Income Tax Brackets Manitoba 2020

4 4 1 4 6 4 7.

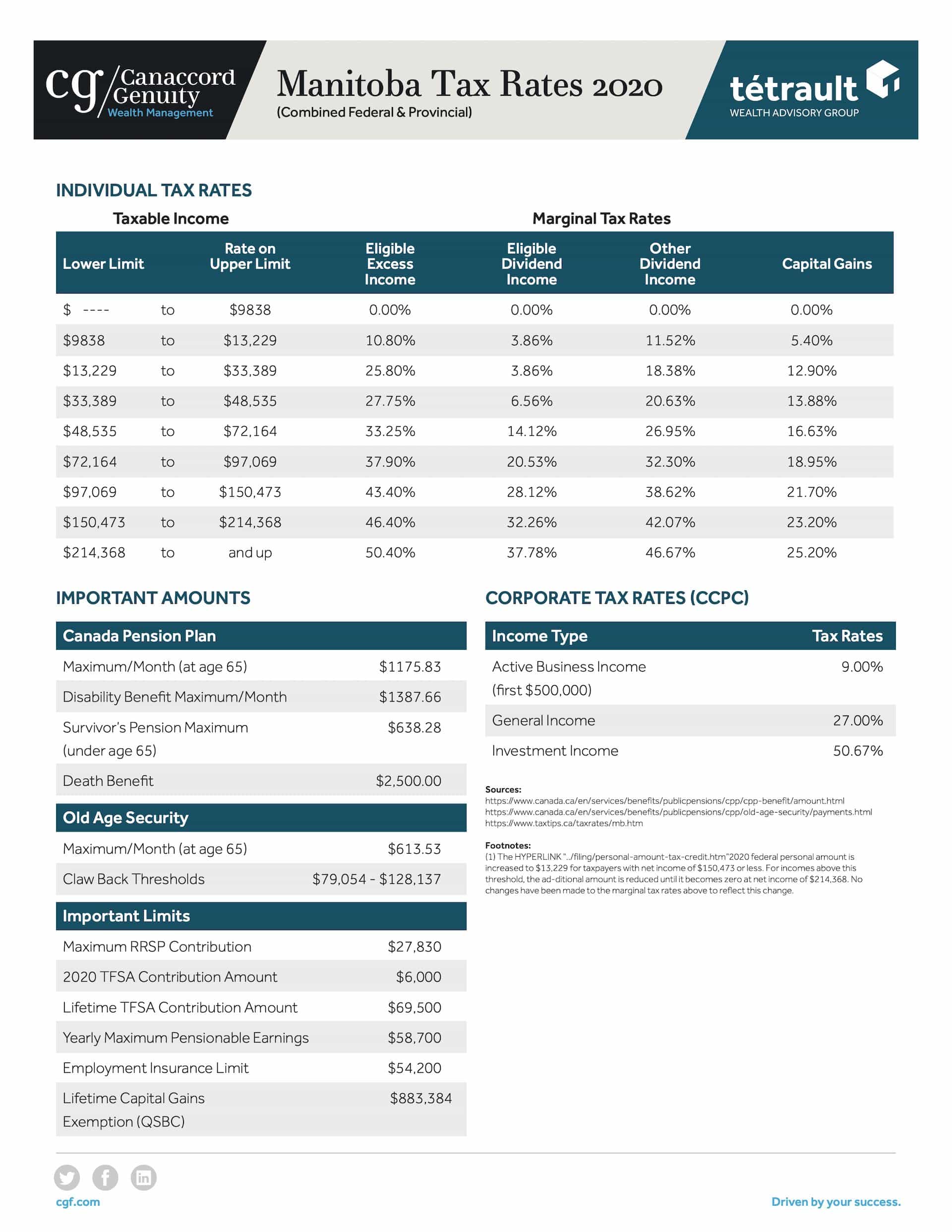

Income tax brackets manitoba 2020. The manitoba income tax brackets and basic personal amount are indexed which began in 2017 but other manitoba personal tax credits are not indexed. Taxable income derived from capital gains will be reduced by half making an effective marginal tax rate on capital gains that is 50 of your current marginal tax rate for example if you have 10 000 in capital gains you would have 5 000 in taxable. The information deisplayed in the manitoba tax brackets for 2020 is used for the 2020 manitoba tax calculator. Where the tax is determined under the alternative minimum tax provisions amt the above table is not applicable.

Amt may be applicable where the tax otherwise payable is less. The annual tax bracket is indexed to inflation and for the 2020 tax year the indexation factor is 2 2. Your first 9 838 in earnings are exempt from provincial income taxes in manitoba for 2020. The lowest tax rate in manitoba kicks in at 10 80 and applies to your taxable income up to 33 389.

Taxable income manitoba marginal rate on 1. Advertisement basic personal amount. The highest provincial tax rate is 17 40 and applies to income exceeding 72 164. Manitoba 2021 and 2020 personal marginal income tax rates manitoba income tax act s.

The 2020 tax year in manitoba runs from january 2020 to december 2020 with individual tax returns due no later than the following april 30 th 2021.