Income Tax Statement Form For Kerala Government Employees

100 of the government employees are paying income tax for their monthly salary arrears bonus and every rupee.

Income tax statement form for kerala government employees. Can i claim under savings for tax filing. Final withholding tax form for non resident payment. Paye withholding form bts200. Form xprovisional certificate for exemption from entertainment tax 6 kb 10.

Last updated on name and. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. I have deposited an amount of 15000 under fixed deposit under government of kerala treasury savings bank. Tax consultant unlimited 5 02 fy 2020 21 n ow you can choose your best tax regime with the updated tax consultant utility.

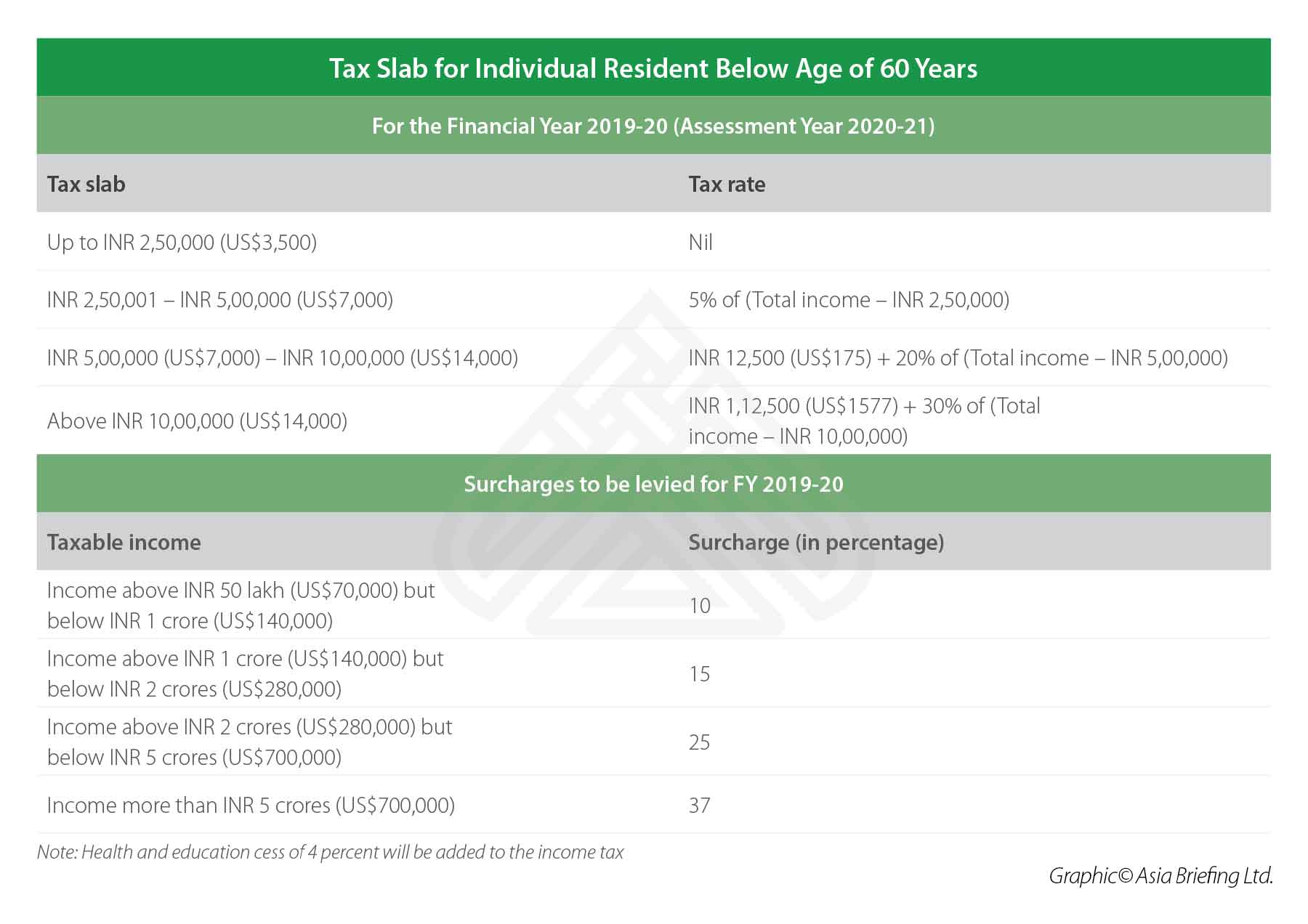

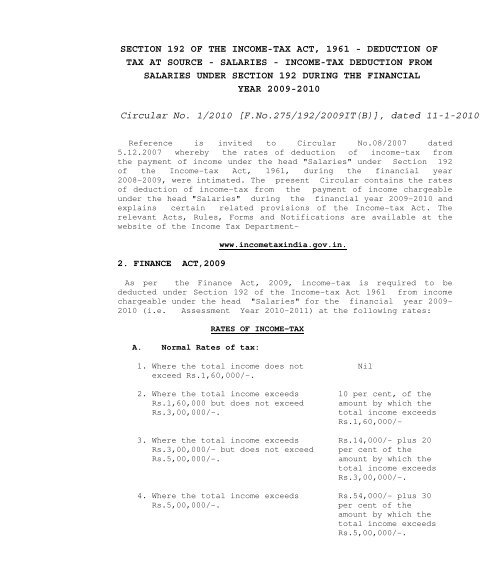

The central govt announced recently in the union budget 2020 21 a new optional income tax slab rate system for individual taxpayers. Regards srinivas