Personal Income Tax Rate Luxembourg 2020

Tax is calculated in accordance with a progressive table ranging from 8 on taxable income in excess of eur 11 265 to 42 on income in excess of eur 200 004 for 2018.

Personal income tax rate luxembourg 2020. If you have questions on topics like income tax special regimes for impatriate workers pension and investment income you will find the answers here. A fixed monthly cash bonus of eur76 88 is granted for each child falling within the scope of the luxembourg family allowances regime irrespective of the taxable income of the parents. In the long term the luxembourg personal income tax rate is projected to trend around 48 78 percent in 2021 and 45 78 percent in 2022 according to our econometric models. The cit rate is 17 for companies with taxable income in excess of eur 200 001 leading to an overall tax rate of 24 94 in luxembourg city for fy 2019 and fy 2020 taking into account the solidarity surtax of 7 on the cit rate and including the 6 75 municipal business tax rate applicable.

The first 11 265 is offered tax free with the lowest rate of 8 kicking in thereafter. The top rate of 38 2 percent remained in 2020. What are the basic principles of income taxation in luxembourg. Luxembourg has a bracketed income tax system with seventeen income tax brackets ranging from a low of 0 00 for those earning under 11 265 to a high of 38 00 for those earning more then 39 885 a year.

With this in mind we have created a brochure to guide you through the taxation of individuals for the new tax year 2020. The top rate on personal income in 2019 is 16 2 percent an increase from 14 5 percent in 2017 with an income threshold of nok 964 800 us 109 611. Workers must also pay between 7 and 9 as an additional contribution to the employment fund. Overall the top rate on personal income fell slightly from 38 5 percent in 2017 to 38 2 percent in 2019.

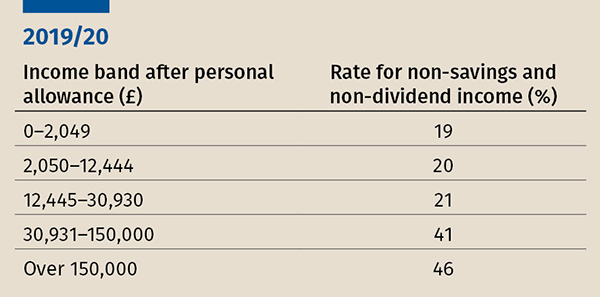

Income tax in luxembourg is charged on a progressive scale with 23 brackets which range from 0 to 42. Find answers to these questions and many more in the new 2020 issue of our luxembourg income tax guide. Income tax rates in luxembourg. The 2020 income tax table for single taxpayers tax class 1 is as follows.

Luxembourg personal income tax rate was 48 78 in 2020. Personal income tax rate in luxembourg is expected to reach 48 78 percent by the end of 2020 according to trading economics global macro models and analysts expectations.