Income Tax Calculation Statement For The Financial Year 2020 21

Suppose your total income in fy 2020 21 is rs 16 lakh.

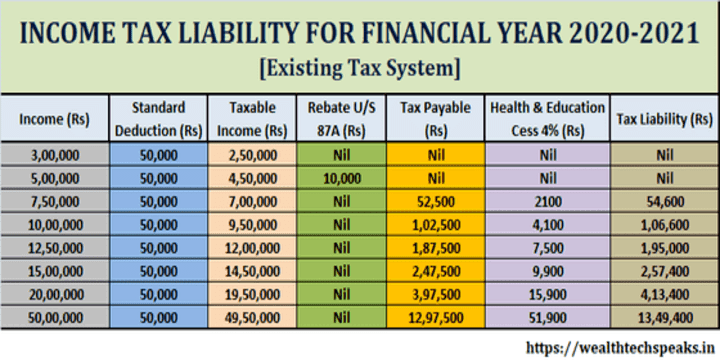

Income tax calculation statement for the financial year 2020 21. To help taxpayers here is a simple excel based income tax calculator for the financial year 2020 21 ay 2021 22. Income tax calculator in excel. Budget 2020 bring two tax regimes somehow benefit certain income taxpayers and drag additional tax from certain taxpayers. The calculator is made using simple excel formulas and functions.

Excel based income tax calculator for fy 2020 21 ay 2021 22. The income tax department appeals to taxpayers not to click on hyperlinks contained in such phishing mails not to respond and not to share information relating to their credit card. You can use this calculator for calculating your tax liability for fy 2020 21 ay 2021 22. Income tax calculation is one of the complex tasks for the taxpayer.

The income tax department never asks for your pin passwords or similar access information for credit cards banks or other financial accounts through e mail. The finance minister has proposed to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forego certain deductions and exemptions however the same is options to individual. The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example. The income tax calculator will allow you to calculate your income tax for financial year fy2019 20 ay2020 21 fy2020 21 ay2021 22.

Further during the year your employer has contributed rs 60 000 to your nps account which is eligible for deduction under section 80ccd 2. From the middle class taxpayers the choice is yours.