Income Withholding Order Form Indiana

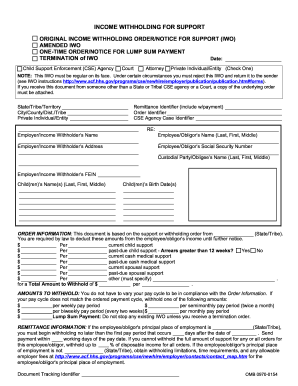

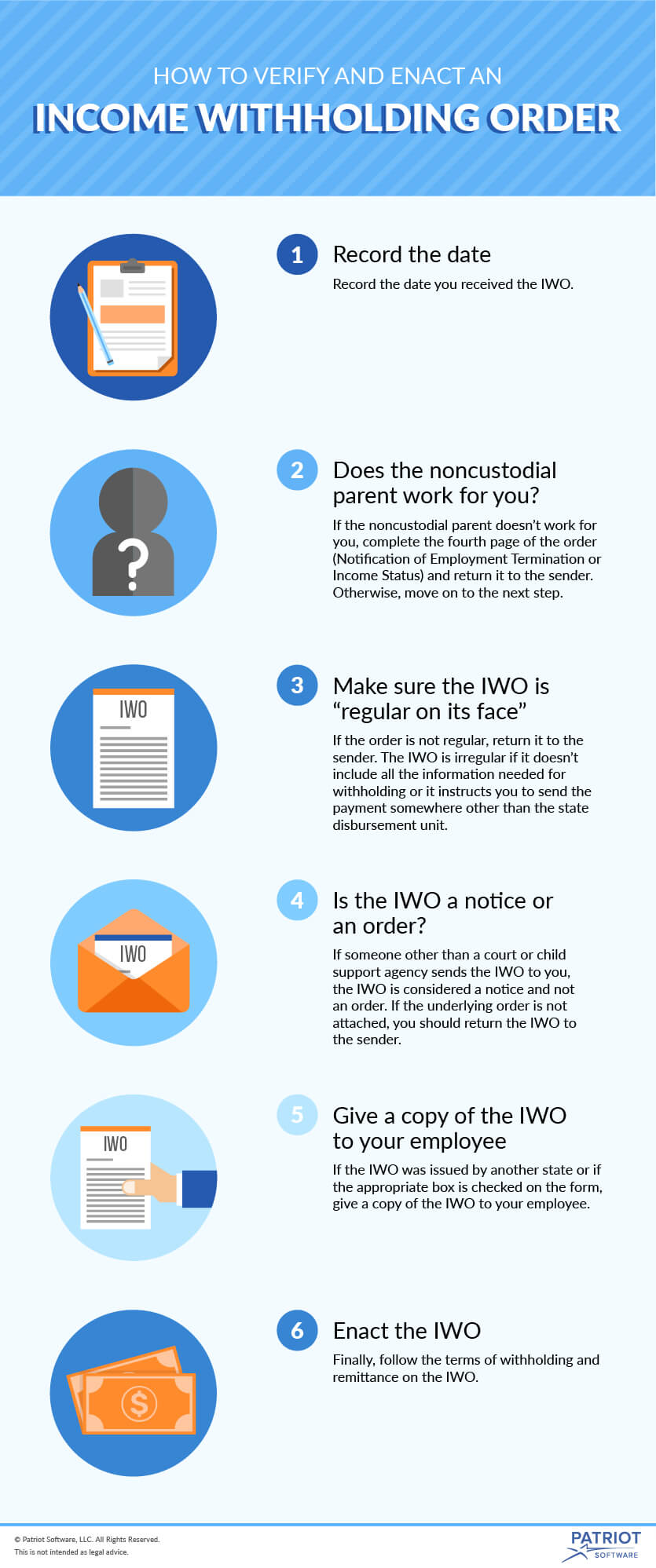

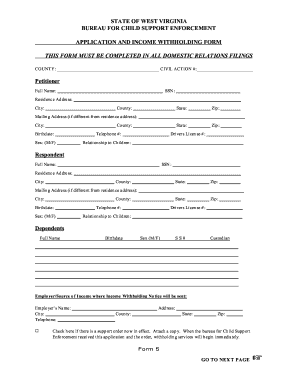

Any withholding form not listed here is considered a controlled document meaning it must be preprinted for the user with a pre established account number.

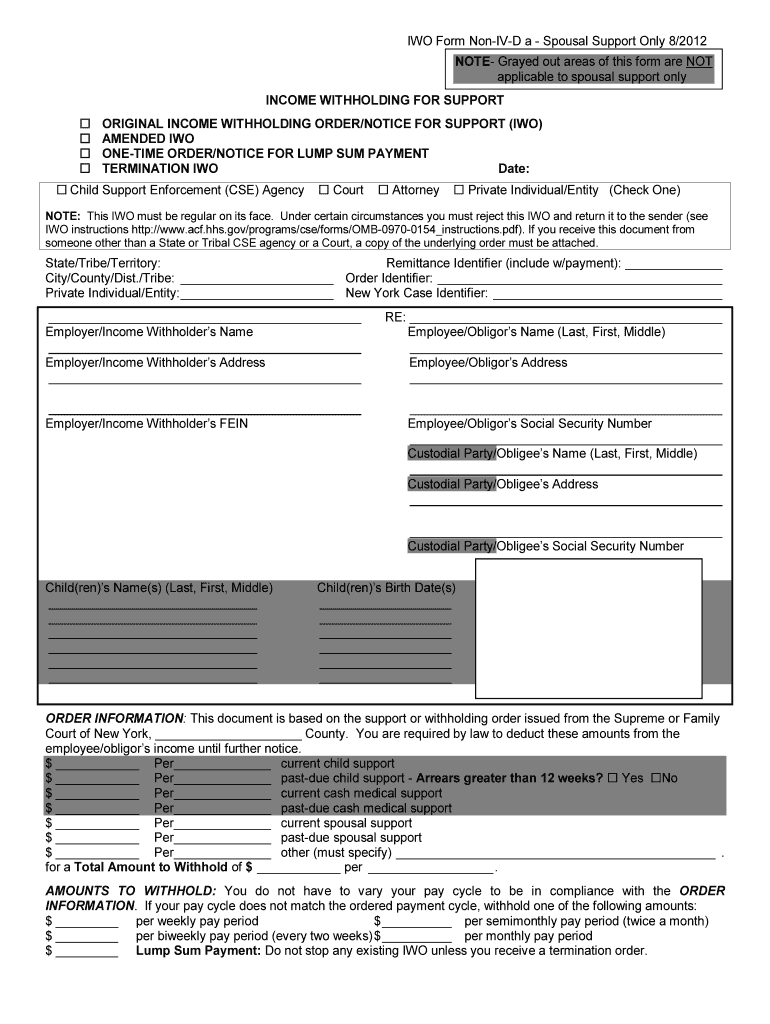

Income withholding order form indiana. Withholding tax forms note. If you cannot withhold the full amount of support for any or all orders for this employee obligor withhold of disposable income for all orders. If you do not have an account with the indiana department of revenue you need to complete your business registration online at inbiz. Send payment the same day as the pay date date of withholding.

Withholding no later than the first pay period that occurs 14 days after the date this order is received. The court should request at the time of the order that the payment cycle will reflect that of the obligor. Than 14 days after the date the income deduction order was served on you and you shall conform the amount specified in the income withholding order to the obligor s pay cycle.