Income Withholding For Support Form California

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

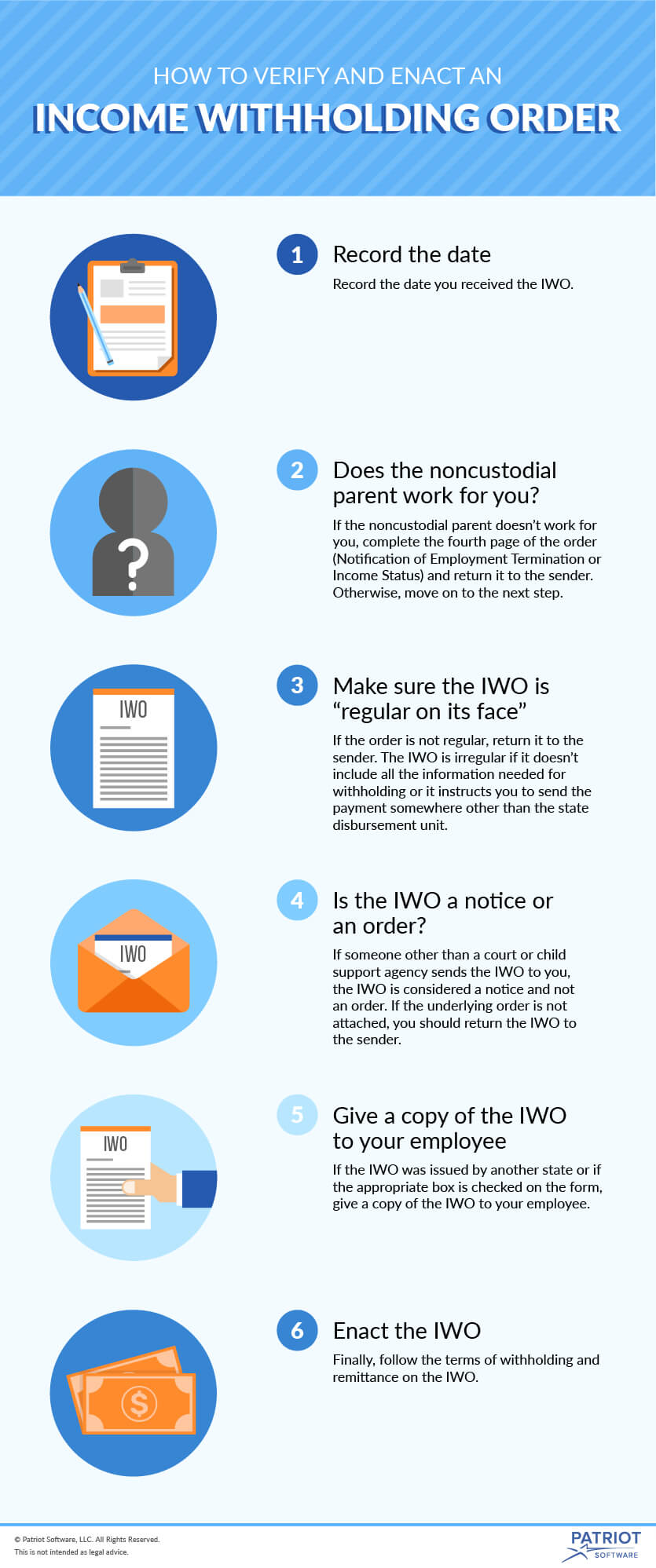

If the iwo is on an official income withholding for support form you must honor the requested withholding.

Income withholding for support form california. This week we ve been talking about income withholding orders. This is for child support and spousal support. This is called nonresident withholding. If a federal tax levy is in effect please notify the sender.

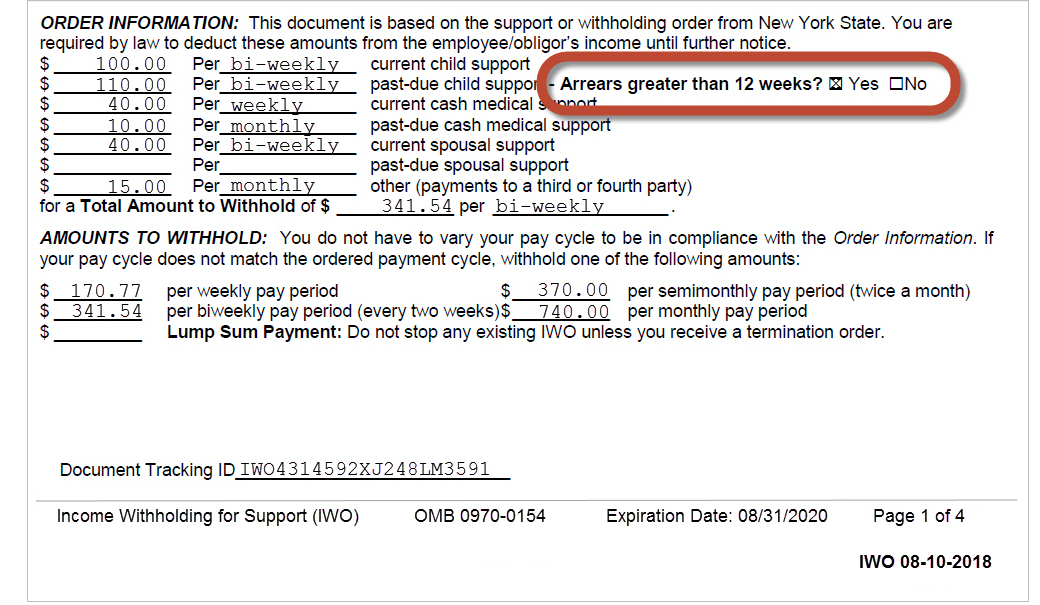

The iwo is the omb approved form used for income withholding in tribal intrastate and interstate cases as well as all child support orders that were initially issued in the state on or after january 1 1994 and all child support orders that were initially issued or modified in the state before january 1 1994 if arrearages occur. This is an official california judicial council family law form which may be used in domestic litigation in california. Your payer must take 7 from your ca income that exceeds 1 500 in a calendar year. Income withholding for support iwo order notice.

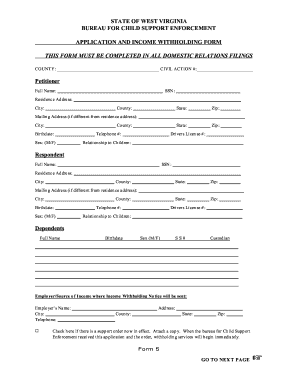

Instructions for form fl 195. An income withholding order iwo is a document sent to employers to tell them to withhold child support from an employee s wages. When filling out form fl 195 make sure to only write the last 4 digits of the social security number of the parent ordered to pay support the law requires it to protect their privacy. How to terminate income withholding order for california divorce.

This california fl 195 income withholding for support form is classified as a child custody form this page contains information about what this form is used for and who must file it as well as links to print or download the form as a pdf. Income withholding for support income withholding order notice for support iwo amended iwo one time order notice for lump sum payment termination of iwo date. If a federal tax levy is in effect please notify the sender. Child support enforcement cse agency court attorney private individual entity check one note this iwo must be regular on its face under certain circumstances you must reject this iwo and return it to the.

Backup withholding resident and nonresident withholding backup withholding is a type of income tax withheld on specific income types when a payee fails to. Withholding for support has priority over any other legal process under state law against the same income section 466 b 7 of the social security act. Income withholding for support. This is an order you can get from the court that can be served on an employer for purposes of withholding support so that can be paid directly to the person receiving.