Percentage Method Tables For Income Tax Withholding 2019

This method works for forms w 4 from 2019 or earlier and forms w 4 from 2020 or later.

Percentage method tables for income tax withholding 2019. Percentage method tables for manual payroll systems with forms w 4 from 2020 or later. Tables for percentage method of withholding. This method also works for any amount of wages. 11 by the internal revenue service in notice 1036.

Alternative 2 tables for percentage method withholding computations continued for wages paid in 2019 table d 2 monthly payroll period amount for each allowance claimed is 350 00. The irs has released publication 15 circular e employer s tax guide containing the federal income tax withholding formula and tables as well as other employer guidance for tax year 2019. Tables for percentage method of withholding. For wages paid in 2019 the following payroll tax rates tables are from irs notice 1036.

2019 federal income tax withholding. If you have an automated payroll system use the worksheet below and the percentage method tables that follow to figure federal income tax withholding. 1038 available at irs gov irb 2018 51 irb not 2018 92 provides that until april 30 2019 an employee who has a reduction in a claimed number of withholding allowances solely. 2019 percentage method tables and wage bracket ta bles for income tax withholding.

Wage bracket method tables for manual payroll systems with forms w 4 from 2019 or earlier. Procedures used to calculate federal taxes withheld using the 2019 form w 4 and prior form w 4 for 2020 or later on page 4. The withholding amount is based on the employee s taxable wages marital status and number of allowances stated on his or her w 4 form combined with the withholding tax tables in irs publication 15 t. However the irs will not be modifying.

2019 form w 4 notice. Employers can calculate federal income tax withholding using either publication 15 t s wage bracket method or its percentage method. Alternative methods for figuring withholding. For payroll paid january december 31 2020.

Federal percentage method of withholding. Irs publication 15 t. The 2019 percentage method federal income tax withholding tables were issued dec. Percentage method tables for manual payroll systems with forms w 4 from 2019 or earlier.

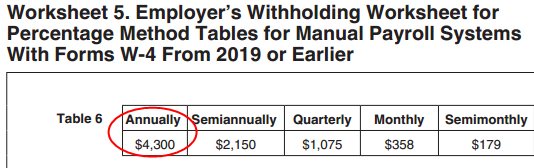

The tables include federal withholding for year 2019 income tax fica tax medicare tax and futa taxes. Notice 2018 92 2018 51 i r b. A withholding allowance is to be worth 4 200 in 2019 up from 4 150 in 2018 the early release copies of the 2019 percentage method tables for income tax withholding showed.