Income Tax Regulations Definition

This is a compilation of the income tax assessment regulations 1997 that shows the text of the law as amended and in force on 1 july 2017 the compilation date.

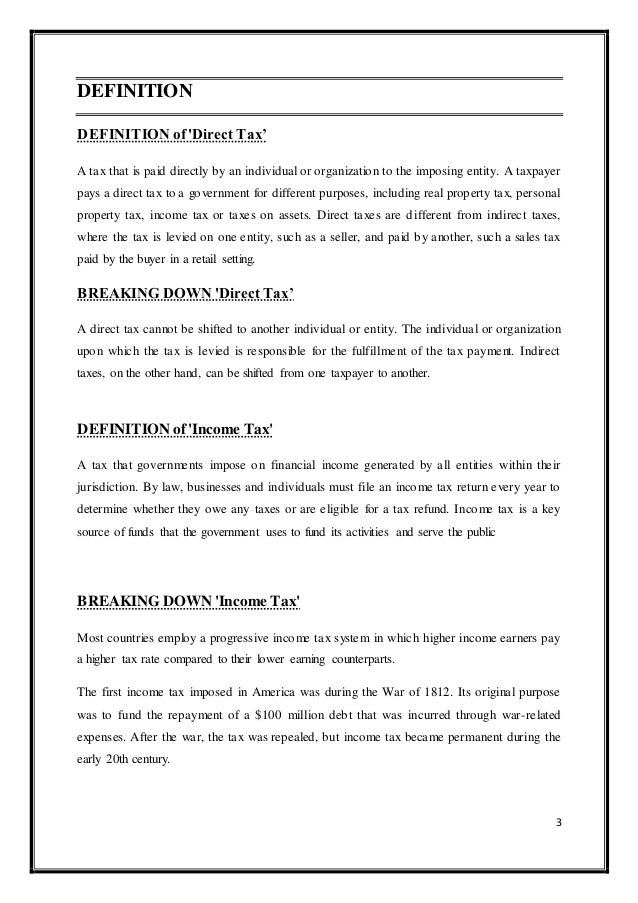

Income tax regulations definition. 2 in these regulations act means the income tax act. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. See relevant amending acts and regulations short title. Income tax regulations means unless the context clearly indicates otherwise the regulations in force as final or temporary that have been issued by the u s.

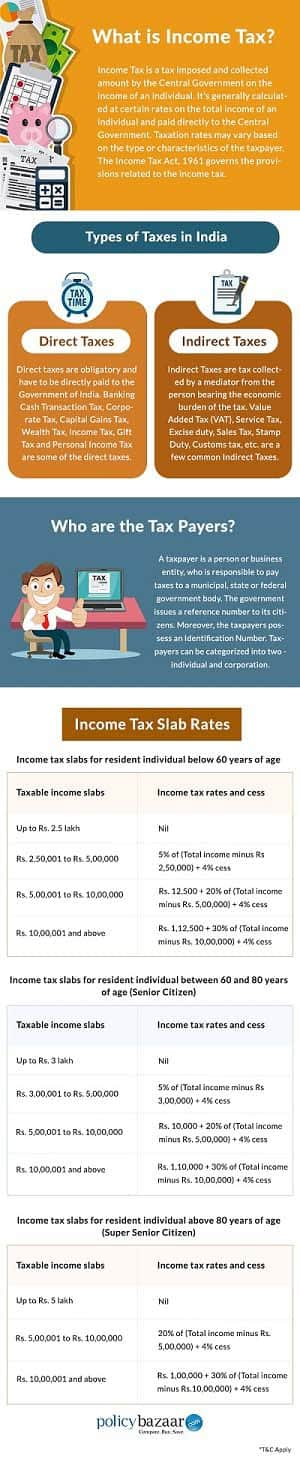

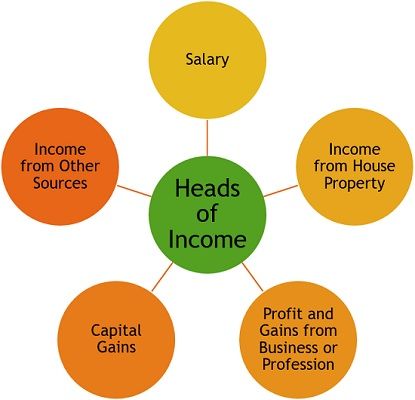

The notes at the end of this compilation the endnotes include information about amending laws and the amendment history of provisions of the compiled law. Application provisions are not included in the consolidated text. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Income tax regulations note.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. 1 1 h 1 capital gains look through rule for sales or exchanges of interests in a partnership s corporation or trust. Income tax is used to fund public services pay government. Income tax regulations 7460 kb regulations are current to 2020 11 02 and last amended on 2020 10 14.

Income tax regulations 5215 kb pdf full document. Learn what those laws mean and how they impact you here. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the internal revenue code or state law. 1 1 i 1t questions and answers relating to the tax on unearned income certain minor children temporary.

Taxes have been called the building block of civilization. 1 these regulations may be cited as the income tax regulations. 1 1 3 change in rates applicable to taxable year. Department of the treasury pursuant to its authority under the code and any successor regulations.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)