Zimbabwe Company Income Tax Rate

Zimbabwe presently operates on a source based tax system.

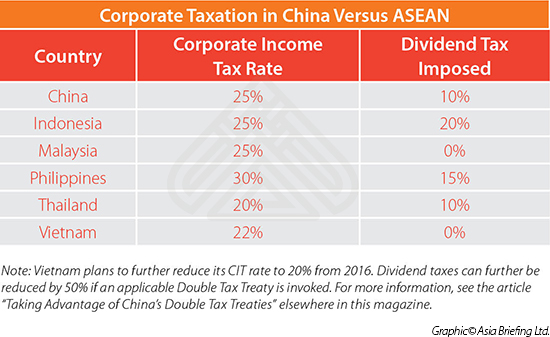

Zimbabwe company income tax rate. Company tax 24 72 standard 24 rate 3 aids levy tax rate for foreign companies zimbabwe adopts a territorial system of taxation. 2 5 where more than 25 of shares are held. Business rents is taxed at the corporate rate of tax currently 24. 2 of 2017 0 income of.

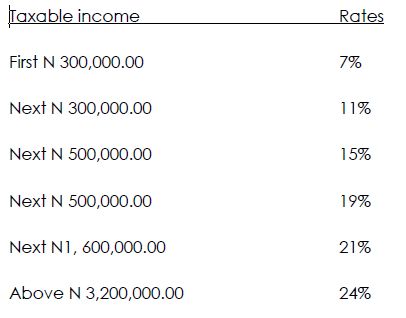

Personal income tax rates these tax brackets only apply to employment income. Rate is based on tax chargeable 3 dividends from company incorporated outside zimbabwe 14 5 20 income of special economic zones for the first 5 years of operation sec 3 of fin no. August to december 2020 paye rtgs tax tables aug dec 2020 tax tables rtgs pdf download details tax tables usd 2020 jan jul jan jul 2020 tax tables usd pdf download details tax tables rtgs 2020 jan jul. Yes investment income is taxable at an effective rate of 25 75 percent being 25 percent plus 3 percent aids levy while capital gains on specified assets are taxable at 20 percent.

7 5 in all other cases. 10 in all other cases. Corporate tax rate in zimbabwe averaged 27 22 percent from 2006 until 2018 reaching an all time high of 30 90 percent in 2007 and a record low of 25 percent in 2017. Tax measures proposed in 2020 budget the national budget for 2020 presented on 14 november 2019 includes proposals concerning the corporate income tax value.

The corporate tax rate in zimbabwe stands at 25 percent. As of 1 january 2020 the corporate income tax cit rate for companies other than mining companies with special mining leases but including branches is reduced to 24 72 previously 25 75. Tax measures proposed in 2020 budget zimbabwe. Non residents who do not have a place of business in zimbabwe may be subject to wht.

The rate for companies listed on the zimbabwe stock exchange is reduced to 10.