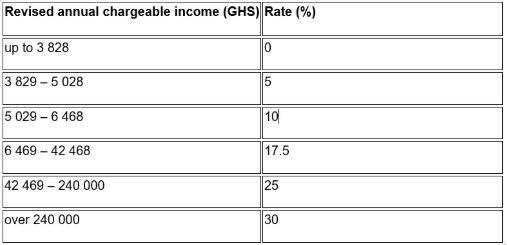

Zimbabwe Income Tax Bands

Income derived or deemed to be derived from sources within zimbabwe is subject to tax.

Zimbabwe income tax bands. Income tax federal and provincial thereon 50 644 52 499 50 368 less. The personal income tax rate in zimbabwe stands at 24 72 percent. It has been indicated that zimbabwe is considering moving to a residence based system during the current tax reform exercise. Zimbabwe presently operates on a source based tax system.

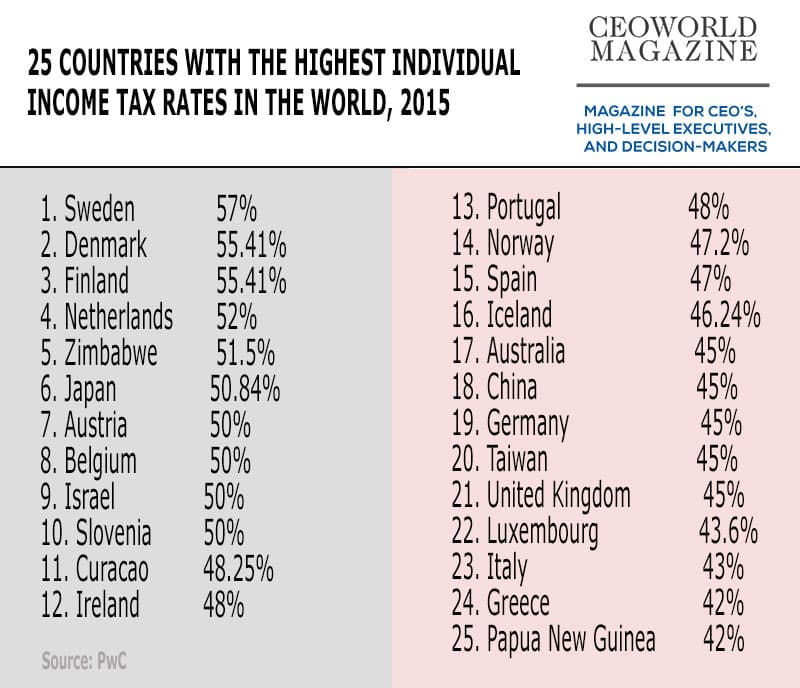

This rate includes a base rate of 24 plus a 3 aids levy. 14 xinhua the zimbabwean treasury has unveiled foreign currency denominated income tax bands with tax free threshold at 350 u s. Dollars a month and a rate of 40 percent for people earning more than 15 000 u s. Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24 72 percent in 2020.

Non refundable tax credits 8 480 8 579 8 065 total income tax 42 165 43 920 42 303 employee contribution to pension plan 2 356 2 426 2 480 891 914. Sunday september 13 2020 newsdzezimbabwe 0 treasury has unveiled foreign currency denominated income tax bands that will see the tax free threshold pegged at us 350 while the highest bracket will. As of 1 january 2020 the corporate income tax cit rate for companies other than mining companies with special mining leases but including branches is reduced to 24 72 previously 25 75. August to december 2020 paye rtgs tax tables aug dec 2020 tax tables rtgs pdf download details tax tables usd 2020 jan jul jan jul 2020 tax tables usd pdf download details tax tables rtgs 2020 jan jul.

The zimbabwean treasury has unveiled foreign currency denominated income tax bands with tax free threshold at 350 u s.