Limit On Income While On Social Security

Supplemental security income ssi is a federal program managed by the social security administration that pays monthly cash benefits to disabled blind or elderly people and even some children with little income and few assets.

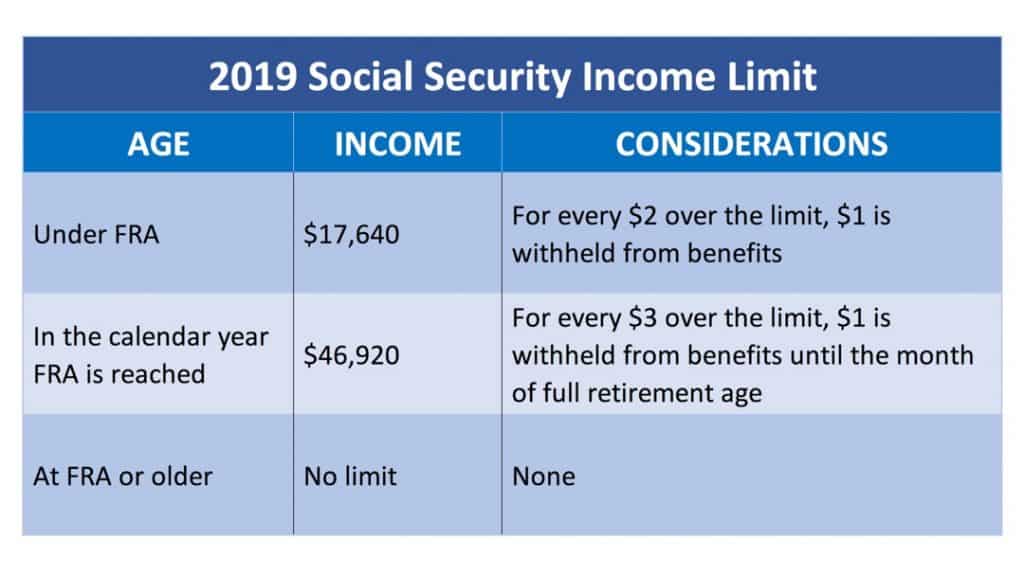

Limit on income while on social security. Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is currently 66 and is gradually rising to 67 over the next several years. Furthermore if you ll be reaching fra in 2021 that limit increases to 50 520 up from. Social security benefits are not. Special earnings limit rule.

Historically social security was designed to replace earnings lost due to disability and retirement. In june 2019 8 1 million people collected ssi benefits. If you will reach full retirement age during that same year it will be reduced every month until you reach full. As of 2015 for any year prior to full retirement age the earnings limit is 15 720 according to the ssa.

In the year the person turns full retirement age the earnings limit becomes 41 880 and for every 3 earned thereafter benefits reduce by 1 until full retirement age is reached. At your full retirement age there is no income limit. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. For 2020 those who are younger than full retirement age throughout the year can earn up to 18 240 per year without.

Once your income exceeds that point you ll have 1 in social security withheld for every 2 you earn. The 17 640 amount is the number for 2019 but the dollar amount of on the income limit will increase on an annual basis going forward. Of that number 1 1 million recipients were children. For every 3 you earn over the income limit social security will withhold 1 in benefits.

Social security provides monthly income to 50 7 million beneficiaries including over 7 2 million disabled recipients. For every 2 earned after that the benefit reduces by 1. We have a special rule for this situation. If you take social security benefits before you reach your full retirement age and you earn an annual income in excess of the annual earnings limit for that year your monthly social security benefit will be reduced for the remainder of the year in which you exceed the limit.

There s a limit on how much you can earn and still receive your full social security retirement benefits while working.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)