Format Income Statement Reports Variable Costs

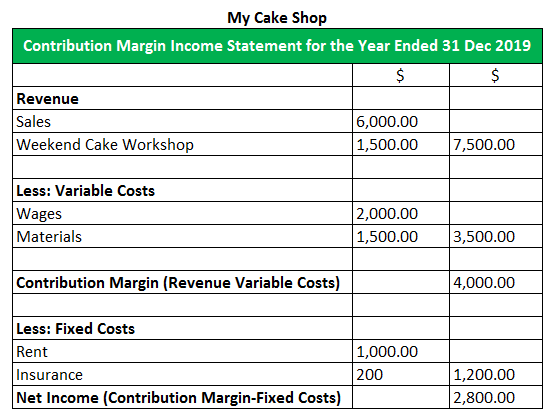

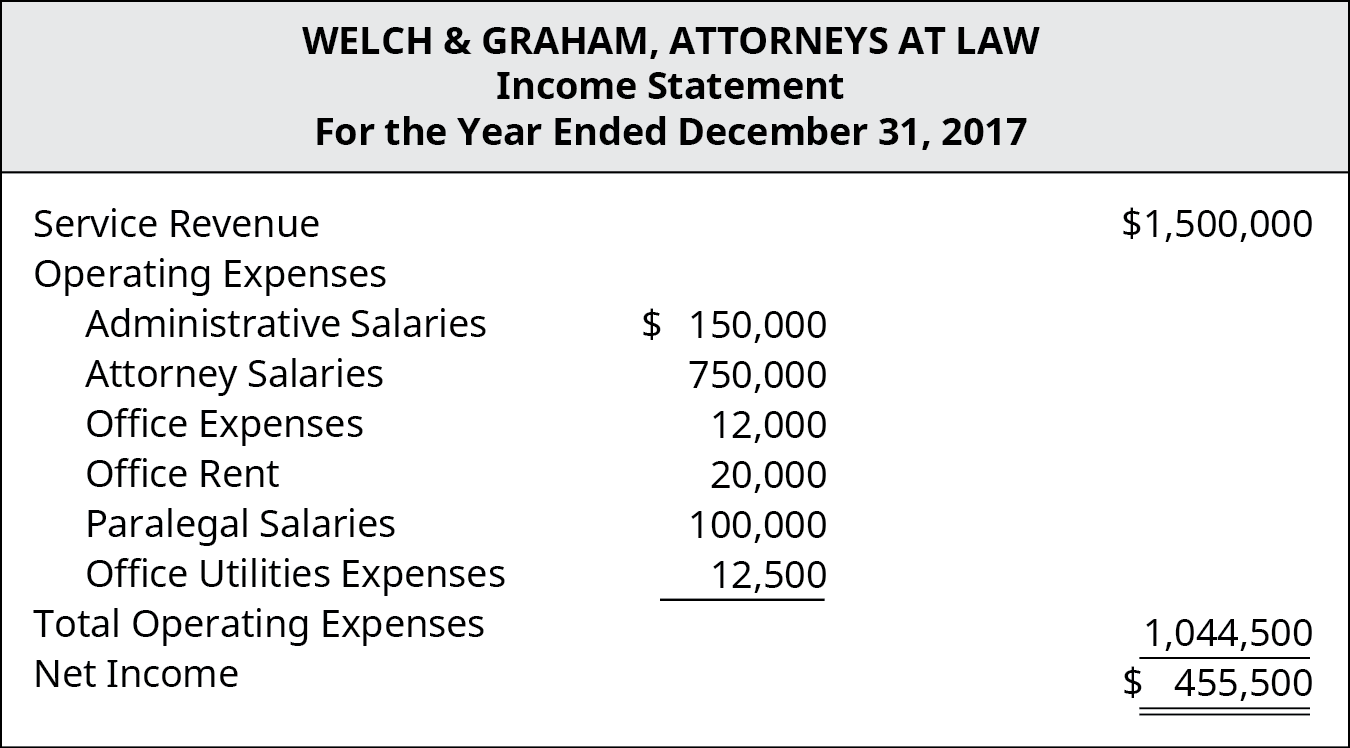

Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing.

