Us Income Tax Rate Kentucky

There are a total of eleven states in the u s.

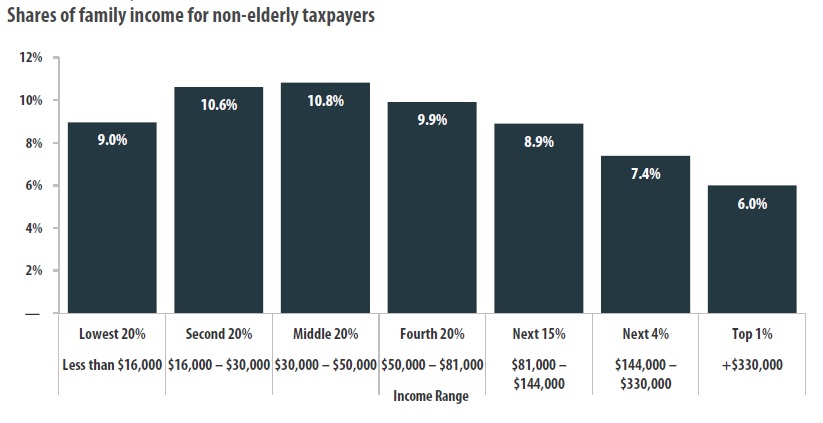

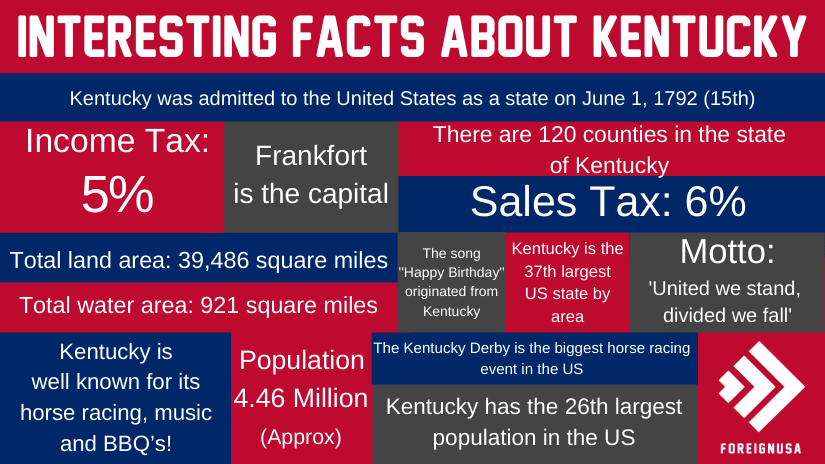

Us income tax rate kentucky. Kentucky income tax rate for 2019. That try to keep things simple when it comes to state income tax rates by imposing a flat rate. Kentucky collects a state income tax at a maximum marginal tax rate of spread across tax brackets. This credit will be available for tax years 2019 and 2020.

This credit was created for those taxpayers whose tax rate increased after hb 487 implemented a flat tax rate of 5. Below you will find 2019 kentucky tax brackets and tax rates for all four ky filing statuses. Notably kentucky has the highest maximum marginal tax bracket in the united states. Unlike the federal income tax kentucky s state income tax does not provide couples filing jointly with expanded income tax brackets.

The kentucky tax rate and tax brackets tabulated below are based on income earned between january 1 2019 through december 31 2019. Income gap tax credit. Kentucky has one individual income tax bracket with a flat rate of 5.