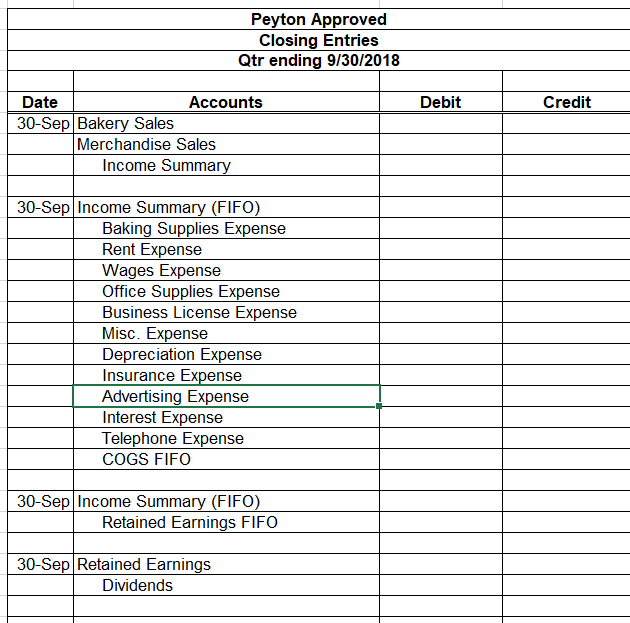

Closing Income Statement And Dividend Accounts

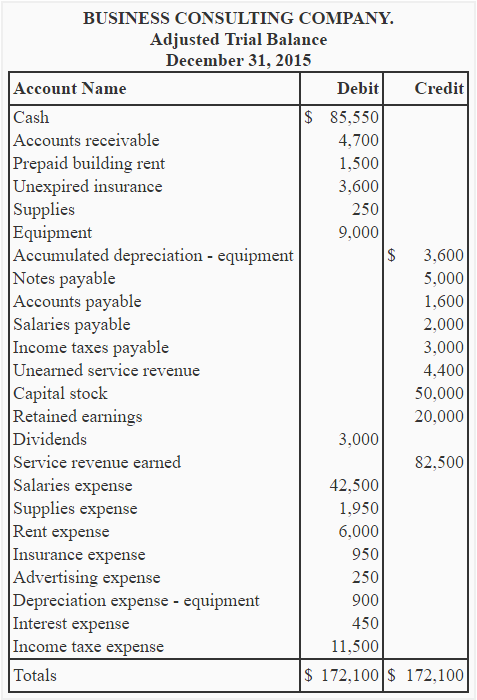

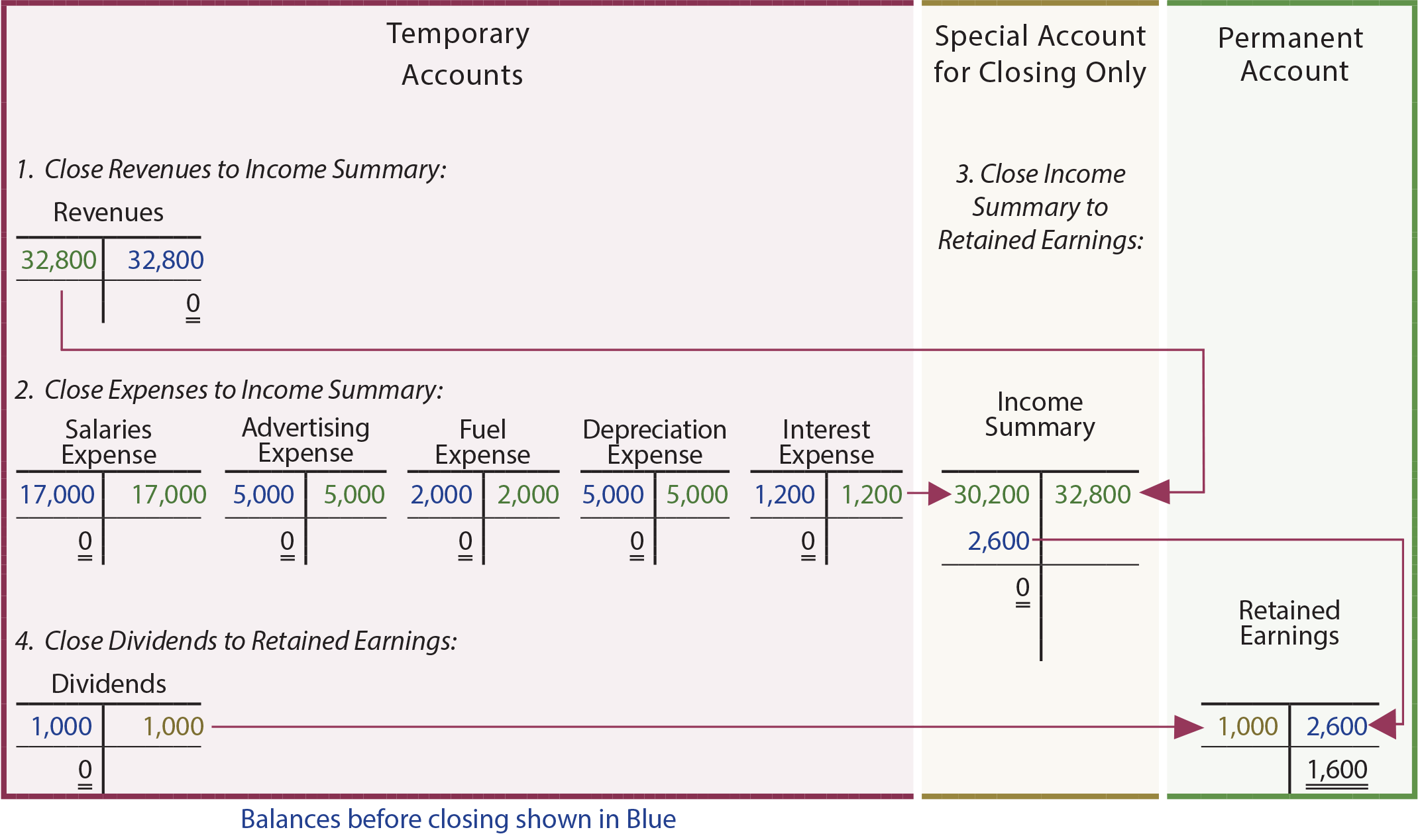

