Income Tax Definition Expense

Income tax is used to fund public services pay government.

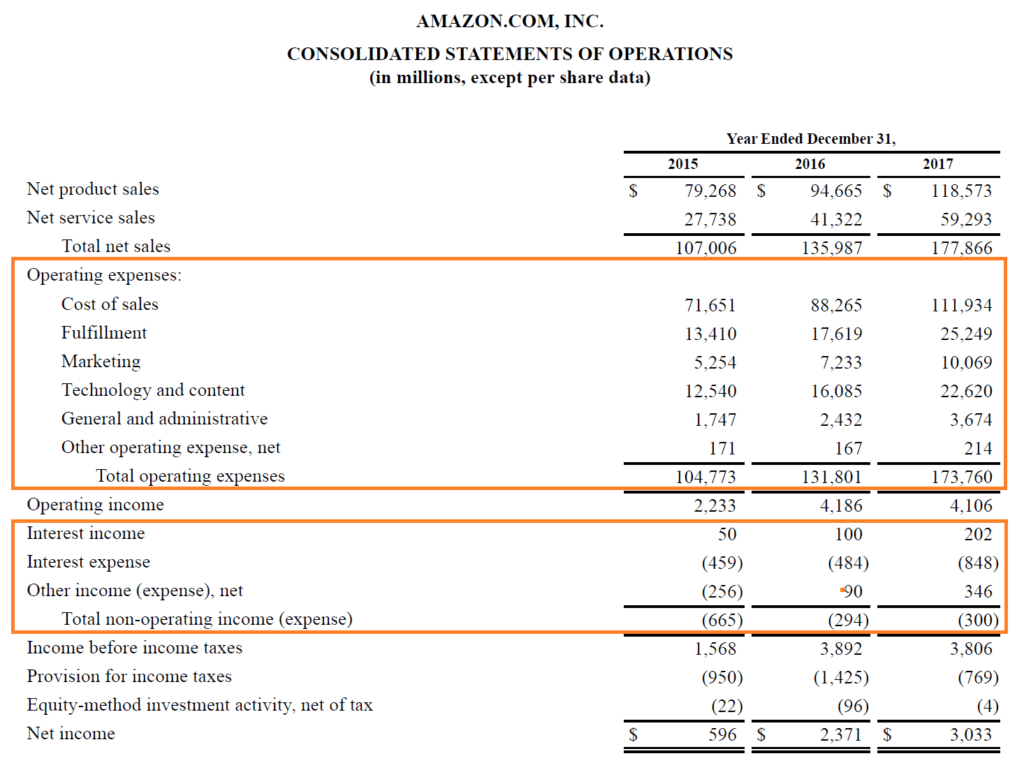

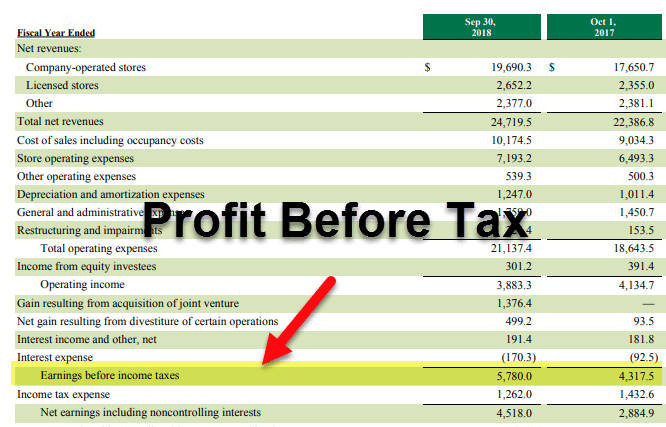

Income tax definition expense. Income tax expense definition. Corporation income tax usually refers to the federal state local and foreign countries taxes that are levied based on a corporation s taxable income. The key driver of the increase was a 241 million increase in gross margin offset by a 163 million increase in operating expenses and other and a 68 million. The taxable income and the related income tax are found on the corporation s income tax return.

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Businesses can write off tax deductible expenses on their income tax returns provided that they meet the irs. A tax expense is a liability owing to federal state provincial and municipal governments. This amount will likely be different than the income taxes actually payable since some of the revenues and expenses reported on the tax return will be different from the amounts on the income.

The amount of income tax that is associated with matches the net income reported on the company s income statement. Tax expenses are calculated by multiplying the appropriate tax rate of an individual or. Definition of income tax. In the accounting for a regular u s.

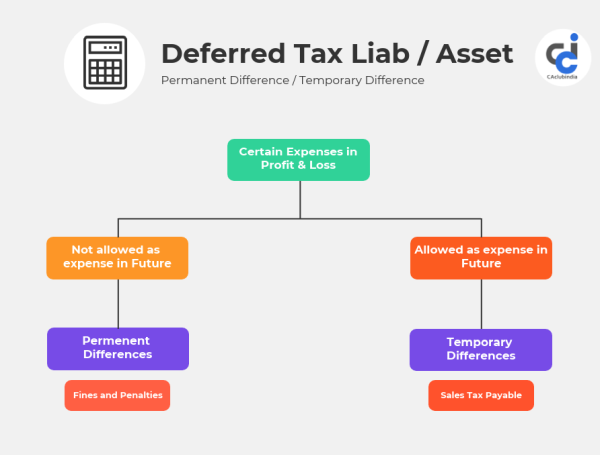

An expense is the cost of operations that a company incurs to generate revenue. Income tax expense is the amount of expense that a business recognizes in an accounting period for the government tax related to its taxable profit the amount of income tax expense recognized is unlikely to exactly match the standard income tax percentage that is applied to business income since there are a number of differences between the reportable amount of income under the gaap or ifrs.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/Target1-de0fcdc67fc44470805a5ccdf3b105e0.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/Screenshot2019-08-21at10.58.51AM-049e1ab335434a16ab7ddc69664758a7.png)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)