Income With Respect To Decedent Annuity

Ird is taxed to the individual beneficiary or entity that.

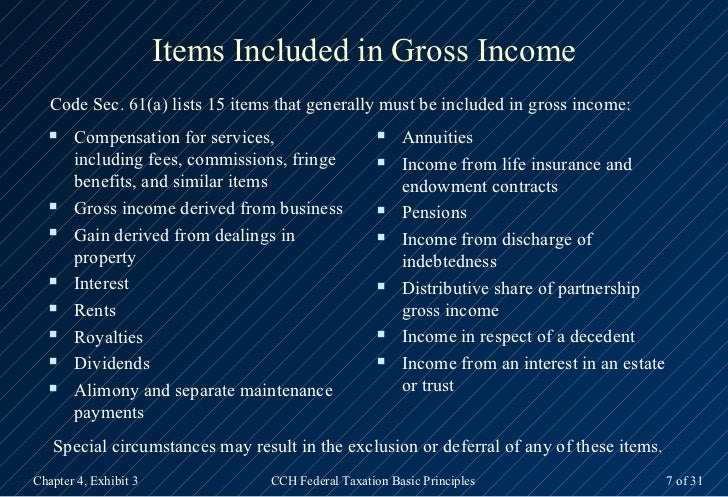

Income with respect to decedent annuity. Uncollected salaries wages bonuses vacation pay and sick pay earned before death but paid after death. Regardless of accounting method ird is subject to income tax when a triggering event generally the actual receipt of the income by the beneficiary occurs. Income in respect to decedent includes the taxable portions of annuities traditional iras and tax deferred retirement plans series ee u s. One way to initially reduce the tax to the beneficiary is by claiming a deduction in respect to decedent drd to offset the revenue.

The beneficiaries must pay income tax as they receive the payments. Deductions in respect to a decedent. O uncollected salaries wages bonuses commissions vacation pay and sick pay of a cash basis employee o certain deferred compensation and stock option. Sources of ird include but are not limited to the following.

Because annuities offer many benefits lottery winners retirees and structured settlement recipients use them to create predictable cash flow for the present future and even after their death. The net value of the items included as income in respect of a decedent is 15 000 20 000 the estate tax determined without including the 15 000 in the. Income in respect of a decedent ird is income earned by the decedent deceased person prior to his death but was payable or paid after his death. The estate tax that qualifies for the deduction is 4 620 9 460.

When the owner dies the income tax liability is passed on to the beneficiaries of the annuity or ira. Income in respect of a decedent includes. For the estate tax deduction an annuity received by a surviving annuitant under a joint and survivor annuity contract is considered income in respect of a decedent. An account held by a beneficiary after the owner dies may be composed of.

Income in respect of a decedent ird is the gross income a deceased individual would have received had he or she not died and that has not been included on the deceased individual s final income tax return. An annuity is a financial instrument that accrues interest on a tax deferred basis and protects against market risk ad longevity risk. Income in respect of a decedent ird is untaxed income that a decedent has earned or had a right to receive during his or lifetime. Savings bonds installment agreements partnership income rent wages bonuses and vacation time paid after death.

Income in respect of a decedent ird refers to untaxed income that a decedent had earned or had a right to receive during their lifetime. Annuities iras and income in respect of a decedent annuities iras and qualified plans are tax deferred.

/GettyImages-BA61273-883c9d0942db4168b8acd8b51acbe1bd.jpg)