Ohio State Income Tax Joint Filing Credit

The total of your senior citizen credit lump sum distribution credit and joint filing credit ohio schedule of credits lines 4 5 and 12 is equal to or exceeds your income tax liability ohio it 1040 line 8c and you are not liable for school district income tax.

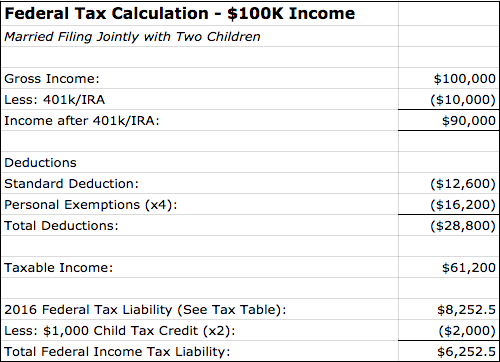

Ohio state income tax joint filing credit. Your exemption amount ohio it 1040 line 4 is the same as or more than your. Qualifying income does not include income from interest dividends distributions royalties rents capital gains and state or municipal income tax refunds. Ohio tries to compensate for this with a joint filing credit but it is limited and doesn t always make up for the higher rates. The joint filing credit also requires qualifying income so if the spouse does not work or have retirement income other than social security the couple does not usually even get the credit.

Source : pinterest.com

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)