august 24 2015 at 1 14 pm. I am a working professional who has to file income tax. Income tax ay 2020 21 calculator for salaried central and state government employees.

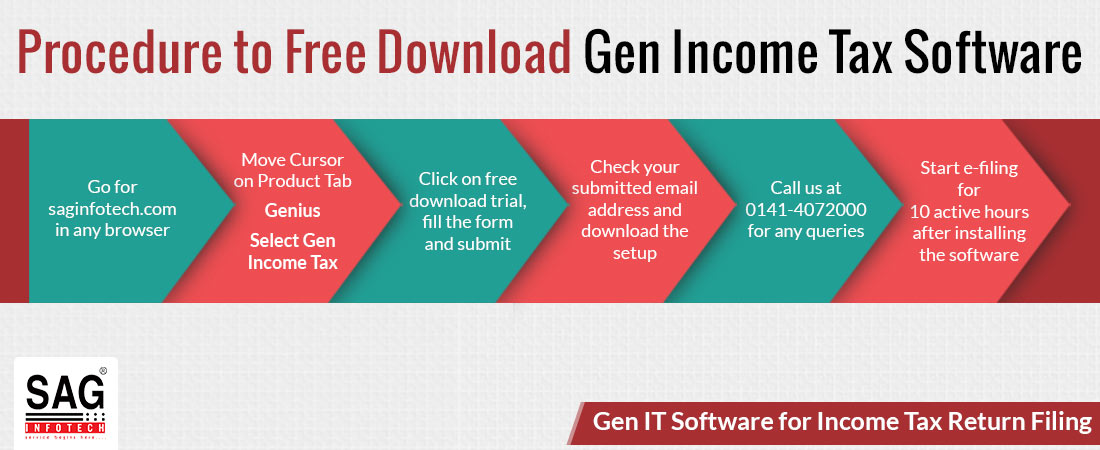

16 see rule 31 1 a part a certificate under section 203 of the income tax act 1961 for tax deducted at source on salary certificate no. Paye withholding form bts200. Released tax consultant unlimited version 5 02 updated on 26 09 2020 for the income tax calculation and preparation of income tax anticipatory statement final statement monthly tds statement form 12bb form 16 and form 10e. If so under which section 80c.

May 1 2020 income tax statement form 4 4 pdf kerala government employees income tax statement form 4 4 pdf kerala government employees is so famous but why. Gross contract tax withholding form. Form tr 104 statement of deductions towards pf to be furnished along salary bill. Application for advance to government employees for building.