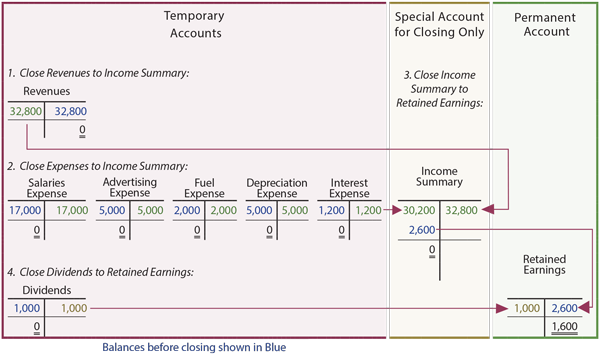

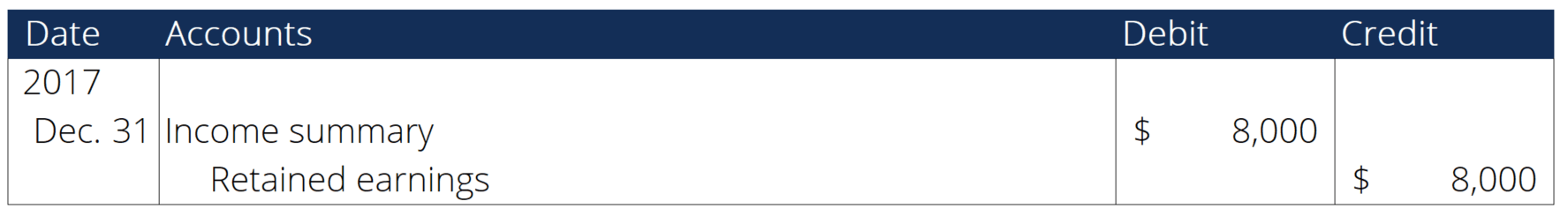

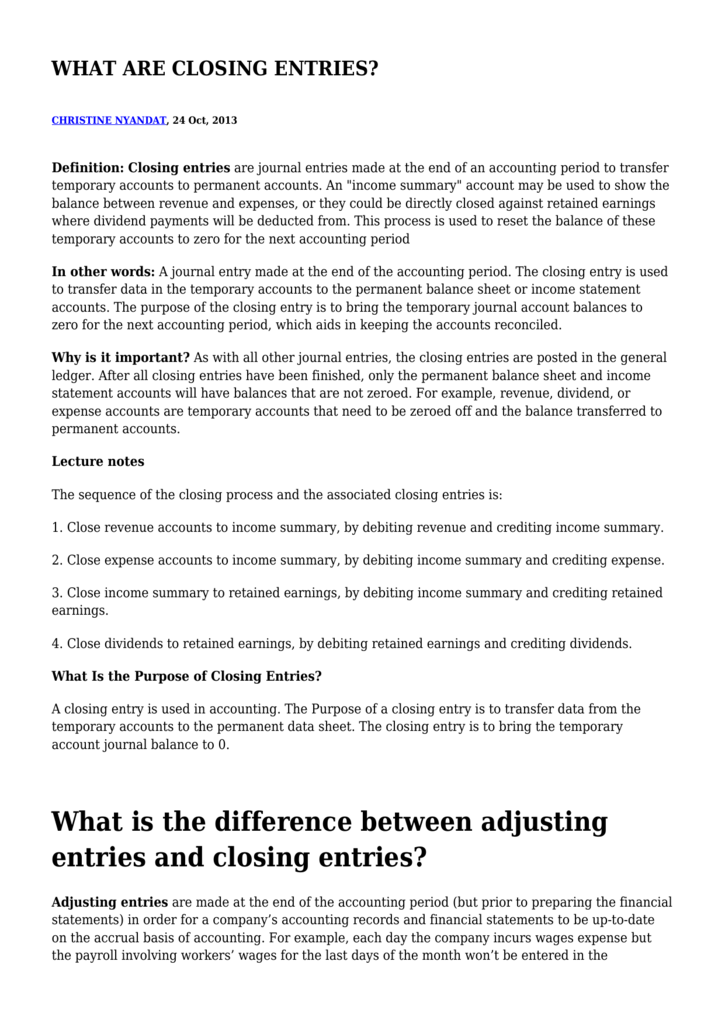

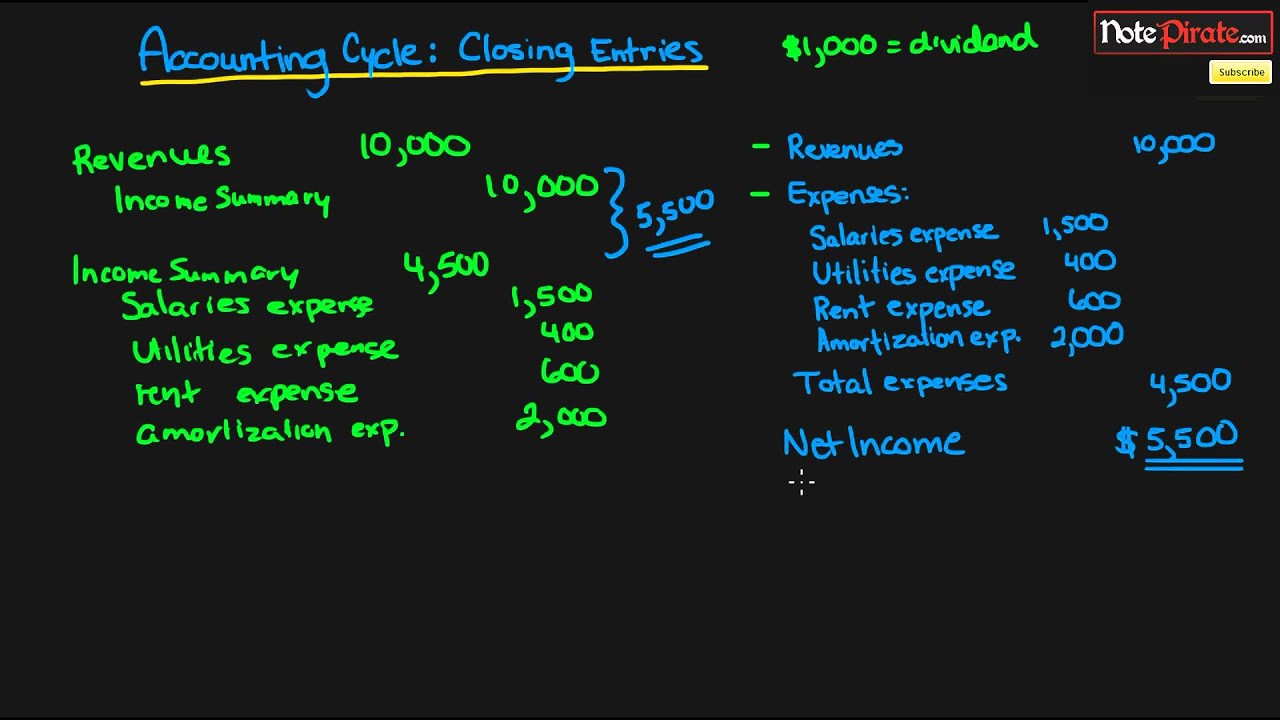

Through a process involving closing entries the income statement numbers are set at zero and the balances in those accounts are transferred to their permanent home the retained earnings account.

