Operating Income And Profit Margin

Like gross profit margin operating profit margin can be expressed as a percentage by multiplying.

Operating income and profit margin. This simplifies comparing profit margins of different companies. The profit margin represents a view in percentage terms of the operating income left after all expenses have been deducted. A large company might have what looks like a significant amount of operating profits but if it s operating costs are high it may have a low profit margin. The operating margin measures the percentage return generated by the core activities of a business while the profit margin measures the percentage return on all of its activities.

Operating profit margin examines the effects of these costs. Operating income and gross profit show the income earned by a company and although there are differences both are essential in an analysis. We can see in the above example that operating income of 238 million was different from ebit of 254 million for the quarter 131 million 71 million 52 million. Operating income which is synonymous with operating profit.

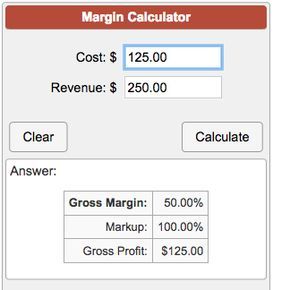

Operating income is a company s profit after deducting operating expenses which are the costs of running the day to day operations. Also referred to as return on sales the operating income is the basis of how much of the generated sales is left when all operating expenses are paid off. The operating profit margin is then calculated by. Operating profit margin is calculated by taking operating income and dividing it by total revenue.

Operating margin measures how much profit a company makes on a dollar of sales after paying for variable costs of production such as wages and raw materials but before paying interest or tax.