Income Tax Percentage Ohio

Please note that as of 2016 taxable business income is taxed at a flat rate of 3.

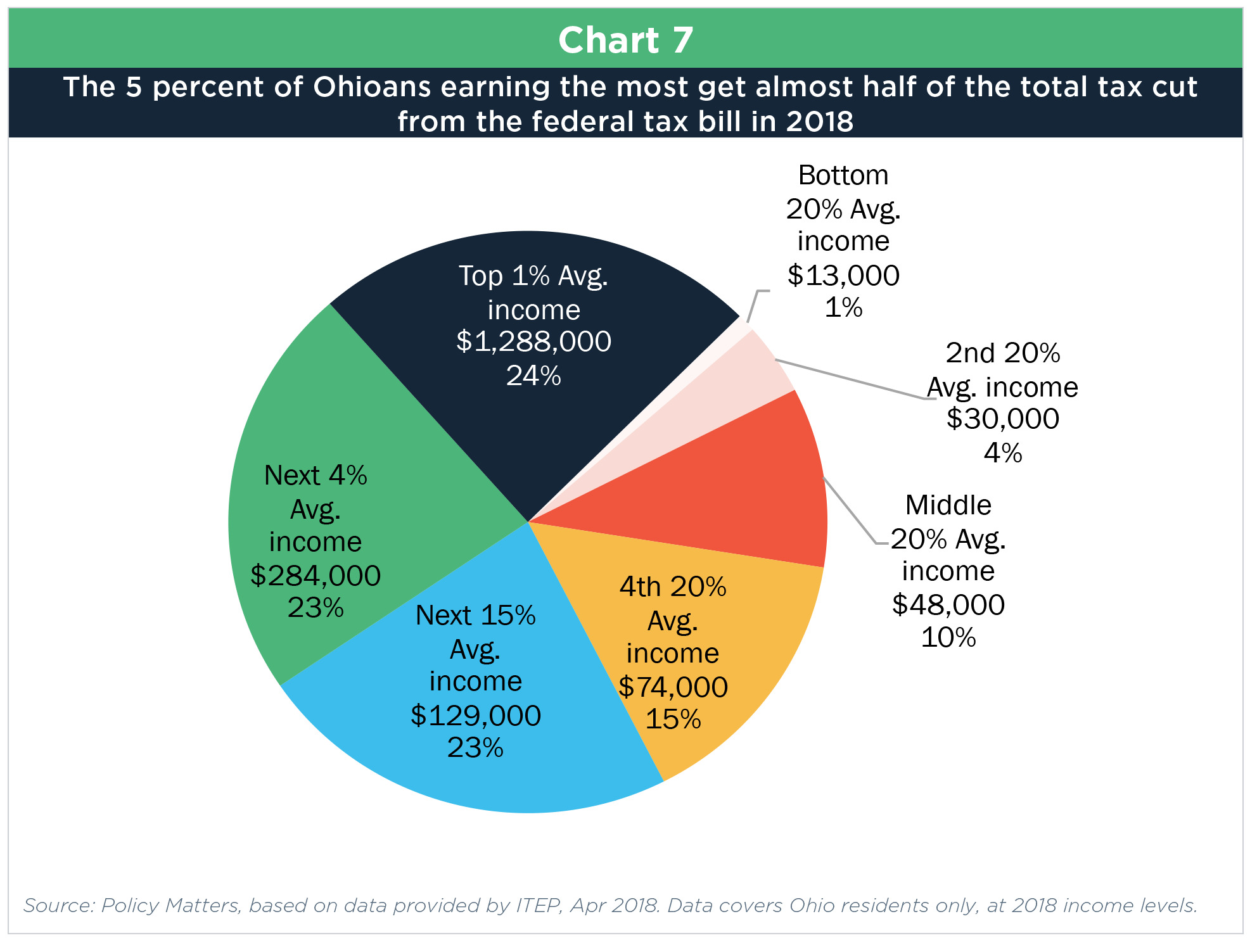

Income tax percentage ohio. For example suppose you made a total of 38 500 in taxable income. Income taxes accounted for 37 percent of state tax revenues in fiscal year 2017 the analysis said. Apply the appropriate tax rate to the income you earned. Here s a breakout of the various tax brackets courtesy of the ohio department of taxation.

The ohio tax rate ranges from 0 to 4 797 depending on your taxable income. Ohio payroll taxes can be a little hard to keep track of. Unlike the federal income tax ohio s state income tax does not provide couples filing jointly with expanded income tax brackets. Beginning with tax year 2019 ohio income tax rates were adjusted so taxpayers making an income of 21 750 or less aren t subject to income tax.

Ohio s 2020 income tax ranges from 2 85 to 4 8. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The tax brackets have been indexed for inflation per ohio revised code section 5747 025. Ohio state payroll taxes.

Ohio state income tax rate table for the 2019 2020 filing season has six income tax brackets with oh tax rates of 0 2 85 3 326 3 802 4 413 and 4 797 for single married filing jointly married filing separately and head of household statuses. This page has the latest ohio brackets and tax rates plus a ohio income tax calculator. Taxpayers with 22 150 or less of income are not subject to income tax for 2020. The state levies a graduated rate tax on income earners.

The top ohio tax rate has decreased from 4 997 last year to 4 797 this year. Top state income tax rates range from a high of 13 3 percent in california to 1 percent in tennessee according to the tax foundation study which was published in february. Similarly ohio s statewide sales tax rate is 5 75 but when combined with county sales tax rates ranging from 0 75 up to 2 25 the total average rate is 7 17. Alone that would place ohio at the lower end of states with an income tax but many ohio municipalities also charge income taxes some as high as 3.

Income tax rates range from 0 to 4 997 with eight varying tax brackets. The following are the ohio individual income tax tables for 2005 through 2020. Ohio income tax rate 2019 2020.