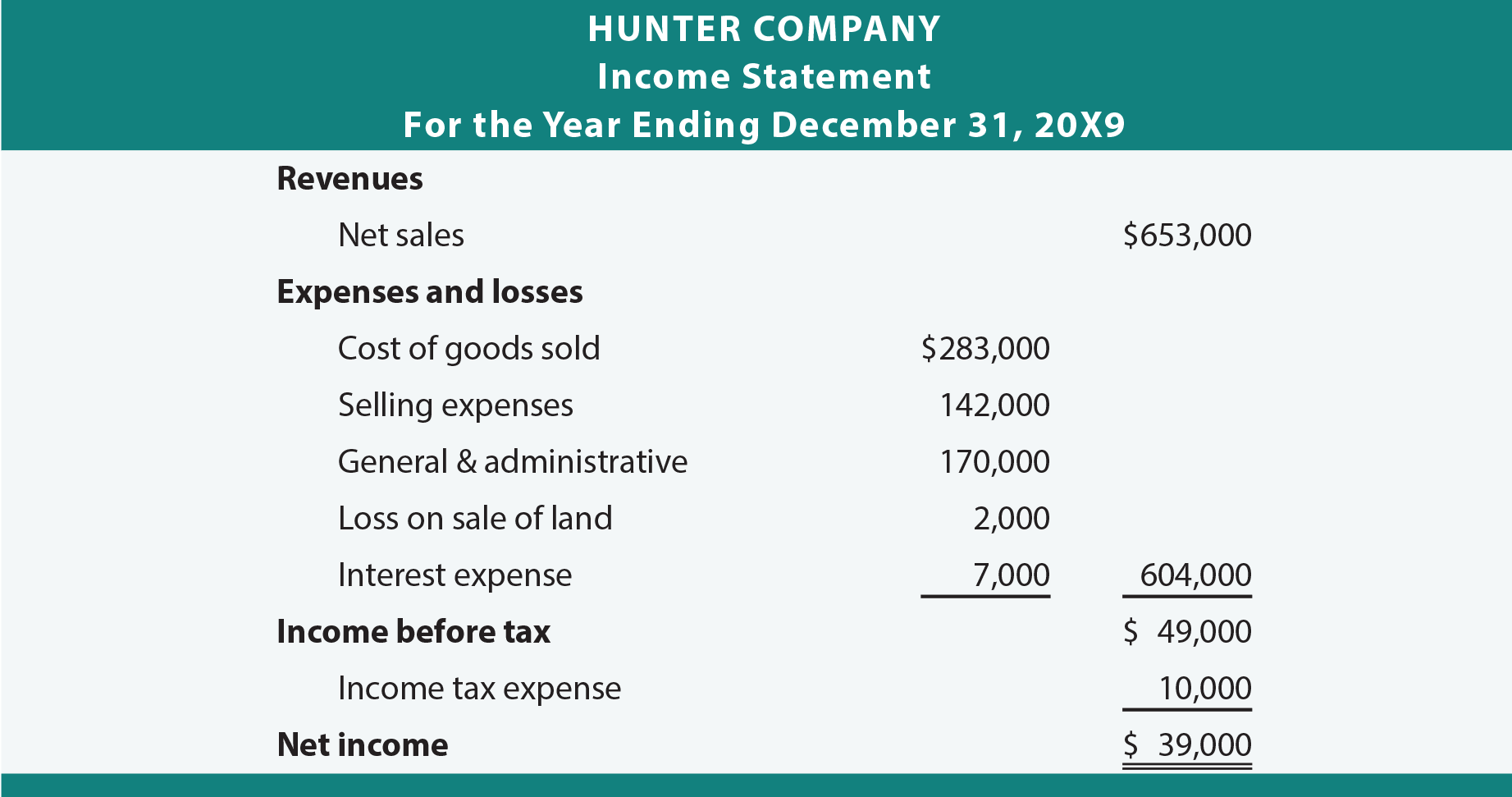

Total sales minus allowances for returned goods and discounts. On a firm s income statement net sales consists of asked apr 30 2016 in business by davein. On a firm s income statement net sales consists of. The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities.

Gross sales should be shown in a separate. Net sales is usually the total amount of revenue reported by a company on its income statement which means that all forms of sales and related deductions are combined into one line item. The income statement is the financial report that is primarily used when analyzing a company s revenues revenue growth and operational expenses. For example if a company has gross sales of 1 000 000 sales returns of 10 000 sales allowances of 5 000 and discounts of 15 000 then its net sales are.

It shows the amount earned on per dollar sales and expressed as a percentage of net. Ias 18 is the accounting standard that entity should follow in order to records net sales in the income statement if entity financial statements follow or use ifrs financial framework. Cost of sales minus all. Although a company s bottom.

Income statement accounts multi step format net sales sales or revenue. On a firm s income statement net sales consists of blank. Net sales that records in income statement are the net amount that entity expected to receive from the sales of goods or services. If a company s income statement only has a single line item for revenues that is labeled sales it is usually assumed that the figure refers to net sales.

The income statement shows investors and management if the firm made money during the period reported. The operating section of an income statement includes revenue and expenses. Total sales minus allowances for returned goods and discounts c. Understanding net sales.

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/Apple10KIS-00e74dfe3f34479180ac7ede7b982292.jpg)