Stp Income Statement Due Date

The finalisation due date for closely held payees is 30 september 2020.

Stp income statement due date. Income tax return relates to a specific tax year. 61a the dates of various compliance for the fy 2019 20 have been extended for various compliance. Company having a special tax year. You will also be able to see your year to date tax and super information in your mygov account after each pay day.

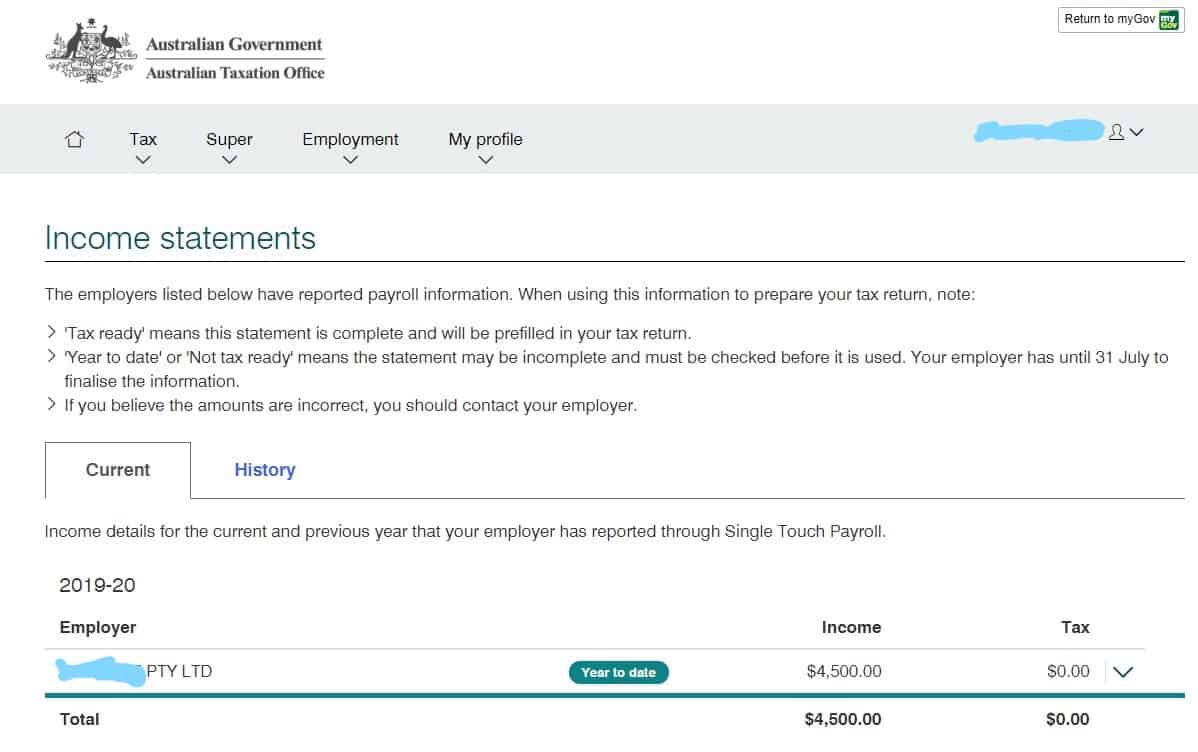

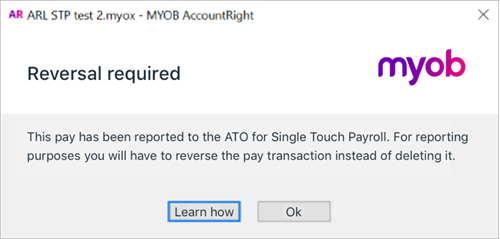

On or before 30th september. After the end of a financial year the ato will produce an income statement which is the equivalent of a payment summary which some people call a group certificate. This year we have until 31 july 2020 to prepare and lodge this stp finalisation with the ato. Tax period for income tax return.

Your final payment summary to employees is due 14th july. 2020 with the ato your tax ready income statement will be available in your mygov account. Income tax due dates. Next tax period for income tax return stay connected.

Due date of filing statement of financial transactions. Lodge and pay annual activity statement for tfn withholding for closely held trusts where a trustee withheld amounts from payments to beneficiaries during the 2018 19 income year. 31 october final date to add new clients to your client list to ensure their 2019 tax return is covered by the lodgment program. A tax year is a period of twelve months ending on 30th day of june i e.

The changes have been done by way of ordinance and amendment thereto at various occasions in the past. Individual association of person aop on or before 30th september. On or before 31st december. For small employers 19 or fewer employees who only have closely held payees the due date for end of year stp finalisation for the financial year ended 30 june 2020 will be the payee s income tax return due date.

The finalisation due date for closely held payees is 30 september 2020. Beyond 1 july 2020 these employers will have an ongoing quarterly pay event period to report under stp. They have an extended due date for the finalisation declaration these employers will need to finalise their stp data by the due date for lodgment of the closely held payees tax return. They can access their year to date and end of year income statement online through mygov or talk to their registered tax agent.

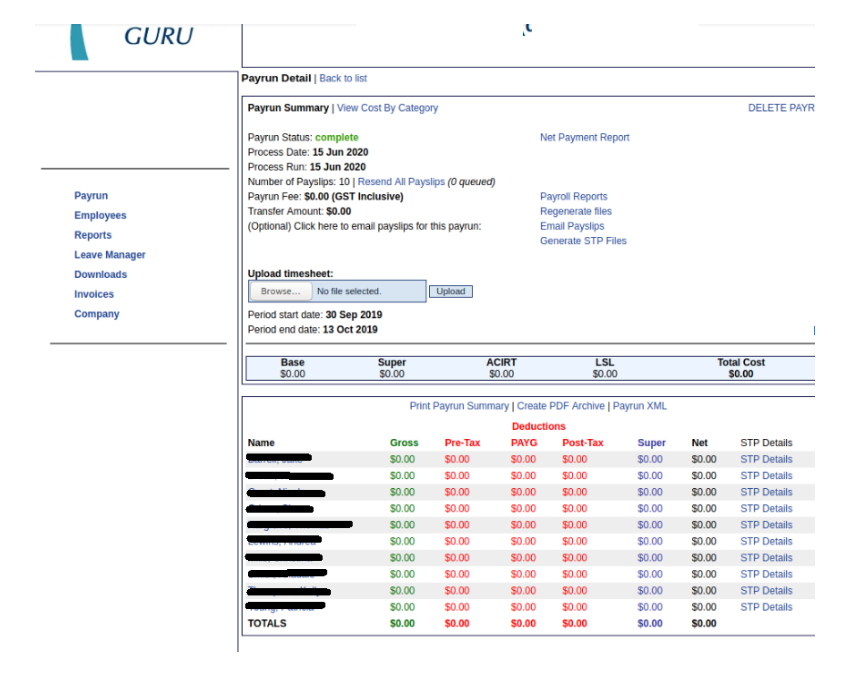

Stp allows your employees to view their payment information at any time in the ato online services through mygov. For example tax year 2017 covers a period from 1st july 2016 to 30th june 2017. You ll have two weeks from the end of the payroll year to issue your payment summary so it s worthwhile preparing now to make the process easy.