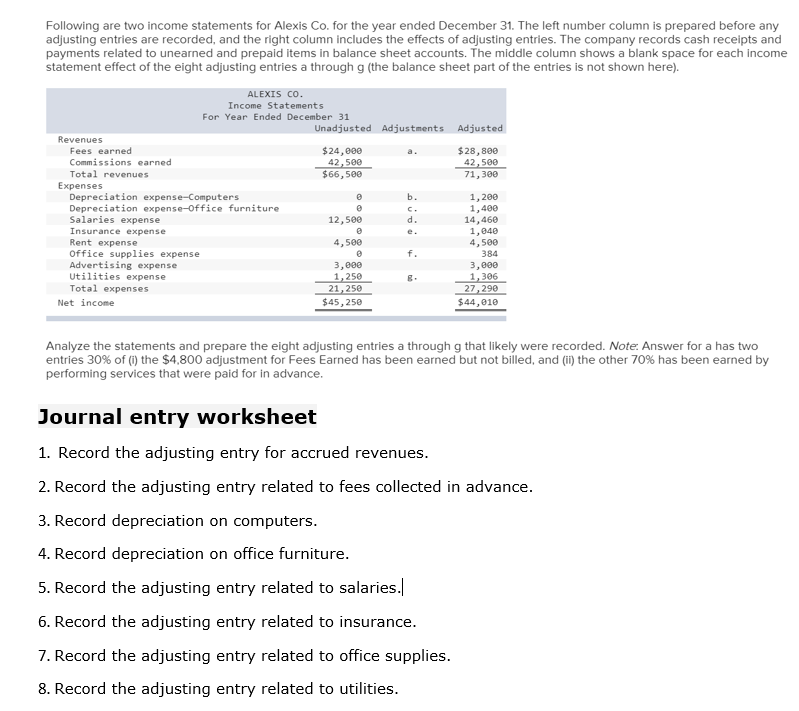

Record Depreciation Income Statement

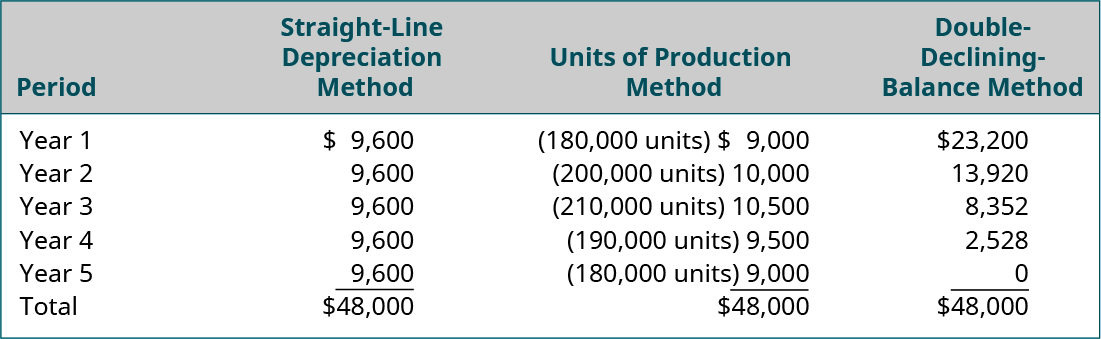

The straight line method of depreciation will result in depreciation of 1 000 per month 120 000 divided by 120 months.

Record depreciation income statement. Income statement will record depreciation of rm31 250. The monthly journal entry to record the depreciation will be a debit of 1 000 to the income statement account depreciation expense and a credit of 1 000 to the balance sheet contra asset account accumulated depreciation. Statement of financial position. It is accounted for when companies record the loss in value of their fixed assets through depreciation.