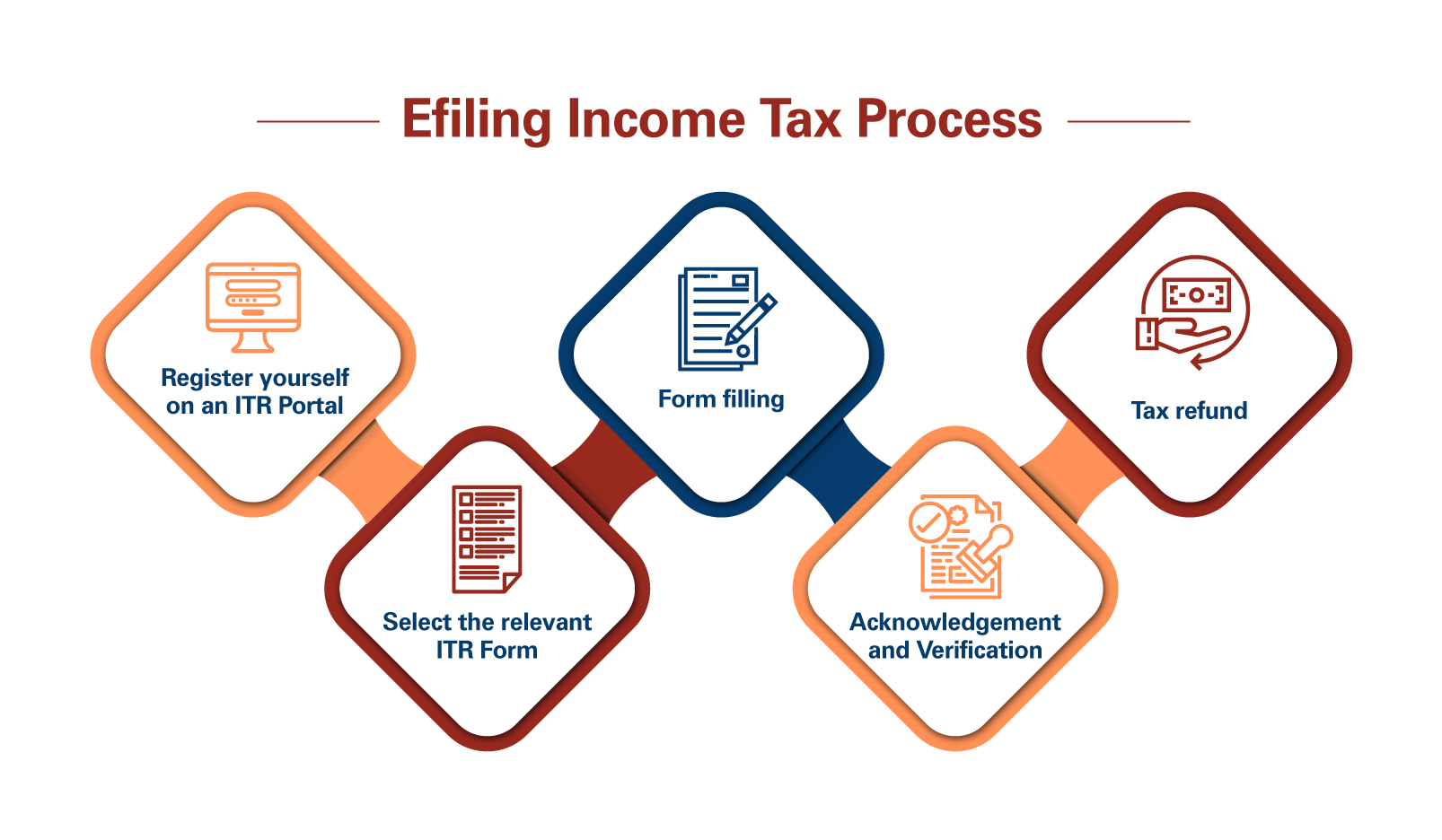

Certificate under section 203 of the income tax act 1961 for tax deducted at source on salary. Payment of arrears form. Income tax 2019 20 section 192 2 d all salaried employees to declare deductions and savings under form 12bb download form 12bb as a word excel or pdf file all employees to file declaration under form 12bb to claim deduction for savings under section 80 c payment of house loan interest under section 24 and hra exemption under section 10. Statement of real estate transaction.

Form no 1application for a licence to manufacture food for sale 4 kb. Business tax monthly form. Application for licence under kerala cinema regulation act 8 kb 9.