Us Jamaica Income Tax Treaty

The treaty covers jamaican income tax and mexican federal income tax.

Us jamaica income tax treaty. Foreign tax paid on income that is not taxed in jamaica is not available as a credit against the individual s jamaican tax liability. United states of america and the government of jamaica for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income the convention together with a related exchange of notes signed at kingston on may 21 1980. The income tax treaty between jamaica and mexico entered into force on 24 march 2018. The treaty signed 18 may 2016 is the first of its kind between the two countries.

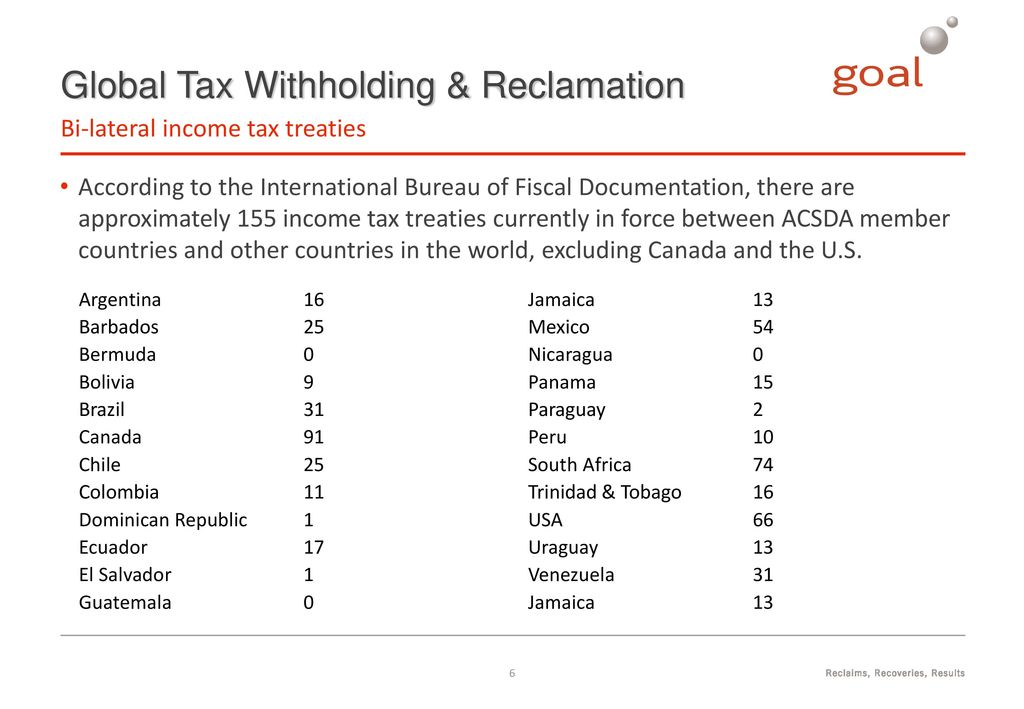

The convention will replace the extension in 1959 to jamaica of the 1945 income tax. The treaties currently in force are. See the withholding taxes section in the corporate tax summary for a list of countries with which jamaica has a tax treaty.