True Or False A Multi Step Income Statement Would Show Cost Of Goods Sold

However the multi step approach can still yield misleading results if management alters where expenses are recorded in the statement.

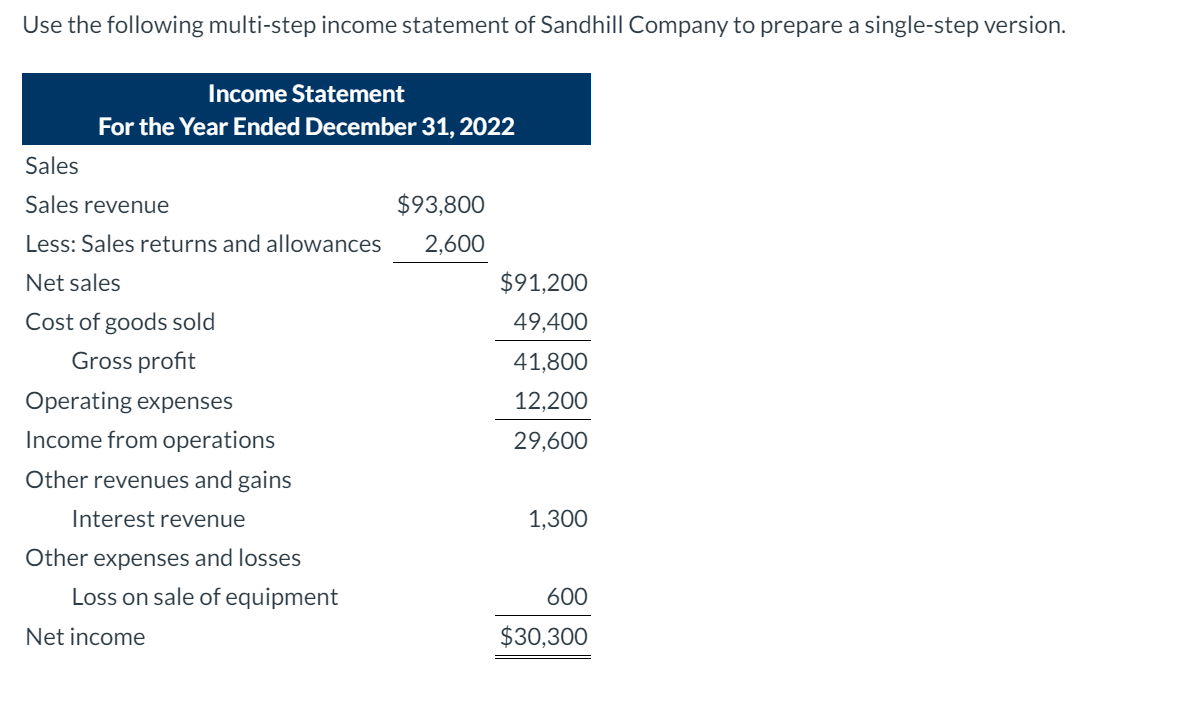

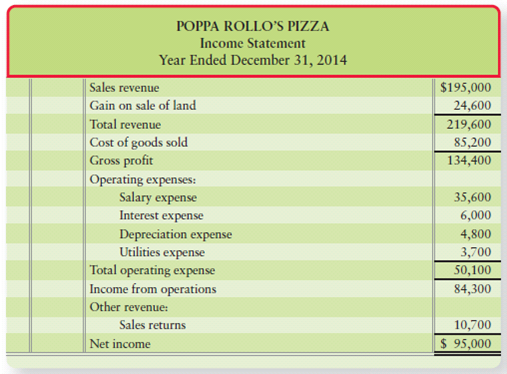

True or false a multi step income statement would show cost of goods sold. 3 operating income equals gross profit minus operating expenses. 2 the net income calculated using either the single step or multi step income statement formats is always the same. Be careful not to confuse the terms total manufacturing cost and cost of goods manufactured with each other or with the cost of goods sold. A single step income statement uses a single equation to compute the net income of the business and it is a more simplified report compared to a multi step income statement.

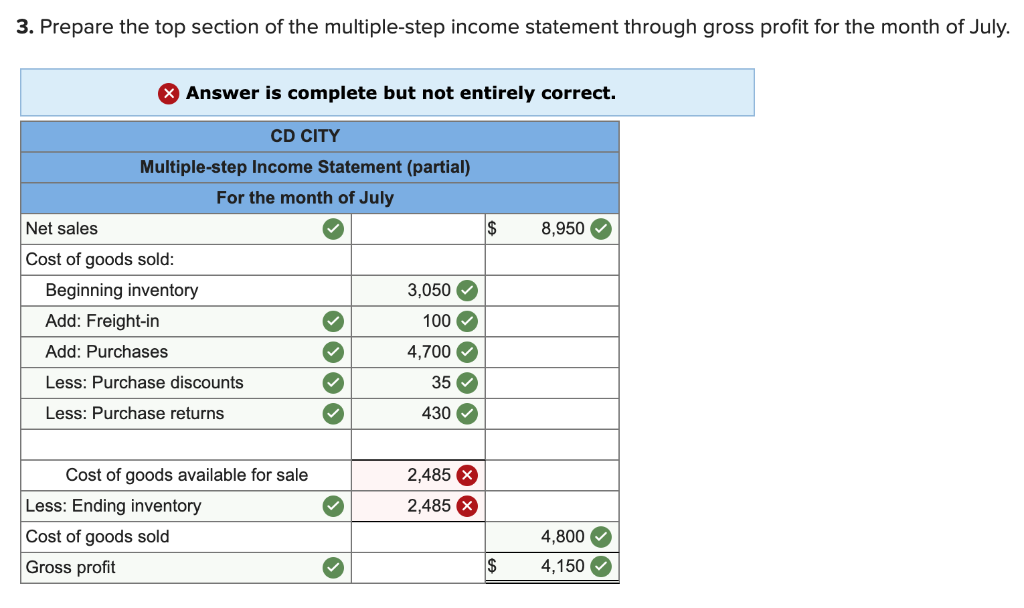

A single step income statement includes just one calculation to arrive at net income. Based on this information the company s year end financial statements would show a. Cost of goods sold is subtracted from net sales in order to determine gross profit. The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured.

