Income Tax Brackets 2020 Arizona

The arizona income tax has four tax brackets with a maximum marginal income tax of 4 50 as of 2020.

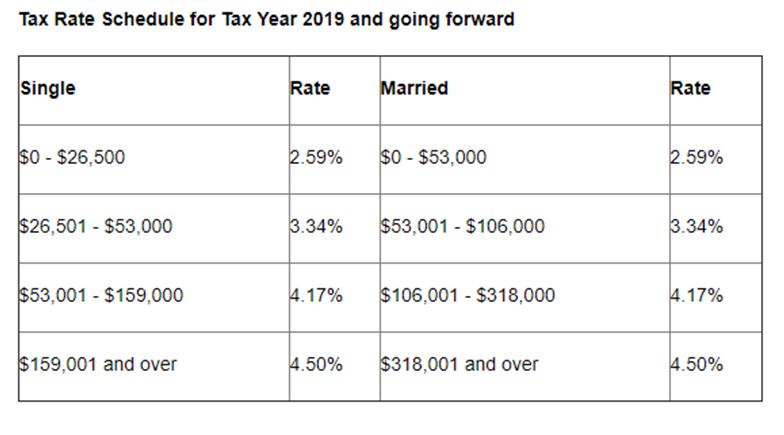

Income tax brackets 2020 arizona. As an editorial in. Individuals filers joint filers 2 59 percent 0 2 59 percent 0 2 88 percent 11 047 2 88 percent 22 090 3 36 percent. Below is a chart of arizona s current income tax brackets compared to the new brackets for both individuals and joint filers. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

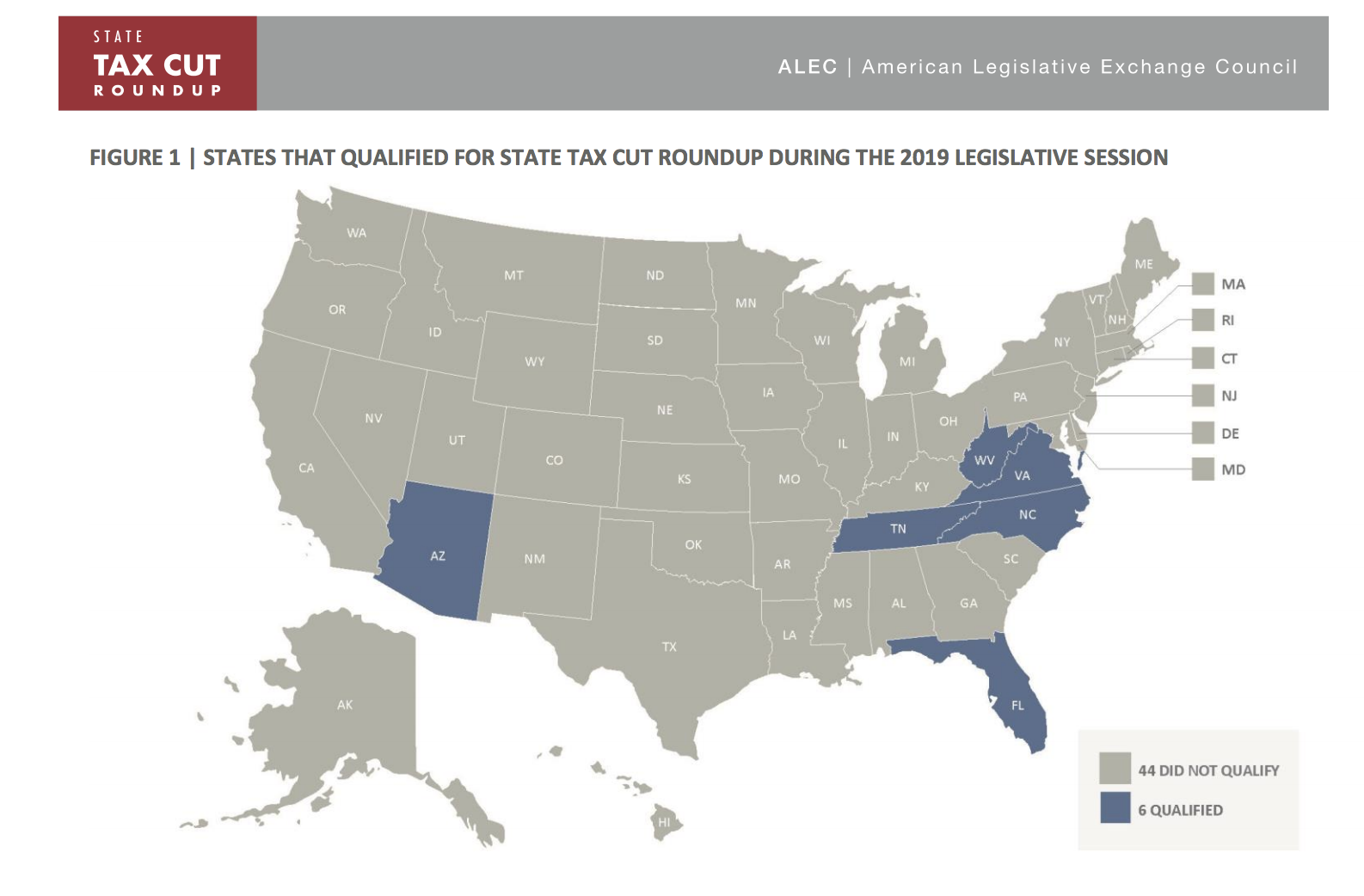

The most notable change to the state tax code is the elimination of an entire tax bracket. 2020 arizona tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Arizona eliminated the second income tax bracket beginning with the 2019 tax year. This page has the latest arizona brackets and tax rates plus a arizona income tax calculator.

