Corporate Income Tax Rate Romania 2020

This page provides romania personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

Corporate income tax rate romania 2020. Non resident individuals become taxable on their worldwide income starting with the date when they become tax residents in romania while respecting the provisions of the dtts where applicable. 25 for income that exceeds the amount of 445 000 lei. The content is straightforward. The standard corporate income tax rate is 16.

Download our 2020 tax guideline for romania. European oecd countries like most regions around the world have experienced a decline in corporate income tax rates over the last decades. The corporate tax rate in romania stands at 16 percent. Companies will be granted a 40 corporate income tax rebate capped at 15 000.

Keep up to date on significant tax developments around the globe with ey s global tax alert library here. Personal income tax rate in romania averaged 24 85 percent from 1995 until 2020 reaching an all time high of 48 percent in 1998 and a record low of 10 percent in 2018. The content is current on 1 january 2020 with exceptions noted. Corporate income tax cit rates.

Companies will be granted a 25 corporate income tax rebate capped at 15 000. This page provides romania corporate tax rate actual values historical data forecast chart statistics economic calendar and news. Personal income tax rates. Taxpayers that are carrying on activities such as gambling and nightclubs are either subject to 5 rate of the revenue obtained from such activities or to 16 of the taxable profit depending on which is higher.

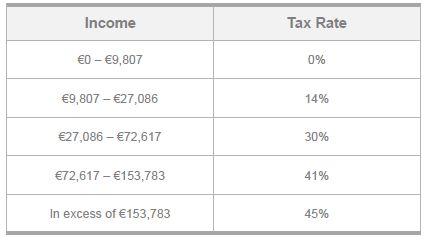

Companies will be granted a 50 corporate income tax rebate capped at 25 000. A flat personal income tax pit rate of 10 is generally in place. In 2000 the average corporate tax rate was 31 6 percent and has decreased consistently to its current level of 21 9 percent. 1 for income between 1 and 66 750 lei inclusively.

See the residence section for the residence criteria. Chapter by chapter from albania to zimbabwe we summarize corporate tax systems in more than 160 jurisdictions. Corporate taxes on corporate income last reviewed 21 july 2020 the standard profit tax rate is 16 for romanian companies and foreign companies operating through a permanent establishment pe in romania. Review the 2020 romania income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in romania.

Corporate tax rate in romania averaged 21 96 percent from 1995 until 2020 reaching an all time high of 38 percent in 1996 and a record low of 16 percent in 2005. The personal income tax rate in romania stands at 10 percent.