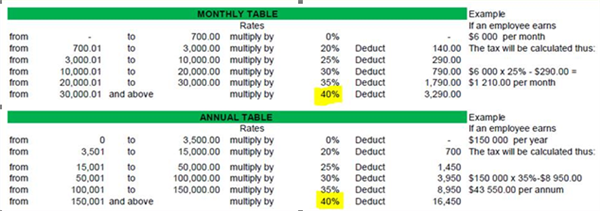

Zimbabwe Income Tax Brackets 2020

Personal income tax rates.

Zimbabwe income tax brackets 2020. These tax brackets only apply to. Last reviewed 29 september 2020. Non residents who do not have a place of business in zimbabwe may be subject to wht. Certain types of income arising outside zimbabwe may in the hands of a zimbabwean tax resident be deemed to arise in zimbabwe and be taxed as such.

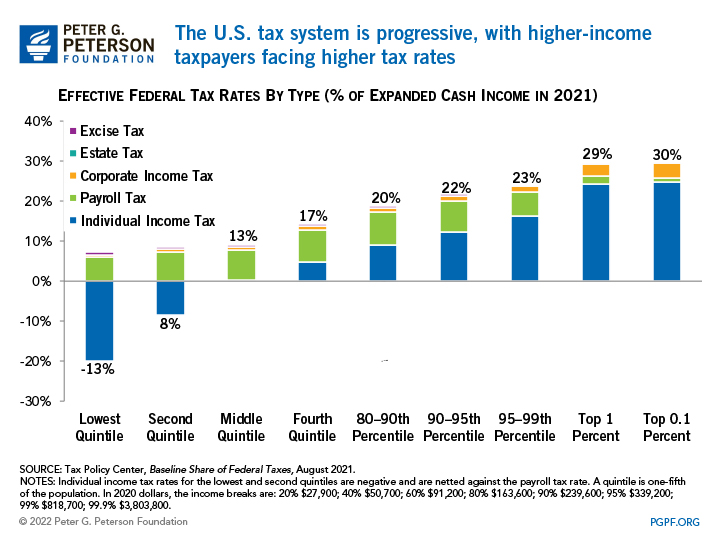

Treasury has unveiled foreign currency denominated income tax bands that will see the tax free threshold pegged at us 350 while the highest bracket will be for those earning more than us 15 000. The income tax rates and personal allowances in zimbabwe are updated annually with new tax tables published for resident and non resident taxpayers. How to calculate your salary after tax in zimbabwe. This page provides zimbabwe personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