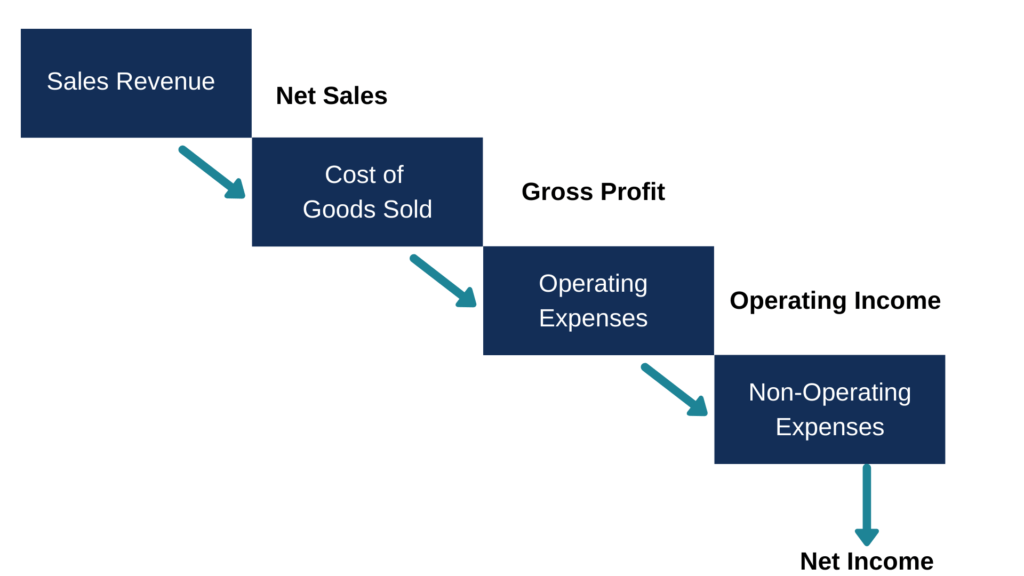

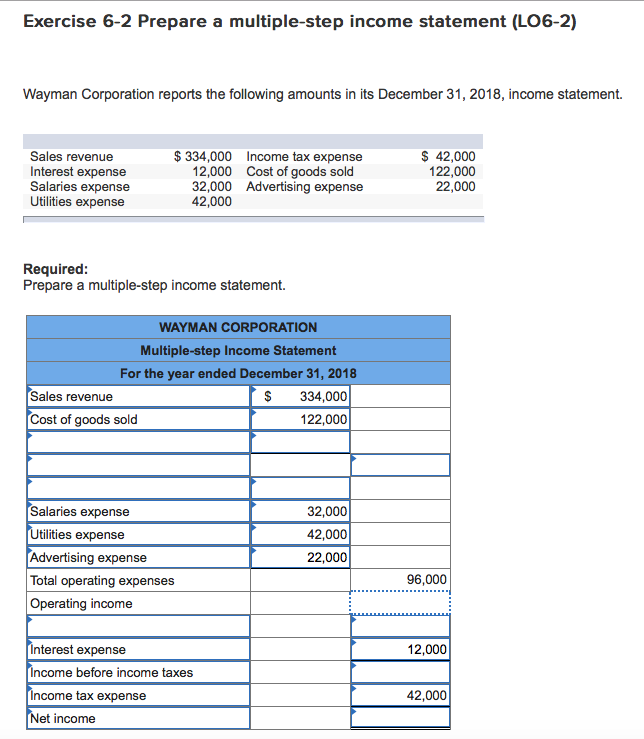

Compute income from operations gross profit operating expenses step 3. The multiple step income statement also shows the gross profit net sales minus the cost of goods sold. 1 cost of goods sold appears on a multi step income statement but not on a single step income statement. Using the above multiple step income statement as an example we see that there are three steps needed to arrive at the bottom line net income.

A gain of 26 500 on the income statement. A cash inflow from operating activities of 1 500 on the statement of cash flows. Compute gross profit total sales cost of goods sold step 2. It presents the revenue expenses and profit or loss generated by the business during a particular period but it uses a single equation to calculate profits.

For example an expense may be shifted out of the cost of goods sold area and into the operating expenses area resulting in a presumed improvement in the gross margin. Amron company sold land that had cost 25 000 for 26 500. Multi step income statements on the other hand use multiple equations to calculate net income. A multi step income statement also differs from an income statement in the way that it calculates net income.

Here is a sample income statement in the multiple step format. A single step income statement shows only one subtotal for. Expenses are subtracted from gross profit in order to calculate net income. As you can see this multi step income statement template computes net income in three steps.

When a company preparing a multiple step income statement has no reportable non operating activities its income from operations is simply labeled net income. Cost of goods sold is. Compute net income income from operations non operating and other the cost of goods sold is. Identify the statements below which are correct regarding a merchandiser s multi step income statement.

A single step income statement includes cost of goods sold as another expense and shows only one subtotal for total expenses.