Income Tax Rates During Ww2

That s a high tax rate.

Income tax rates during ww2. During those war years income tax went from 16 per cent to 44 per cent of total federal revenue at a time when states and territories still charged income taxes of their own. During the war the top marginal rate was 94 but 94 of what. In addition to rationing on food and clothing there were shortages of many commodities so there was a limited range of things people could buy even if they did have the money the common pleasures left to the average man smoking and drinking were now targeted. The full rate of 7s 6d will apply to the 1940 41 budget.

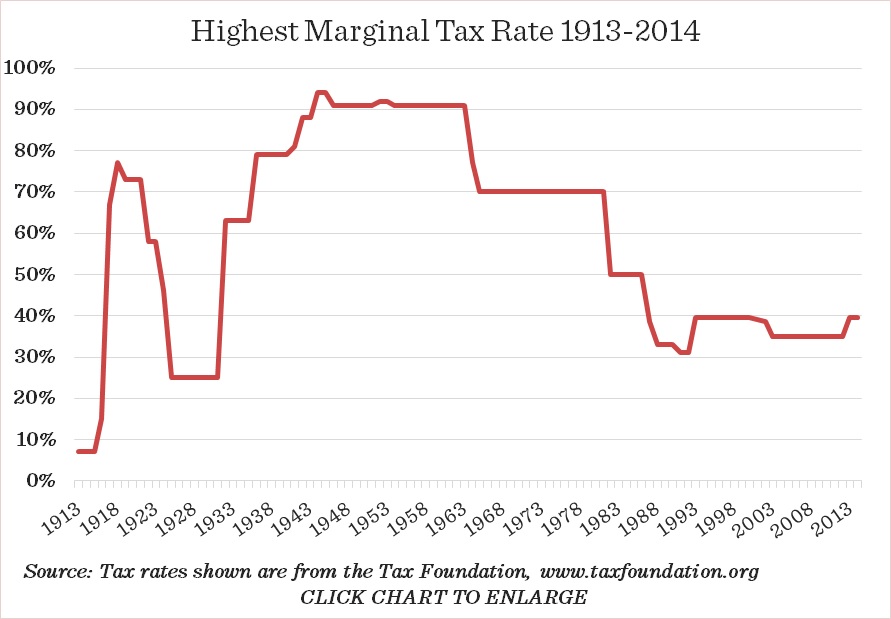

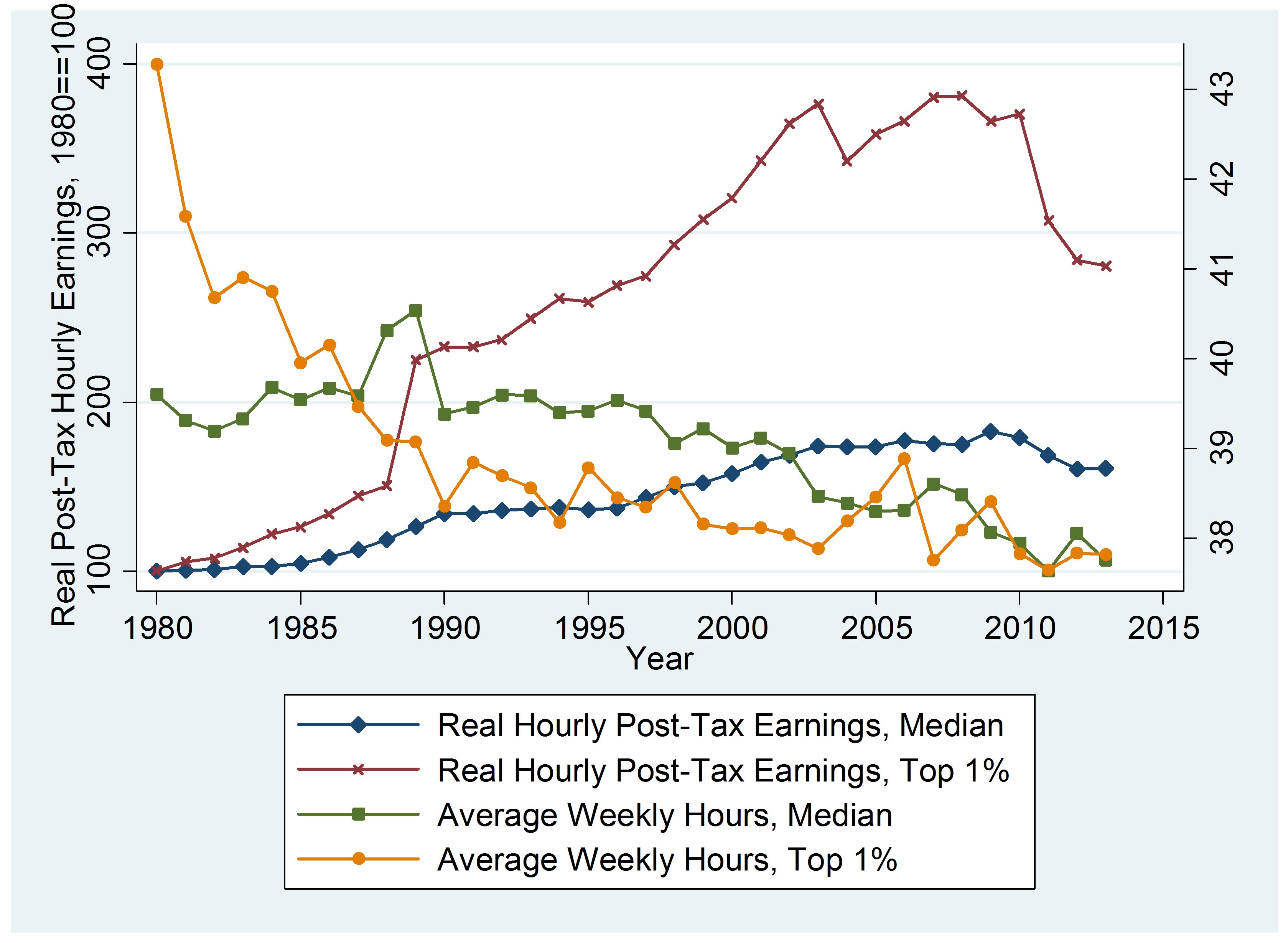

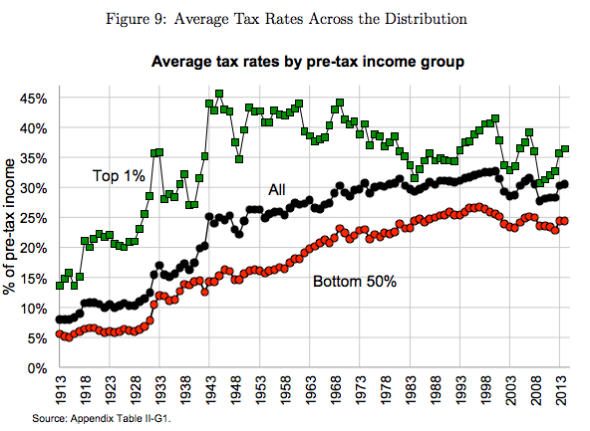

In 1944 the top rate peaked at 94 percent on taxable income over 200 000 2 5 million in today s dollars 3. Sanders said income tax rates under eisenhower were as high as 90 percent a look through the records shows that top earners in the eight years of eisenhower s presidency paid a top income tax rate of 91 percent. Tax loopholes contributed to the rich paying lower effective income tax rates. In 1944 45 during world war ii couples making more than 200 000 faced an all time high of 94 percent.

