Income Tax Yonkers Ny

The state applies taxes progressively as does the federal government with higher earners paying higher rates.

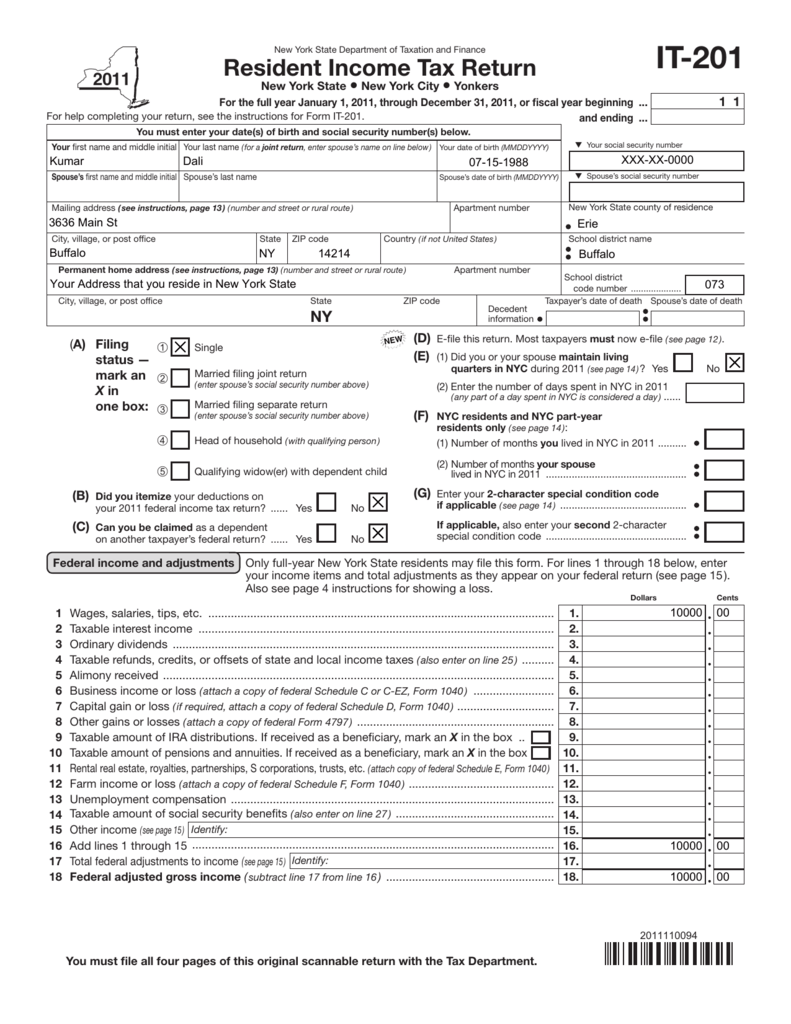

Income tax yonkers ny. If you live in yonkers and work in nyc you will be taxed by yonkers on your ny state return for your yonkers residency. All address changes or any other information pertaining to your tax bill shall be directed to the assessment department. Want to see who made the cut. Earned wages or carried on a trade or business within the city of yonkers or are a member of a partnership that carried on a trade or business there.

