Income Statement Fluctuation Analysis

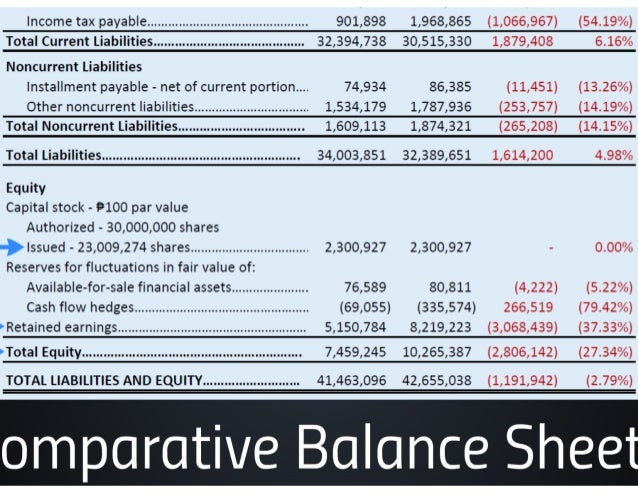

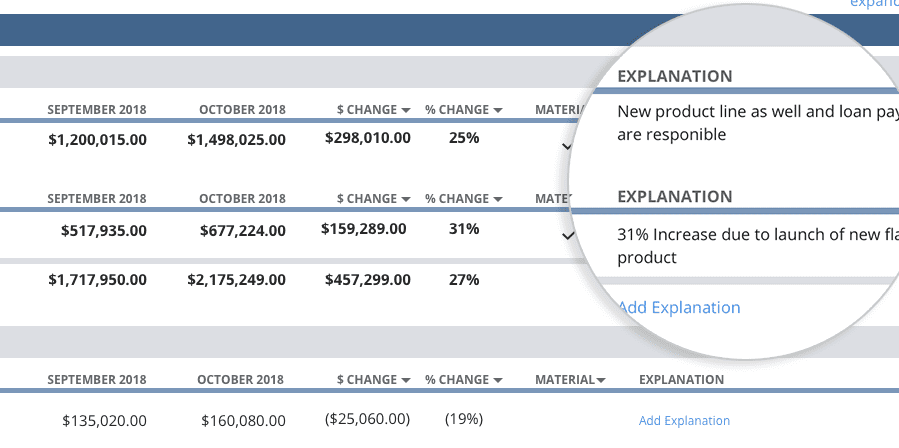

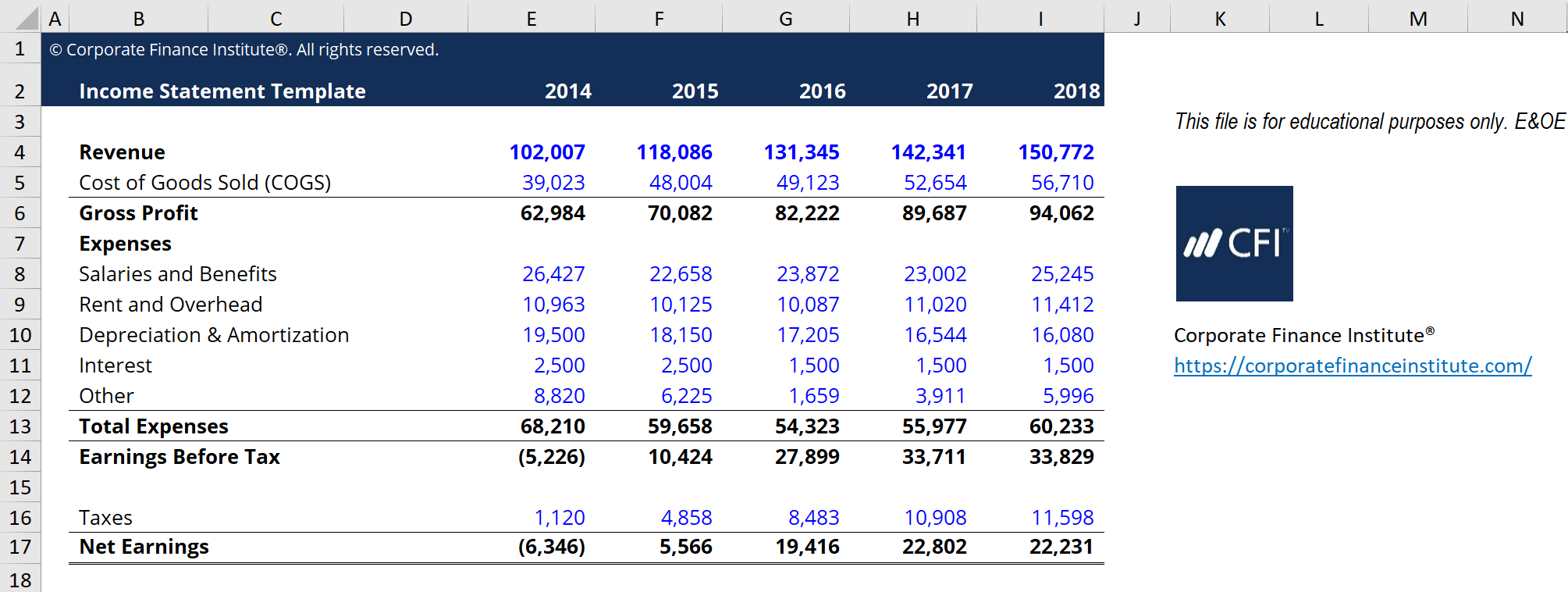

Accountants use it to understand the changes in income statement and balance sheet accounts over two periods could be month over month budget vs actual prior quarter vs current quarter etc.

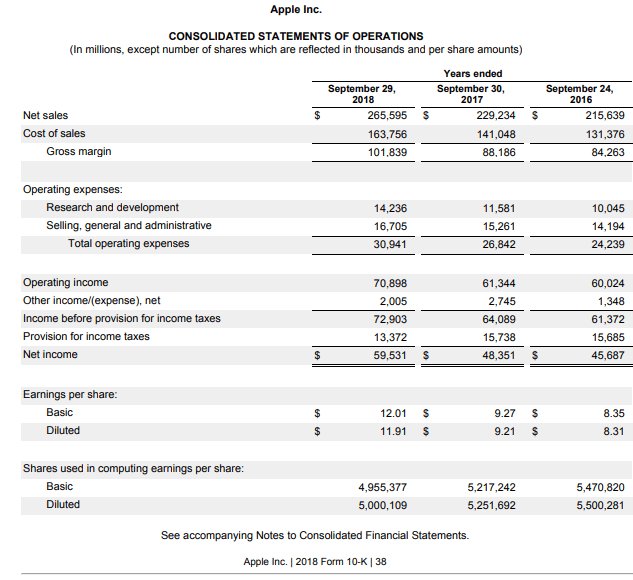

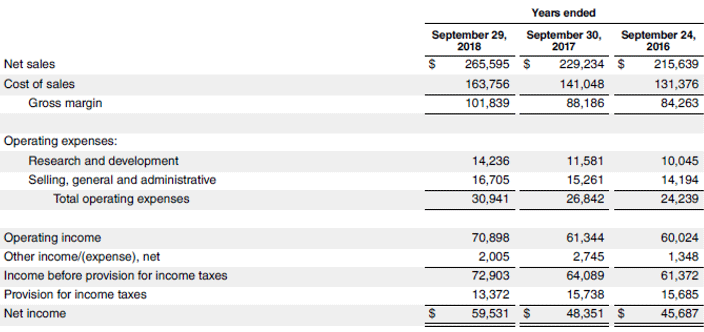

Income statement fluctuation analysis. Get the detailed quarterly annual income statement for alphabet inc. Financial analysis of an income statement can reveal that the costs of goods sold are falling or that sales have been improving while return on equity is rising. Income statements are also carefully reviewed when a business wants. Flux analysis means fluctuation analysis.