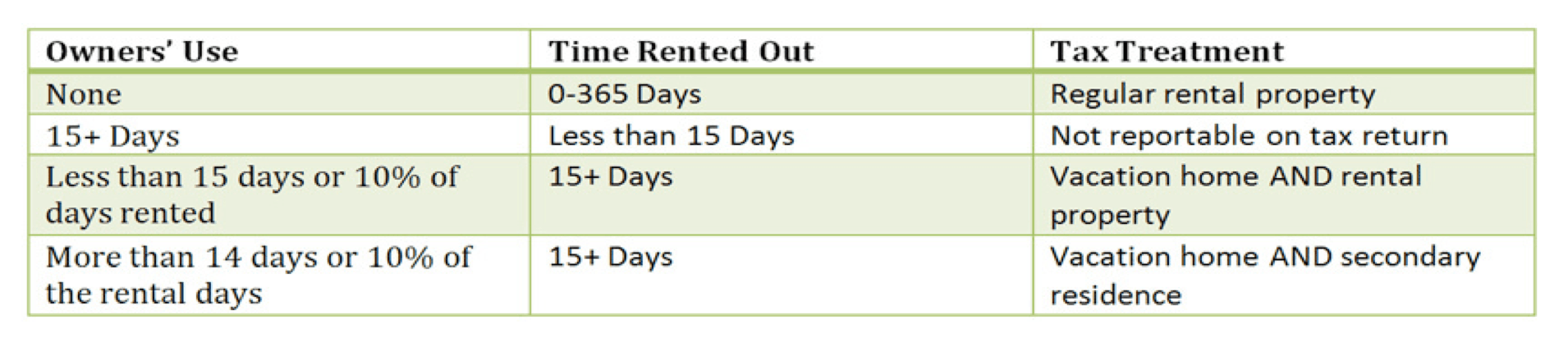

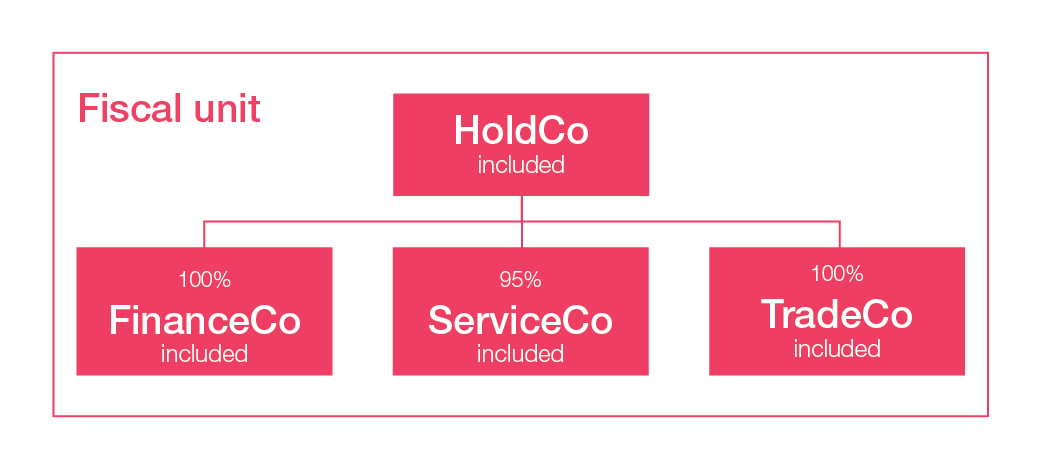

Enter your salary and the zimbabwe salary calculator will automatically produce a salary after tax illustration for you simple. Member of the board of directors in a group company situated in zimbabwe trigger a personal tax liability in zimbabwe. Section 15 2 of the vat act chapter 23 12. August to december 2020 paye usd tax tables.

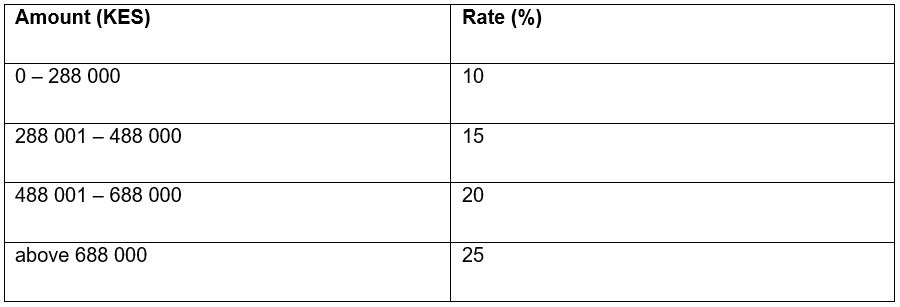

Zimbabwe has implemented the authorised economic operator aeo programme in line with international best practice and the. Lower limit upper limit specified percentage 0 usd840 0 usd841 usd3 600 20 usd3 601 usd12 000 25 usd12 001 usd10 000 30 usd4 800 usd36 000 35. Aug dec 2020 tax tables usd pdf. Remuneration and benefits and trade income.

11 september 2020 deduction of input tax using a tax invoice. Will a non resident of zimbabwe who as part of their employment within a group company is also appointed as a statutory director i e. The tax tables below include the tax rates thresholds and allowances included in the zimbabwe tax calculator 2020. The personal income tax rate in zimbabwe stands at 24 72 percent.

Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24 72 percent in 2020. Follow these simple steps to calculate your salary after tax in zimbabwe using the zimbabwe salary calculator 2020 which is updated with the 2020 21 tax tables. Income tax zimbabwe 2020 national budget statement. What categories are subject to income tax in general situations.