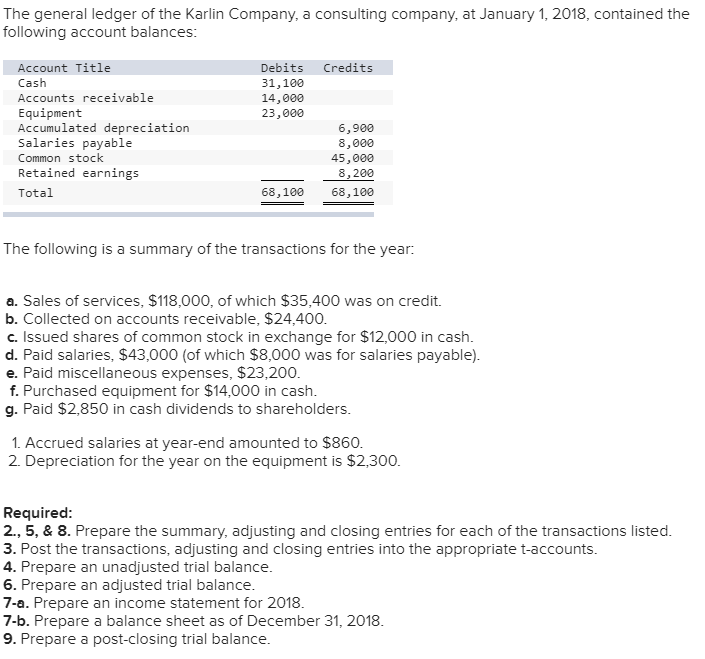

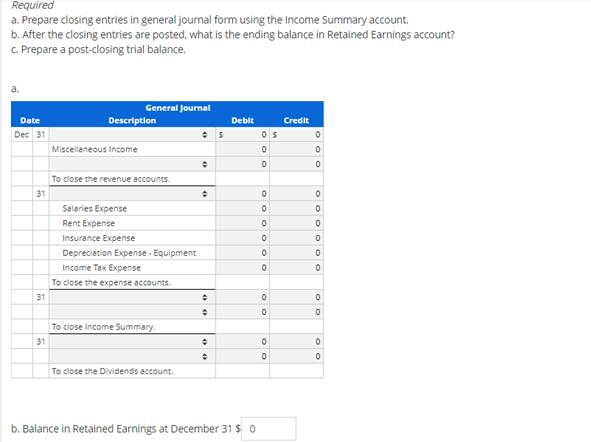

Closing income statement and dividend accounts. They are all expense accounts. Expense accounts have debit balances. Two examples of closing entries are. Green has eight income statement accounts with debit balances.

Closing revenue expense and dividend accounts general journal entries. Chapter 3 spring 2017 page 3 12 purpose of closing accounts. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. This preview shows page 12 16 out of 20 pages.

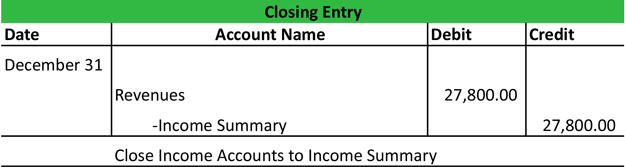

Closing the revenue accounts transferring the credit balances in the revenue accounts to a clearing account called income summary. Closing for expense accounts. Closing the expense accounts. Chapter 3 spring 2017 page 3 12.

Income statement accounts and dividends declared closed purpose of closing accounts. Closing an expense account means transferring its debit balance to the income summary account the journal entry to close an expense account therefore consists of a credit to the expense account in an amount equal to its debit balance with an offsetting debit to the income summary. Now that all the temporary accounts are. The closing of the income statement accounts revenues expenses gains losses by transferring their balances to the owner s capital account or the corporation s retained earnings account.

Examples of closing entries. This is done after the company s financial statements for the year have been prepared. The four basic steps in the closing process are. Only revenue expense and dividend accounts are closed not asset liability common stock or retained earnings accounts.