Income Tax Definition South Africa

1 march 2020 to 28 february 2021.

Income tax definition south africa. However in a departure from previous tax years only the first r1million will be exempt from income tax in south africa. The act has gone through numerous amendments with the act presently in force is the income tax act no 58 of 1962 which contains provisions for four different types of income tax. There are no special tax concessions for expatriates. Amended by income tax amendment act 99 of 1988.

South africa uses a residence based taxation system whereby residents are taxed on worldwide income and non residents are taxed on south african sourced income. In the light of a recent supreme court of appeal decision the sa revenue service has released a draft interpretation note concerning the definition of gross income contained in the income tax. The form of tax that people generally associate with the concept of income tax is normal income tax. Income tax is a tax levied on all income and profit received by a taxpayer which includes individuals companies and trusts.

Amended by legal succession to the south african transport services act 9 of 1989. Income tax act 34 of 1953. However assuming the foreign national is not a south african tax resident non south african sourced employment income investment income and capital gains excluding gains derived from the disposal of immovable property held in south africa will not be subject to tax. How is interest paid to a non resident from a south african source taxed.

To consolidate the law relating to the taxation of incomes and donations. As from 1 march 2015 interest from a south african source paid to a non resident will be taxed at a final withholding tax rate of 15. Amended by income tax act 90 of 1988. It is the national government s main source of income and is imposed by the income tax act no.

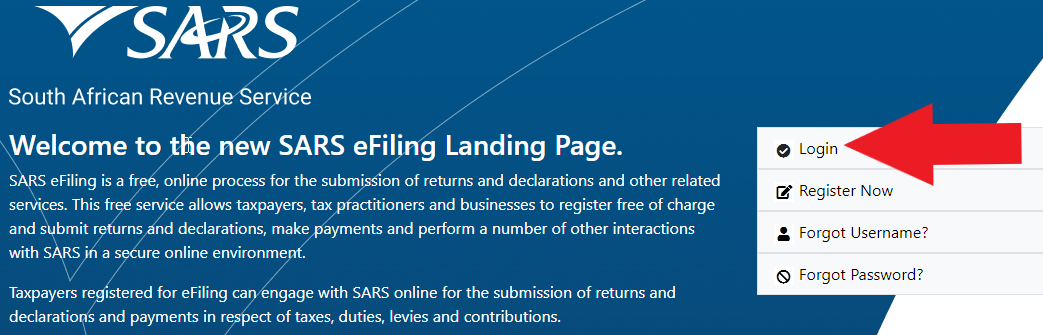

With 22 2 million of its 58 million strong population paying taxes most of the state s income comes from personal and corporate tax. The income tax return which should be completed by individuals is known as the itr12.