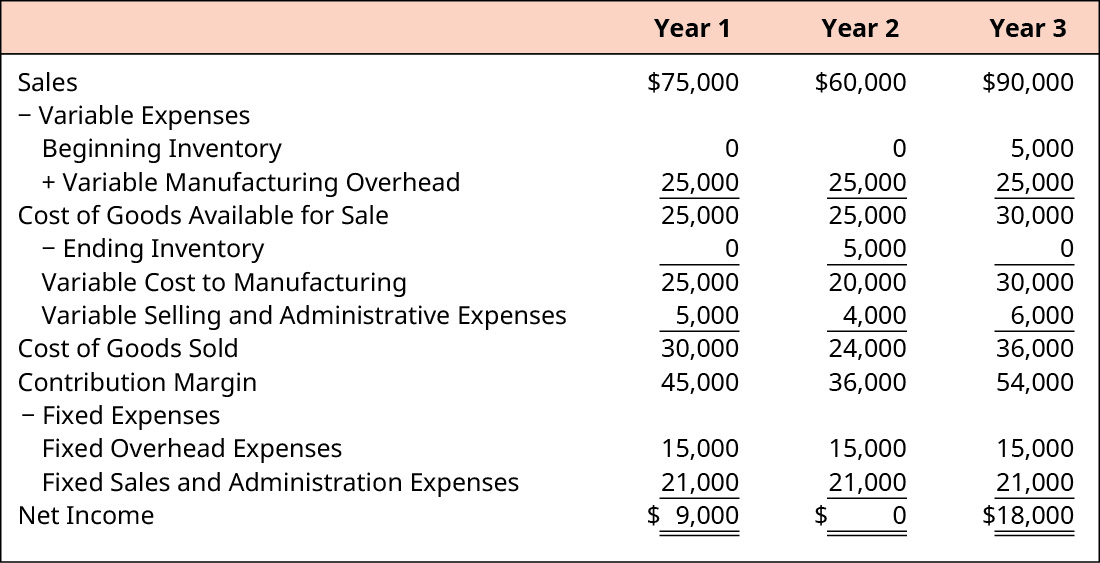

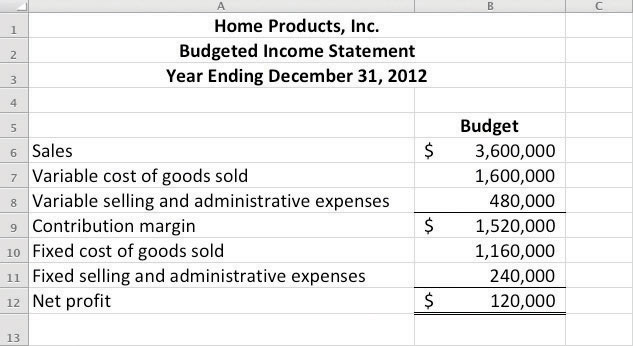

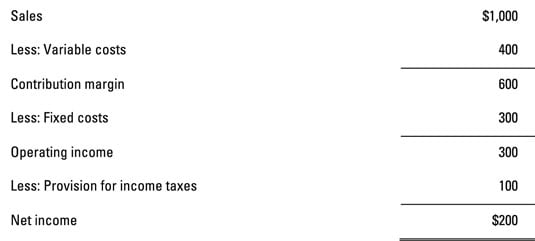

Format income statement reports variable costs. An income statement which separately reports variable costs from fixed costs is known as a n contribution format under absorption costing fixed overhead is allocated to products sold so when production is greater than units sold net income will be greater less than income calculated under variable costing. Ifc does not report an opening inventory. The variable costing income statement is one where all variable expenses are subtracted from revenue which results in contribution margin. Below are excerpts from the company s income statement for its latest year end 2018.