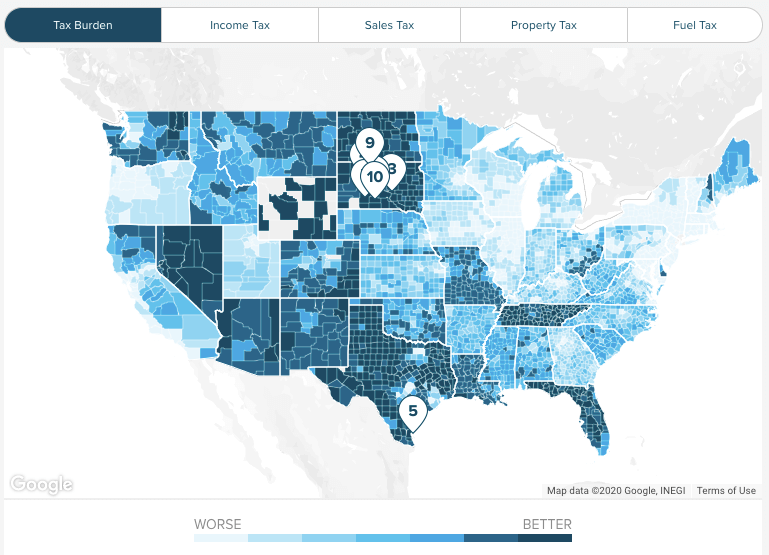

2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Arizona s 2020 income tax ranges from 2 59 to 4 5. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. They range between 0 and 12.

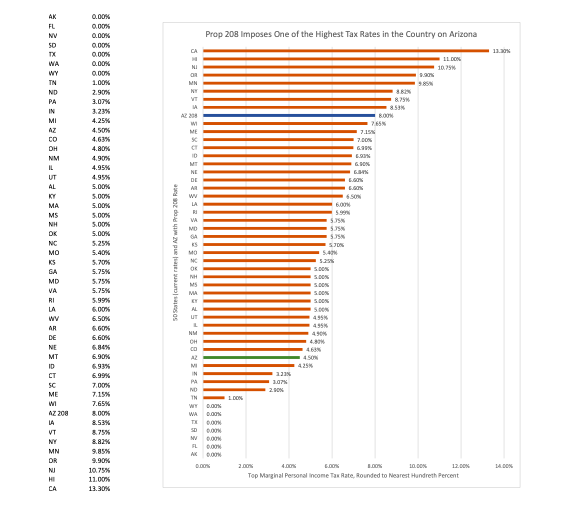

There are 126 days left until taxes are due. Arizona income tax rates tend to be lower than federal tax rates. In a recent corner post i discussed arizona s proposition 208 which would introduce a new fifth income tax bracket raising the top rate from 4 5 percent to 8 percent. Arizona is one of those states where tax rates in arizona based on income and filing status.

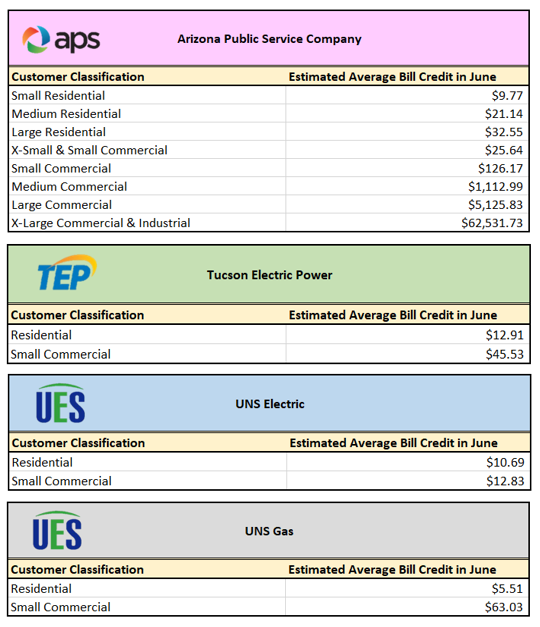

Arizona income tax rate 2019 2020. The arizona tax calculator is designed to provide a simple illlustration of the state income tax due in arizona to view a comprehensive tax illustration which includes federal tax medicare state tax standard itemised deductions and more please use the main 2020 21 tax reform calculator. The ballot measure in question proposition 208 or the invest in education act imposes a 3 5 surtax on incomes above 250 000 for single filers and 500 000 for joint filers. Income tax tables and other tax information is sourced from the arizona department of revenue.

Start filing your tax return now. What are the arizona state income tax brackets. General income tax bracket information. Detailed arizona state income tax rates and brackets are available on this page.