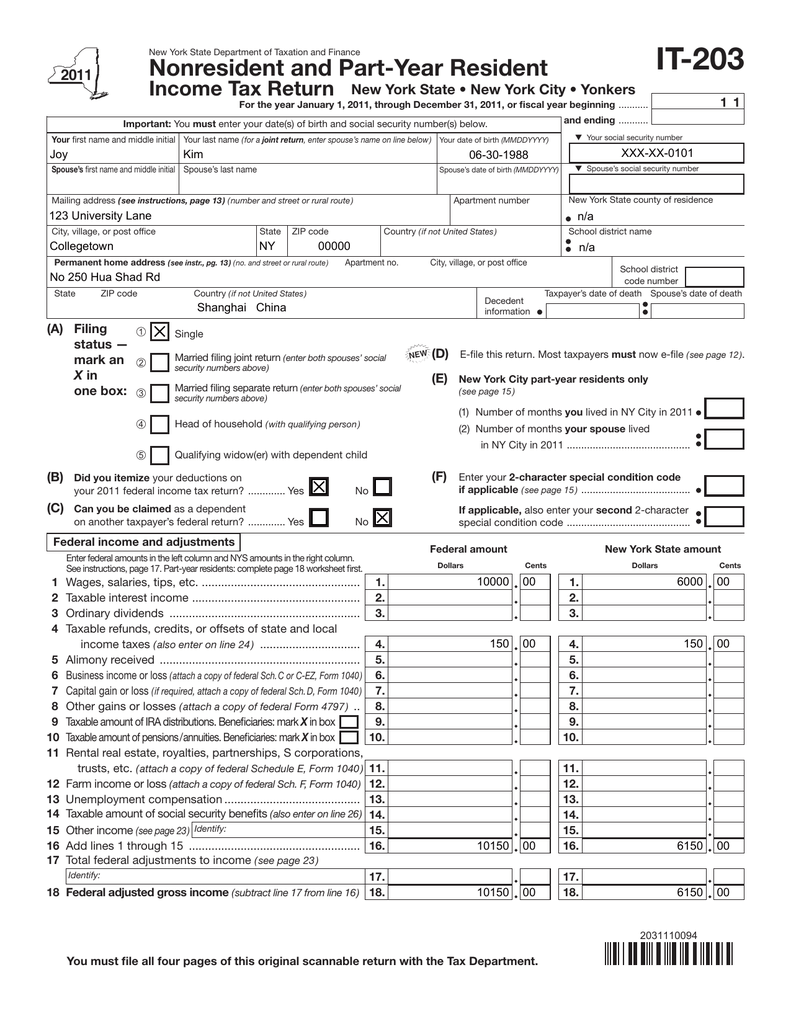

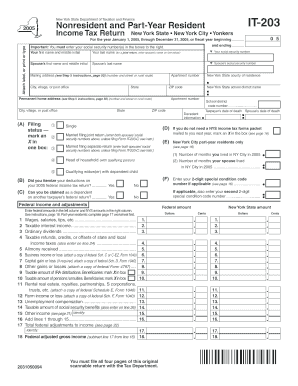

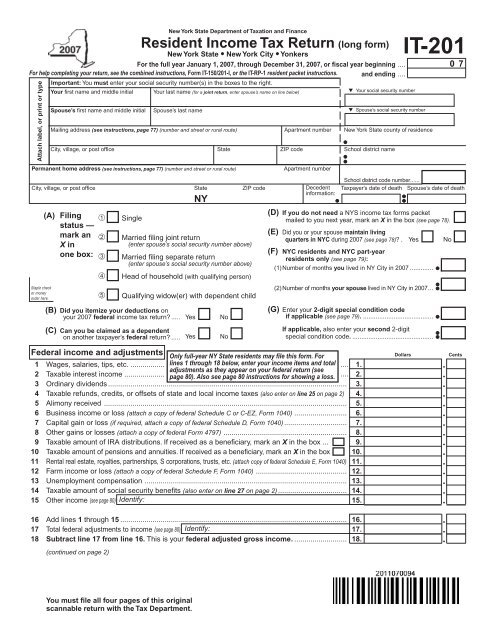

15 of net state tax. Changes to your information. If you are not a yonkers resident you must file form y 203 city of yonkers nonresident earnings tax return if you. Yonkers has local income tax for residents so residents of yonkers pay only the new york income tax and federal income tax on most forms of income.

File or are required to file a new york state income tax return. Pay in person at city hall 1st floor room 108 cashier s office. City of yonkers assessment office. Pay online or by credit card or electronic check.

Individuals with yonkers income. The city real estate property taxes are paid in three equal installments. The irs has a searchable database where you can verify the background and credentials of your income tax preparation professional. Yonkers income tax information.

Yonkers income tax single weekly payroll period 0 100 100 105 105 110 110 115 115 120 120 125 125 130 130 135 135 140 140 145 145 150 150 160 160 170 170 180. We started locally in yonkers ny and slowly expanded digitally across the country specializing in tax consulting and accounting we focus on tax consulting audit assistance business corporate income tax filings corporation setups and immigration services with a network of professional staff in the usa and abroad bringing you a level of sophistication that has. The only two ny cities that have a separate tax are yonkers and nyc. Our journey began in 1985.

1st installment due date will always vary based on when the city budget is adopted. New york income taxes. The yonkers income tax imposed on nonresidents is 0 50 0 50 higher than the city income tax paid by residents. The 2020 new york state personal income tax rate schedules have been revised to reflect certain income tax rate reductions enacted under chapter 60 of the laws of 2016 part tt.

A note to our community regarding covid 19. Yonkers taxes you if you live or work in yonkers but nyc only taxes you if you live there you are not taxed in nyc for your work performed there. New york s top marginal income tax rate of 8 82 is one of the highest in the country but very few taxpayers pay that amount. Once adopted usually in june taxes are due 30 days from then.

Here is the definitive list of yonkers s tax preparation services as rated by the yonkers ny community. 2nd installment due date is always october 6th unless october 6th falls on a weekend. 1st installment due july 13 2020.