Ohio Income Tax Underpayment Penalty

Ohio it 2210 4708 interest penalty on underpayment of ohio pass through entity income tax 2006 use this form to calculate interest penalty on underpayment of pass through entity taxes and to show the exceptions where no interest penalty is due.

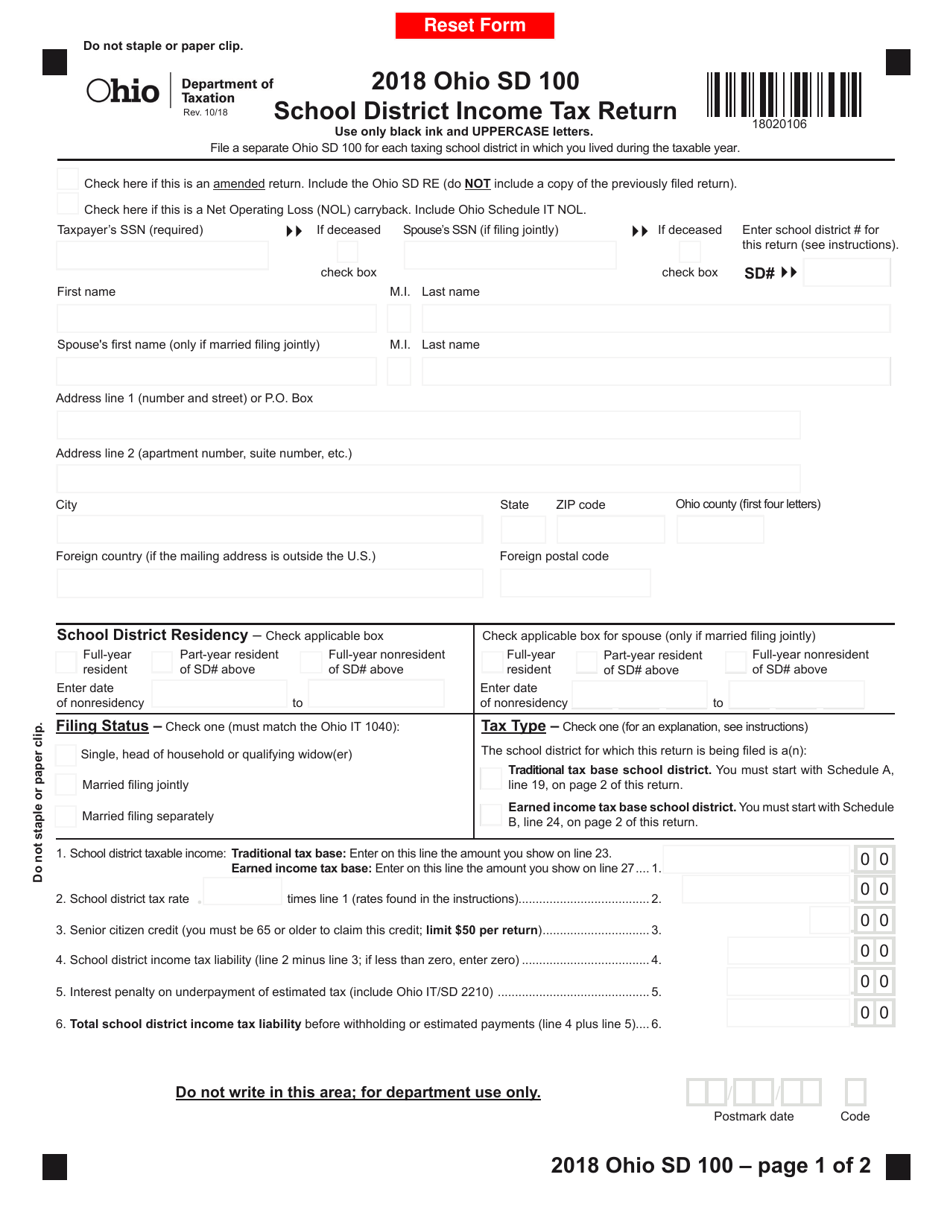

Ohio income tax underpayment penalty. Usually the dot permits it if the failure to comply with the provisions of the tax code were due to reasonable cause and not willful. 2018 ohio it sd 2210 interest penalty on underpayment of ohio individual income school district income and pass through entity tax include with your 2018 ohio tax return. Include with your 2019 ohio tax return. Tax amount was paid.

Tax filings and tax payments related to tax years beginning before january 1 2016 are subject to the penalty and interest rates and late filing penalties if any imposed by each municipal income tax ordinance in effect prior to january 1 2016 regardless of the date of filing or payment. Ohio county the purpose of this form is to calculate interest penalty on underpayment of estimated taxes and to show the exceptions where no interest penalty is due. Ohio state tax penalty abatement common penalties. Spouse s first name only if married filing jointly m i.

Ohio law permits the department of taxation dot to abate penalties. The amount of the underpayment. 7 07 1. Interest penalty on underpayment of ohio individual income school district income and pass through entity tax.

Underpayment penalty example tax due 1 ooo oo x less withholding less estimate payments underpaid amount penalty 900 00 200 00 200 00 500 00 75 00 penalty and interest for late payment is assessed on taxes paid after april 17th including extended returns. Check here if you engage in farming or fi shing activities and see the note on page 3. Last name name of pass through entity trust or estate. 0 spouse s first name only if married filing jointly m i.

2019 ohio it sd 2210. Part 1 figuring your underpayment and interest penalty 1. Last name name of pass through entity trust or estate. If you do not make the required estimated payments or increase your withholding you may be subject to an interest penalty for underpayment of estimated taxes.

A request for penalty abatement is a written request asking the state to waive some or all of the penalties that have been assessed. 1 19 10211411 1. If you fail to file your ohio income tax return or federal extension by the tax deadline a failure to file penalty of the greater of 50 per month up to a maximum of. To avoid this penalty even if you cannot pay your ohio income tax balance it is important you either file your ohio income tax return or a federal extension by the tax deadline.

Instead of making estimated payments you may increase your ohio withholding by filing a revised ohio it 4 employer withholding exemption certificate with your employer. 11 19 10211411 1.