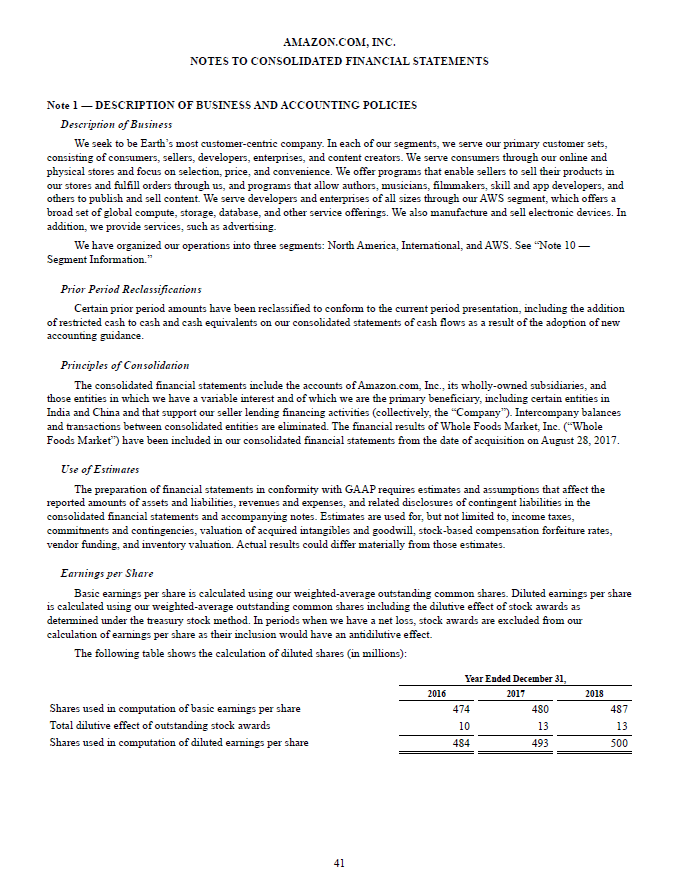

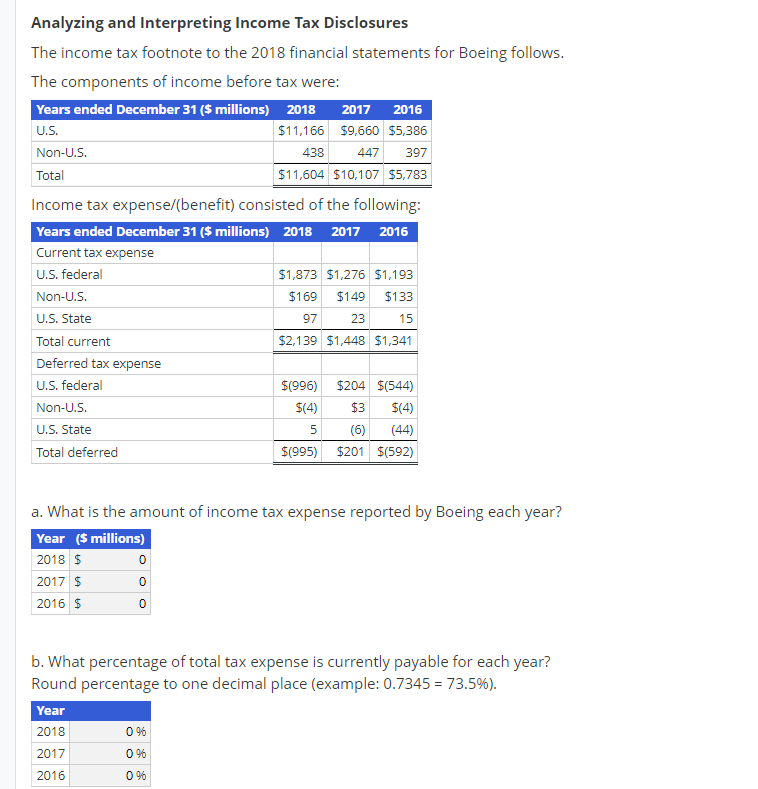

Financial Statement Disclosure Of The Components Of Income Tax Expense

The amount of deferred tax expense income relating to the origination and reversal of temporary differences.

Financial statement disclosure of the components of income tax expense. Netted against one another in the balance sheet. For a business entity performance is measured in terms of profit. Statement of comprehensive income. Is not necessary when only permanent differences exist.

The following are the important points about this tax expense. Is usually done in the footnotes. Important points about income tax expense income statement. Is not necessary when only permanent differences exis d.

Financial statement disclosure of the components of income tax expense. Usually is included in the disclosure notes. In some cases these transactions could significantly affect the consolidated financial statements. Must include the amount of cash paid for taxes.

Must be made on the face of the income statement. An important component of financial statements of an entity is statement of comprehensive income. The deferred tax expense relating to the. H income tax expense.

Must include the amount of cash paid for taxes. Financial statement disclosure of the components of income tax expense. You ve presented your operating results the very core results of your business and everything supporting it and now you show what s the extra bit you do with your funds. For each type of temporary differences the amount of the deferred tax income or expense recognised in the statement of comprehensive income if the information is not evident from the movement in statement of financial position amounts.

54 financial statement disclosure of the components of income tax expense. Income tax expense is paid out of the operating profits of the entity. As a component of income tax expense over the five year economic life of the intellectual property. Financial expenses and income on your income statement are the last group of results presented just after the operating profit.

The major components of tax expense income shall be disclosed separately. Current tax liability of 18 000 56. As mentioned above income tax involves an outflow of cash and hence it is seen as a liability for the company. Due to differences between depreciation reported in the income statement and depreciation.

Components of tax expense income may include. At december 31 2013 moonlight bay resorts had the following deferred income tax items. Usually is included in the disclosure notes. Current tax expense income.

1 disclosure shall be made in the statement of comprehensive income or a note thereto of the components of income loss before income tax expense benefit as either domestic or foreign. The tax associated with intra entity asset transfers should be accounted for under asc 740 10 25 3 e and asc 810 10 45 8. The main purpose of this statement is performance measurement. Must be made on the face of the income statement.

After reading this article you will learn about the format of income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)