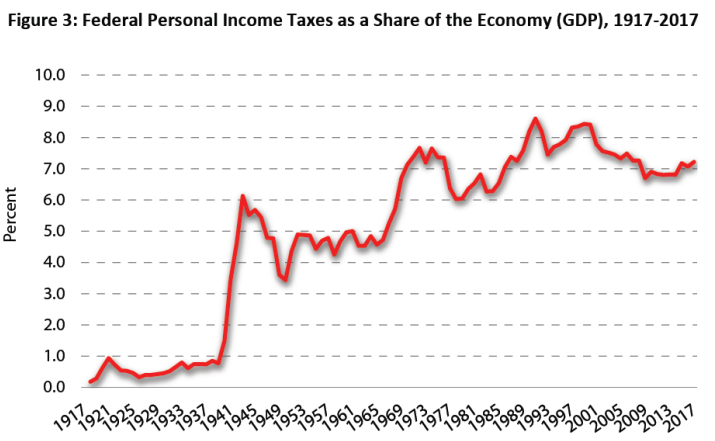

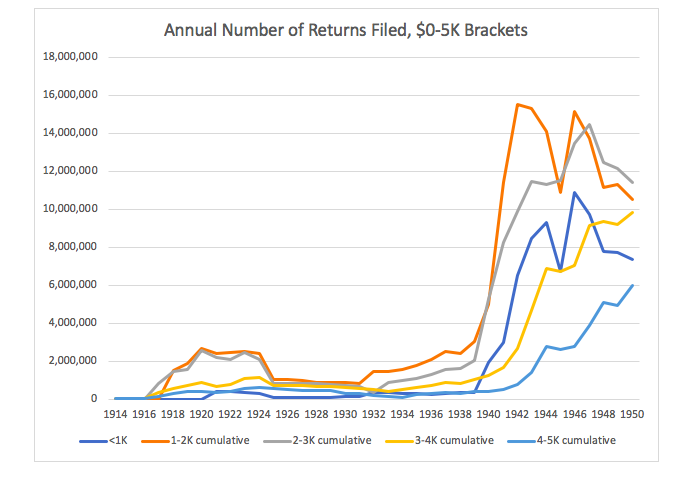

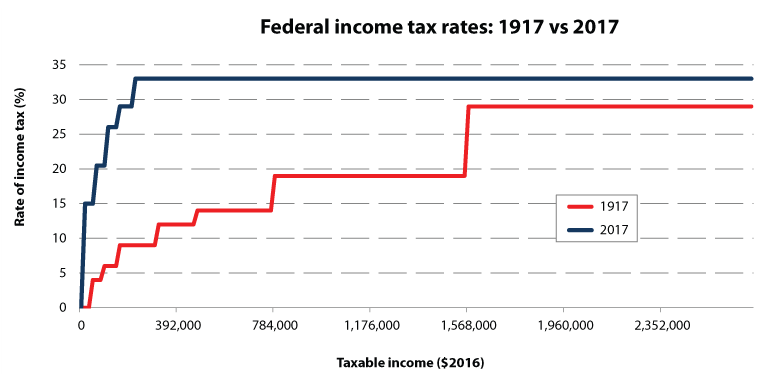

To solve that problem the current tax payment act of 1943 actually cancelled 75 100 of the lower of 1942 or 1943 individual tax liability. The effect is that the rate of tax payable on january 1 will be 7s in the pound. Congress raised taxes again in 1932 during the great depression from 25 percent to 63 percent on the top earners. Then as now income tax rates moved up at distinct break points in world war two tax law revisions increased the numbers of those paying some income taxes from 7 of the u s.

Population 1940 to 64 by 1944. Piketty and saez wrote in their 2007 paper that while the overall tax system was more progressive at the top of the income scale in 1960 than in 2004 the top 0 01 percent paid an average total federal tax rate of 71 4 percent in 1960 compared to 34 7 percent in 2004 that was not primarily due to extremely. Several previous reader messages have stressed the high tax rates during america s post world war ii growth decades as a sign that higher top bracket rates could be valuable once again. The 1950s 1960s and 1970s.

As we mentioned earlier war is expensive. World war ii. Income tax had already been raised to 50 per cent.