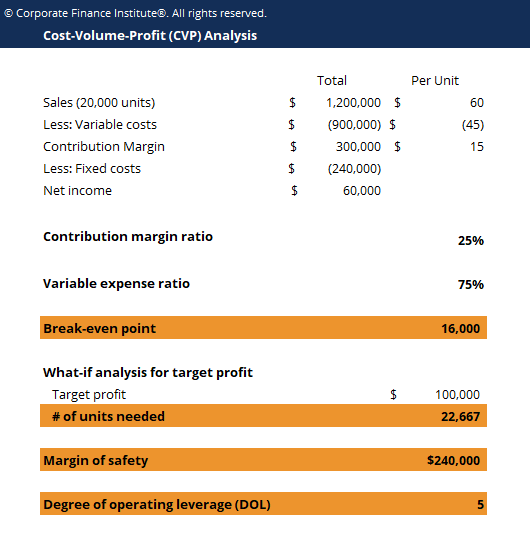

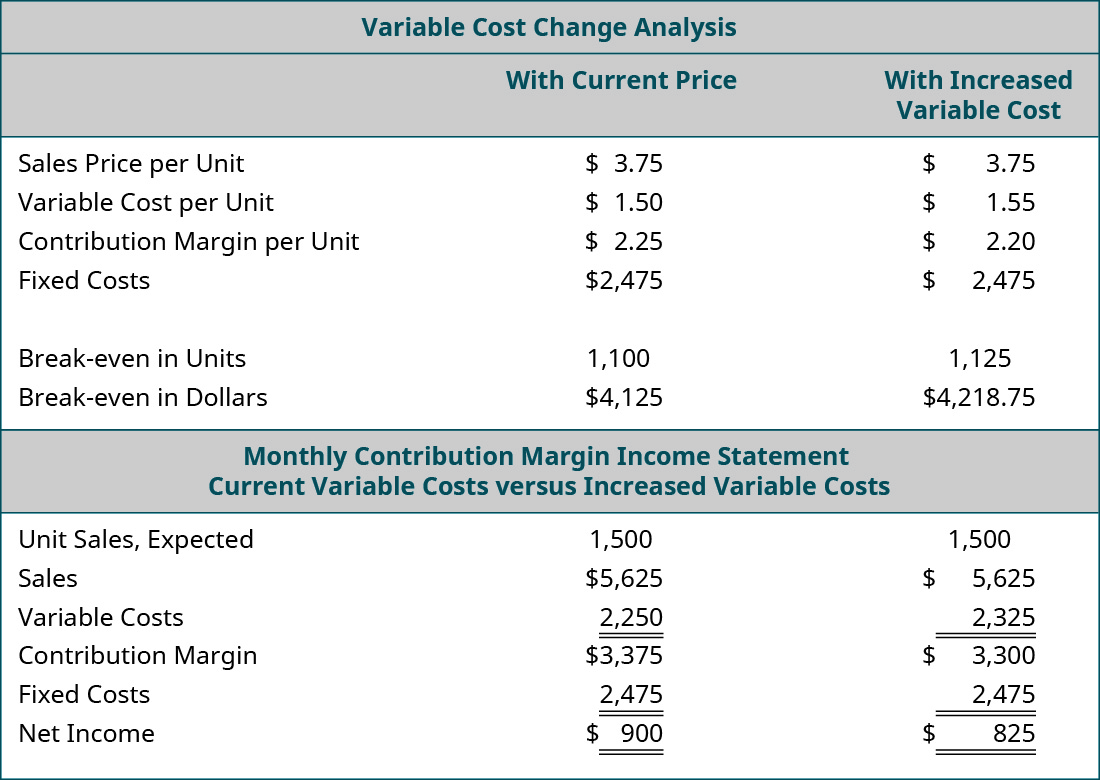

Variable expenses net income contribution margin differences in income between variable costing and absorption costing is due to timing sales minus variable costs is called contribution margin a format income statement reports variable costs separately from fixed costs contribution makum company s is using a traditional absorption costing. Financial reports are geared toward external users whereas. Under sales revenue there should be a line item labeled cost of goods sold and variable selling general and administrative expenses. Select all that are correct.

Variable costs are explicitly labeled on a variable costing income statement. Moreover in income statement variable costing calculations fixed overhead costs are not considered when the cost of goods produced is calculated. Small business owners may be interested in both financial and managerial reports for different potential users. A format income statement reports variable costs separately from fixed costs contribution margin an income statement which shows excess of sales over variable costs is referred to as income statement.

In many cases direct labor should be categorized as a fixed expense in this income statement format rather than a variable expense because this cost does not usually change in direct proportion to the amount of revenue generated. Financial reports about a company. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost. Sum these two line items to determine total variable costs.

Gross margin is replaced by the contribution margin. From this all fixed expenses are then subtracted to arrive at the net profit or loss for the period. Thus the format of a variable costing income statement is.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)