Bad Debt Expense Income Statement Classification

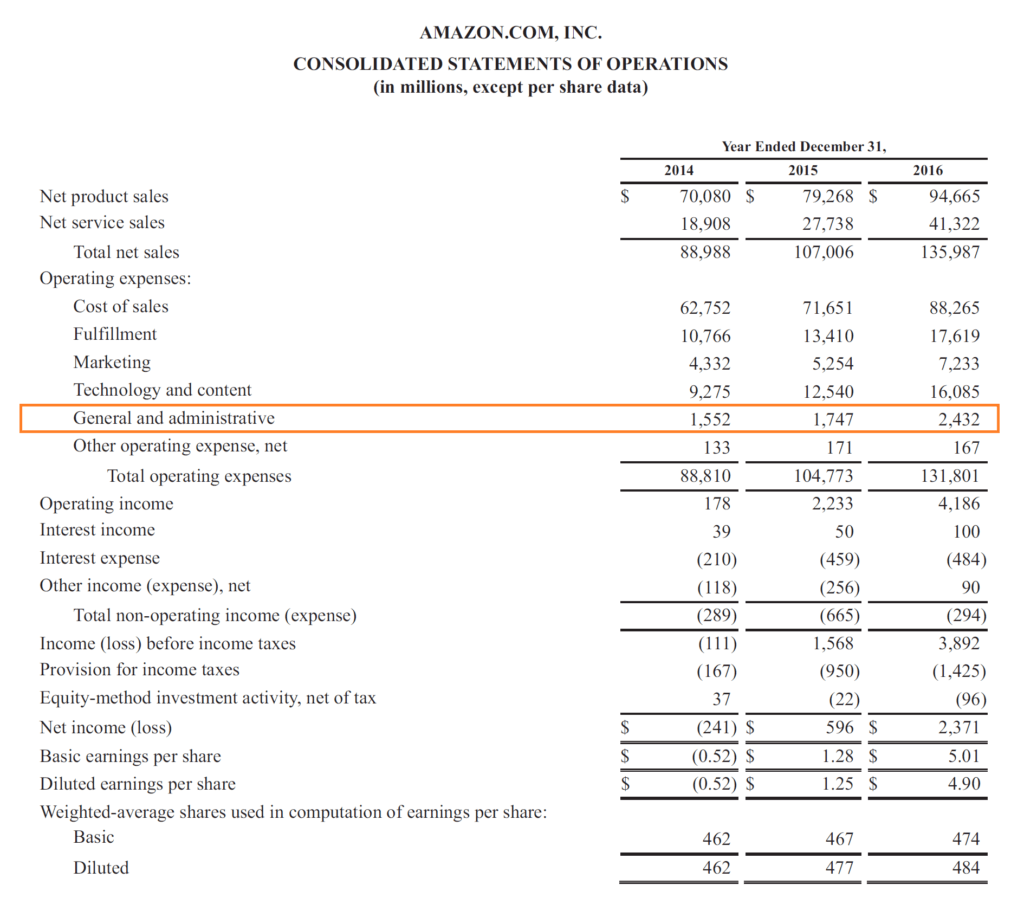

Bad debt expense is reported on the income statement bad debt is the expense account which will show in the operating expense of the income statement.

Bad debt expense income statement classification. Amortization expense operating expense income statement debit b bad debts expense operating expense income statement debit bonds payable long term liability balance sheet credit buildings plant assets balance c. I m confused by the text book regarding the classification of bad debt. With both methods the bad debt expense needs to record in the income statement by a different time. This method is based on an evaluation of the collectibility of accounts receivable.

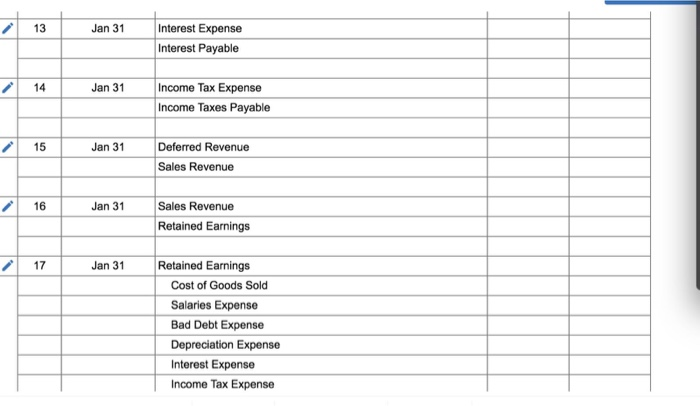

Cash flow statement 14. Accordingly they enter a bad debt expense of 3 000 on the company s monthly financial statement and add the same amount to the allowance for doubtful accounts on the balance sheet. Accounts receivable and bad debts expense 17. Is it belonging to distribution cost or admin expense when prepare the company.

Hi everyone i m doing unit 11 dfs with kaplan book at the moment. Net income effect you would also charge 2 000 to bad debt expense which appears on your income statement. Inventory and cost of goods sold 19. The bad debt expense appears in a line item in the income statement within the operating expenses section in the lower half of the statement.

Accounts receivable aging method. As an example of the allowance method abc international records 1 000 000 of credit sales in the most recent month. As your company uses up or spends down its bad debt reserve the release of that liability flows through your income. Posted by kauditor at 11 41 pm labels.

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)