Negative Bad Debt Expense On Income Statement

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

If a company does decide to use a loyalty system or a credibility system they can use the information from the bad.

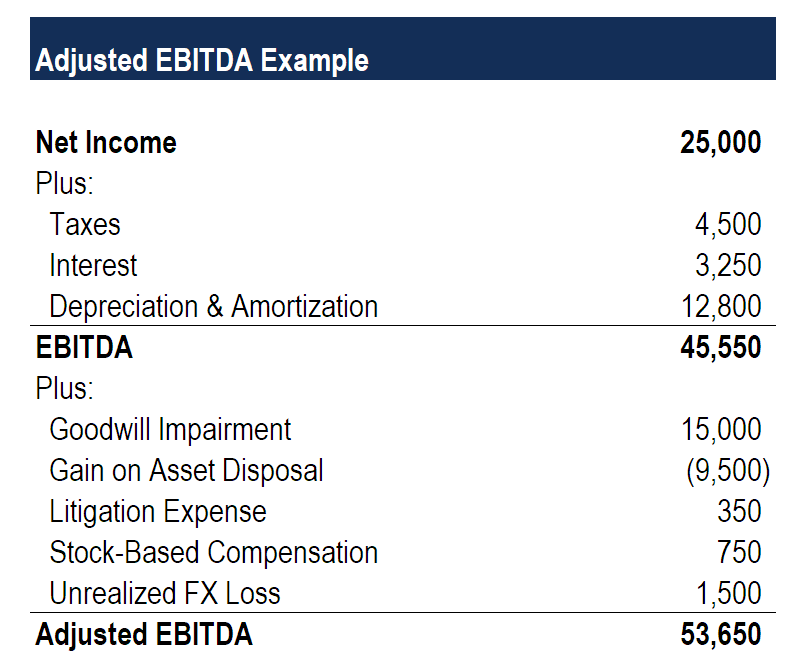

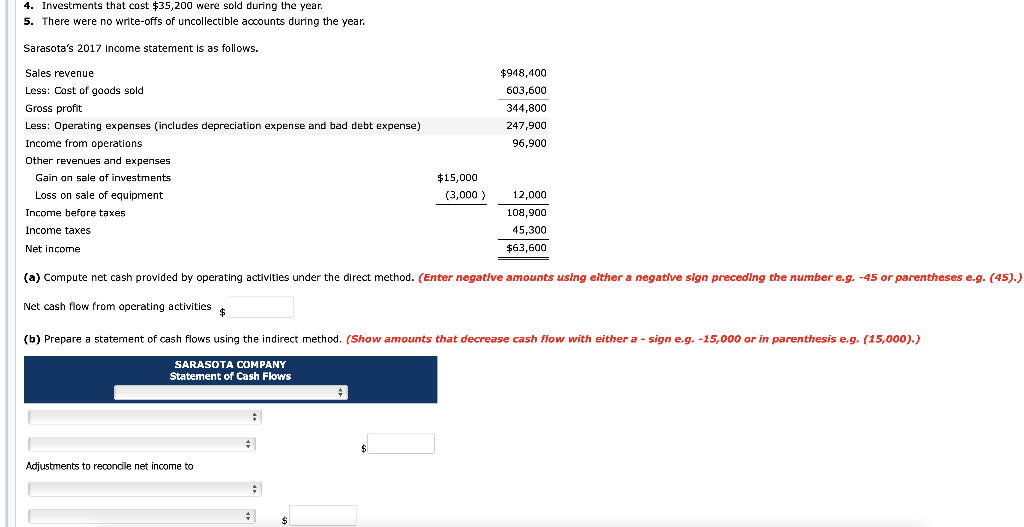

Negative bad debt expense on income statement. Understanding bad debt expense bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement recognizing bad debts leads to an. Debt repayment is not included in the income statement due to simple basic reason because debt in itself is a liability which has to be paid off by the organization it is by nature neither income or expense which can be. Net income effect you would also charge 2 000 to bad debt expense which appears on your income statement. Accounts receivable aging method.

As your company uses up or spends down its bad debt reserve the release of that liability flows through your income. Accordingly they enter a bad debt expense of 3 000 on the company s monthly financial statement and add the same amount to the allowance for doubtful accounts on the balance sheet. When bad debt expense can be negative december 03 2019 steven bragg if uncollectible accounts receivable are being written off as they occur the direct charge off method then there will be times when a customer unexpectedly pays an invoice after it has been written off. This stays on the income statement but does not mean the cost of debt is negative.

My boss wants me to provide an answer in the next 2 days. 615 views view 3 upvoters related questions more answers below. This method is based on an evaluation of the collectibility of accounts receivable. Bad debt expense also helps companies identify which customers default on payments more often than others.

The bad debt expense appears in a line item in the income statement within the operating expenses section in the lower half of the statement. As an example of the allowance method abc international records 1 000 000 of credit sales in the most recent month. With both methods the bad debt expense needs to record in the income statement by a different time. Allowance for doubtful accounts on the balance sheet allowance for doubtful is the contra asset account with accounts receivable which present in the balance sheet.

Interest expense is negative when you pay more interest than you get paid.

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)