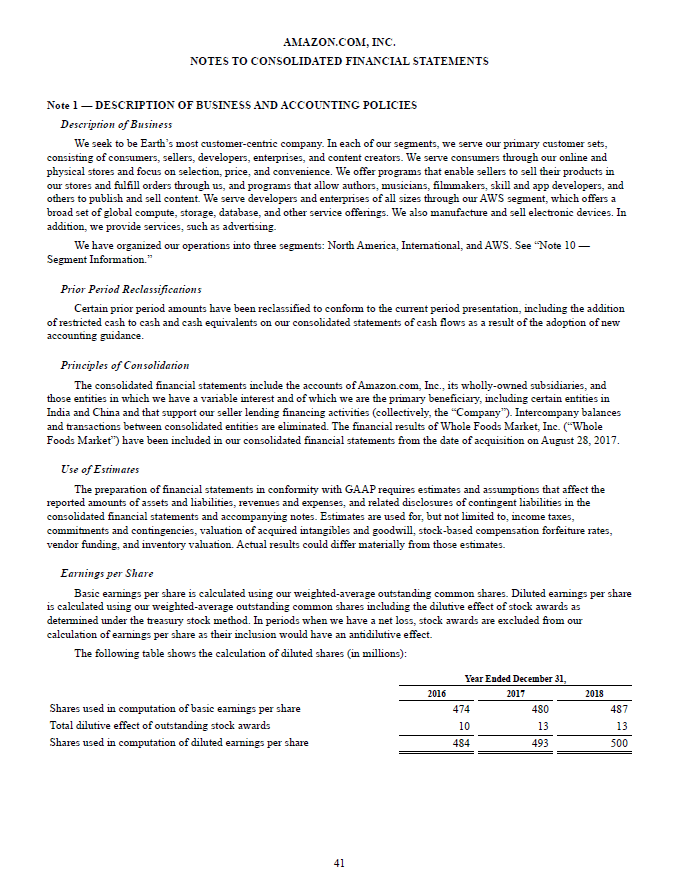

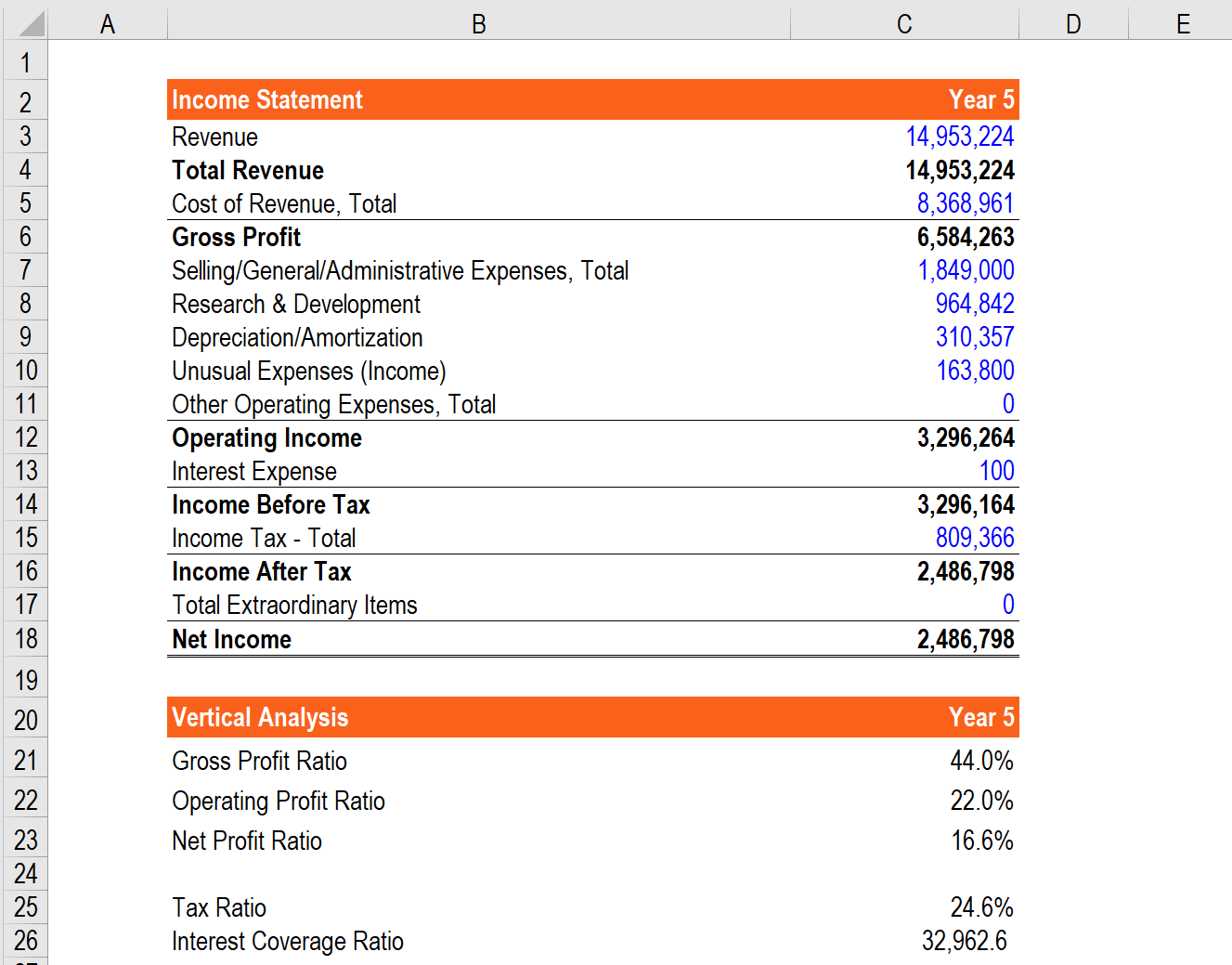

In performing fluctuation analysis both dollar and percentage changes should be analyzed. While performing income statement vertical analysis all the amount from all 3 major categories of accounts in an income statement viz. This video walks you through how to calculate the numbers required for vertical analysis. Fluctuation analysis for outlays the outlays fluctuation analysis is based on the outlays line item on the statement of budgetary resources which is populated by ussgl accounts 49x2 and 48x2 budgetary cash paid.

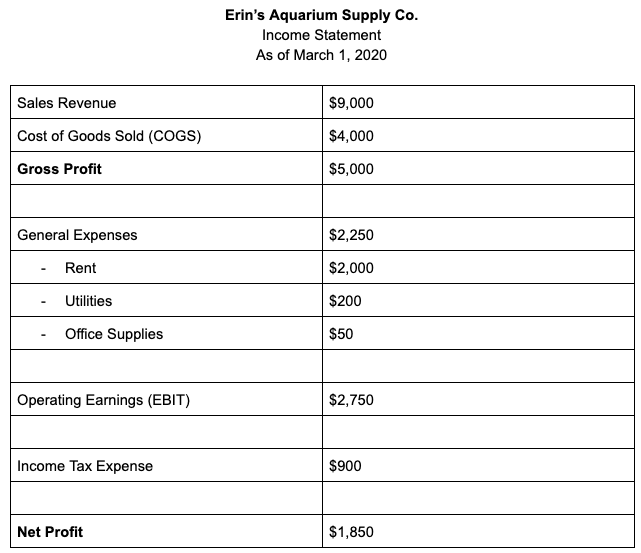

Incomes expenses and taxes are represented as the filed under. Financial statement analysis is the process of analyzing a company s financial statements for decision making purposes. For example in the income statement shown below we have the total dollar amounts and the percentages which make up the vertical analysis. Find out the revenue expenses and profit or loss over the last fiscal year.

Vertical analysis refers to the analysis of the income statement where all the line item which are present in company s income statement are listed as a percentage of the sales within such statement and thus helps in analyzing the company s performance by highlighting that whether it is showing upward or downward trend.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)