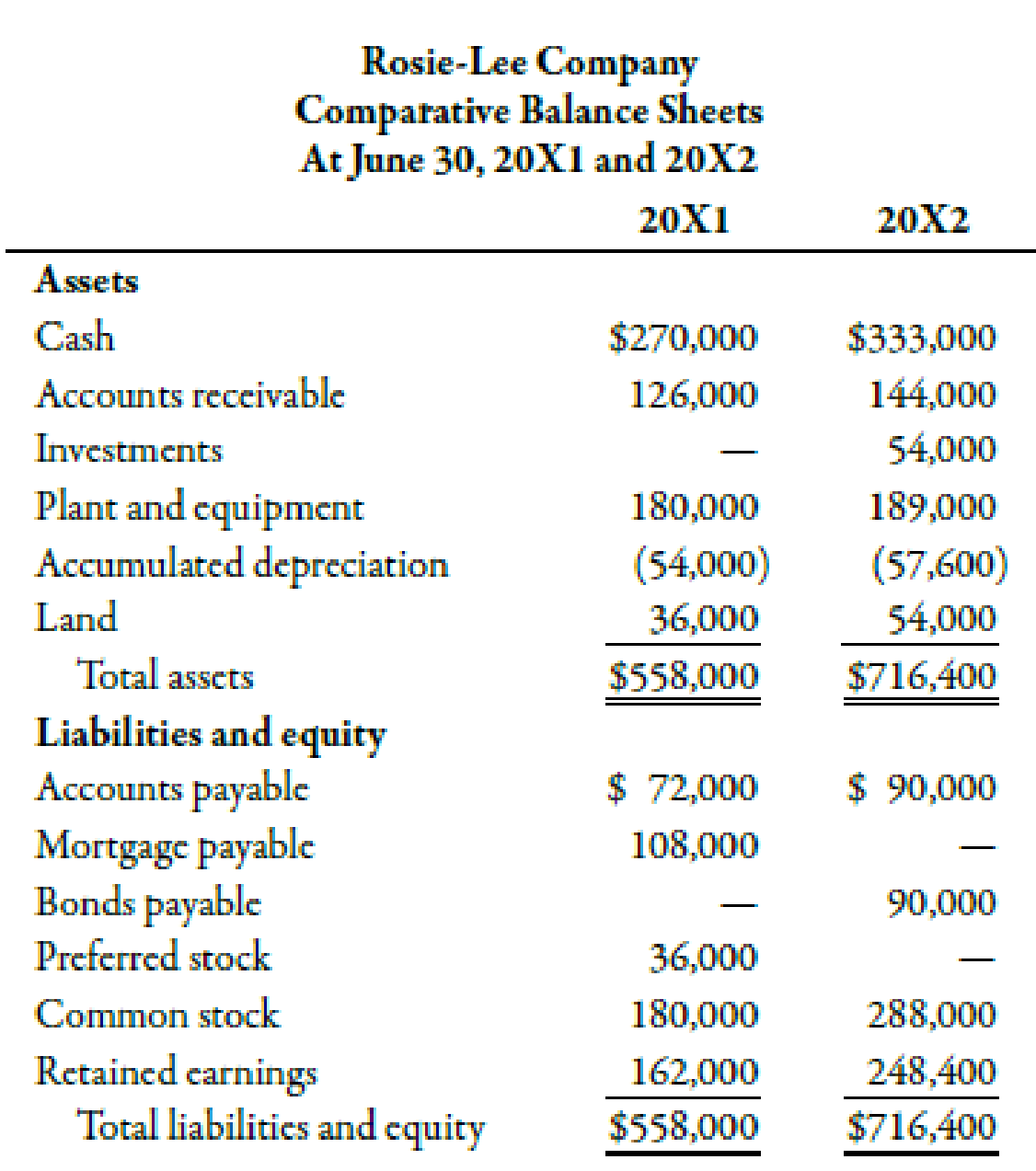

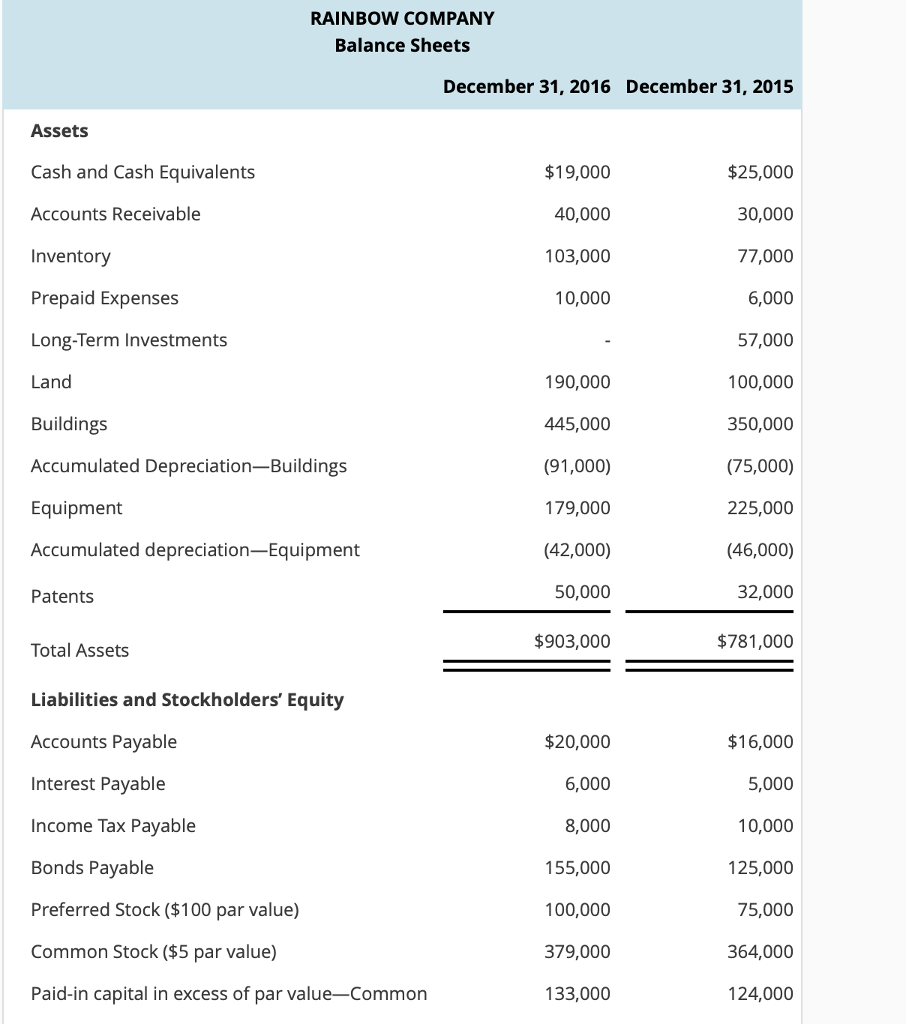

The financial statement shows that the business has used up 4 400 of the truck s value by the end of its first year. Example of depreciation usage on the income statement and balance sheet. You record depreciation expense on the income statement and record accumulated depreciation as a contra asset account on the balance sheet. Machine rm250 000 accumulated depreciation rm31 250 rm218 750 credit deferred grant revenue income statement will record grant revenue of rm31 250 and depreciation of rm62 500.

Income statement will record depreciation of rm31 250. Depreciation is a way to account for changes in the value of an asset. Depreciation on the income statement is an expense while it is a contra account on the balance sheet. The repair of sewing machine is considered as a major repair and as it can increase the efficiency and quantity of cloth production the cost of rm50 000.

Statement of financial position. Depreciation expense and accumulated depreciation. Machine rm250 000 accumulated depreciation rm31 250 rm218 750 g explain the accounting treatment for the repair of sewing machine. How your depreciation method affects your income taxes.

One expense reported here relates to depreciation. In the absence of these assets depreciation doesn t exist as an expense on a firm s income statement. You ll need to understand how to record depreciation in journal entries. This expense is most common in firms with copious amounts of fixed assets.

Depreciation expense is an income statement item. Physical assets such as machines equipment or vehicles degrade over time and reduce in value incrementally. Depreciation also affects your business taxes and is included on tax statements. The income statement reports all the revenues costs of goods sold and expenses for a firm.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)