The Income Statement For A Manufacturing Company Usually Contains A Detailed Computation Of The

Service companies have the most basic income statement of all the types of companies.

The income statement for a manufacturing company usually contains a detailed computation of the. Costs of goods sold. Consider the following information. B from the company s balance sheet at may 31. Work in process inventory on march 1.

Determine the amounts of the missing items identifying them by letter. Direct materials used totaled 124 700. The income statement for a manufacturing company usually contains a detailed computation of the a. A from the company s balance sheet at april 30 april 30 ending balance is the same as may 1 beginning balance.

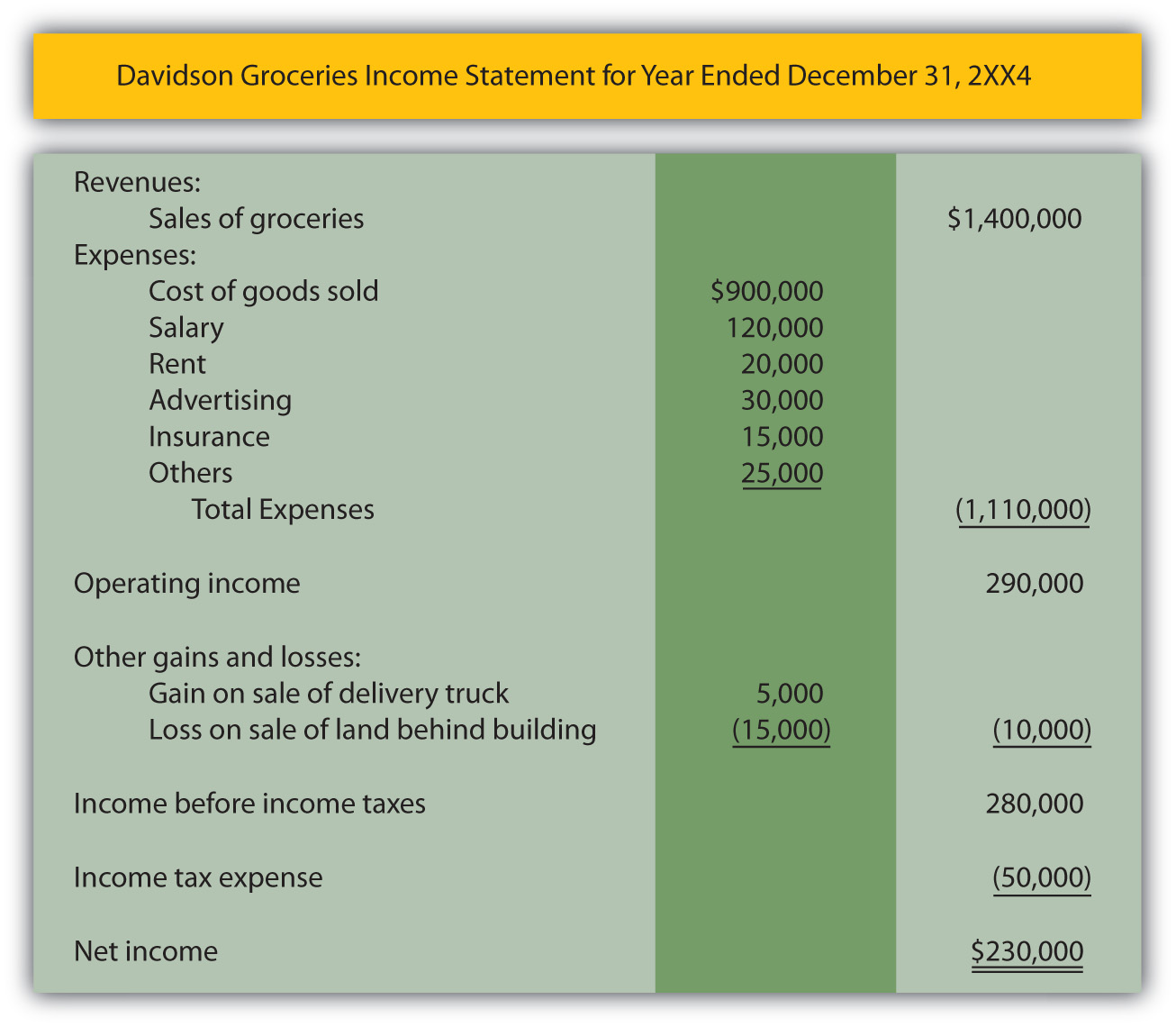

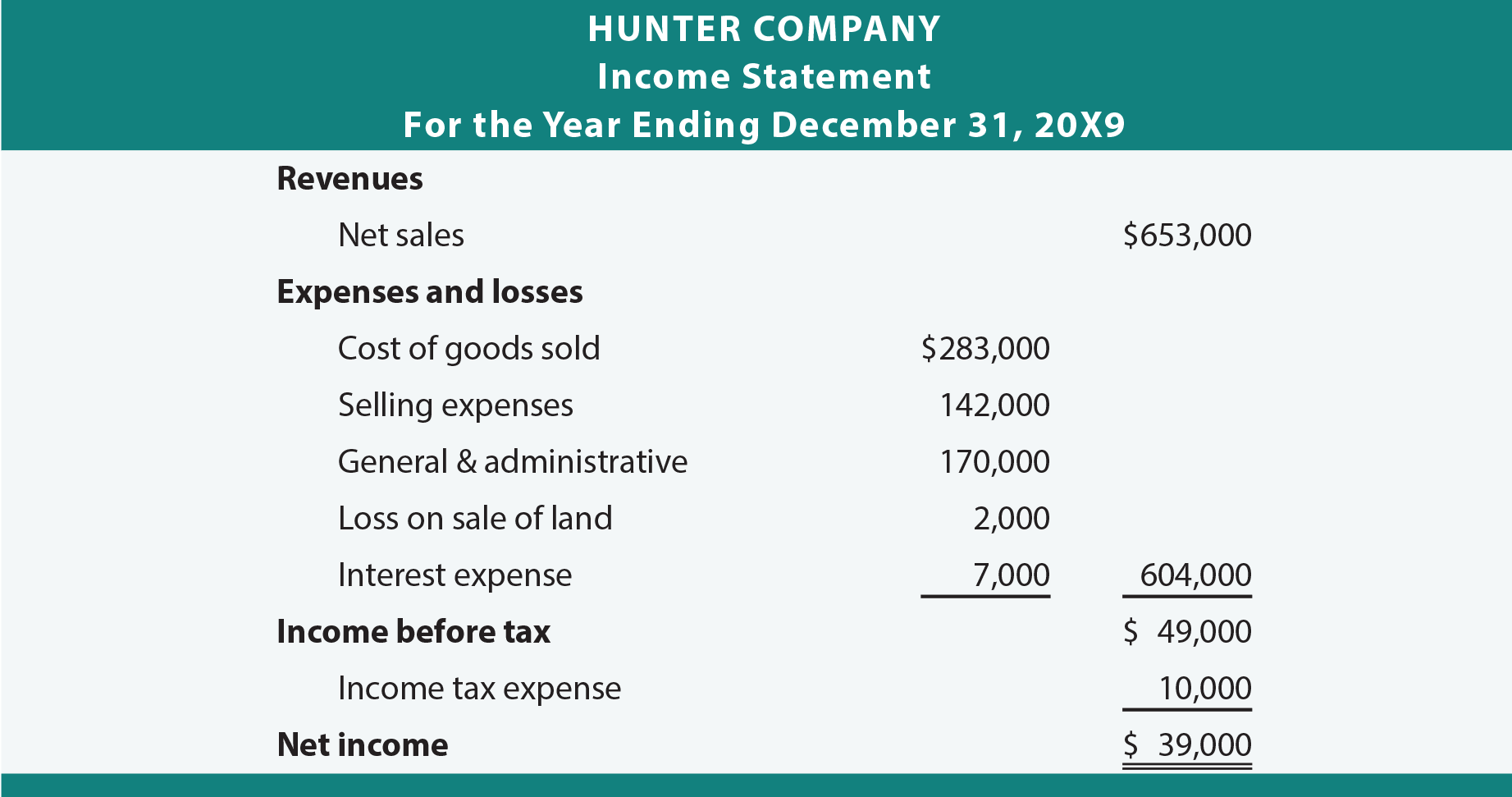

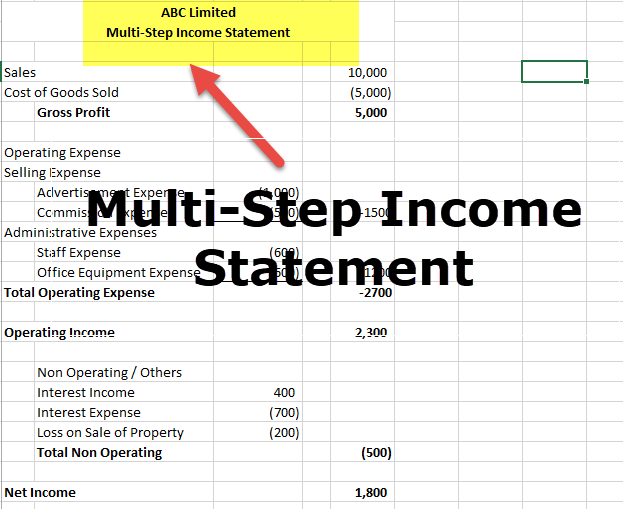

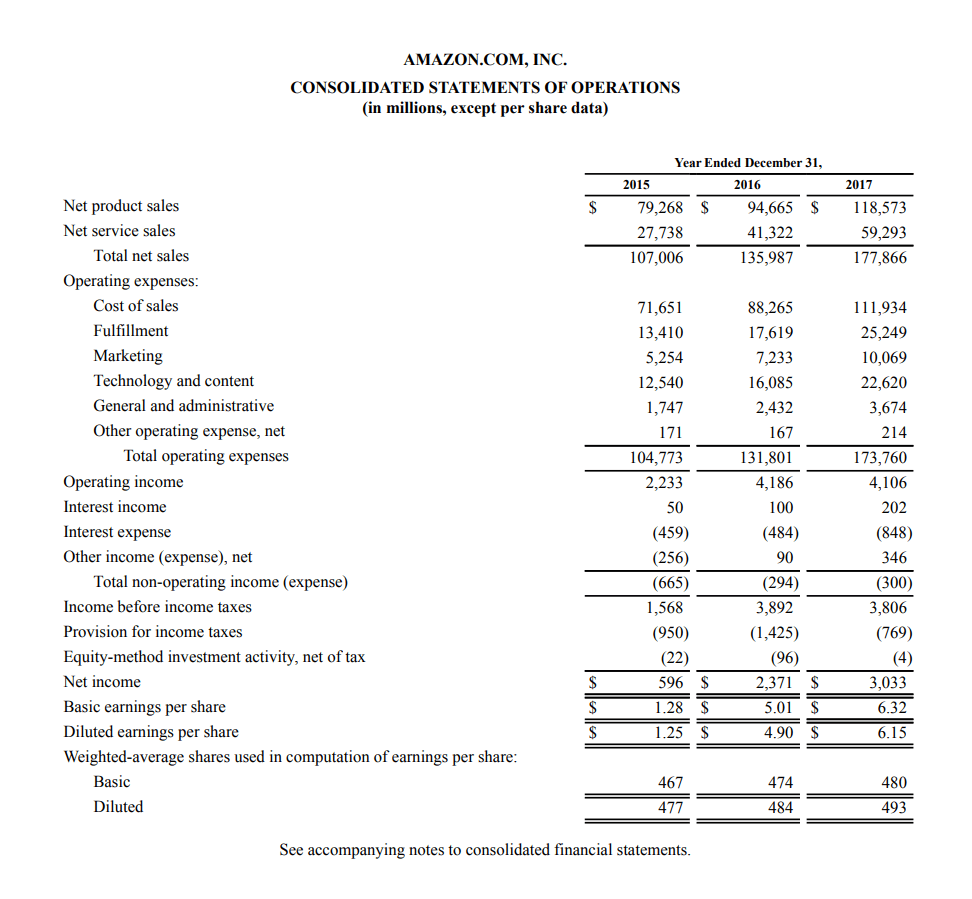

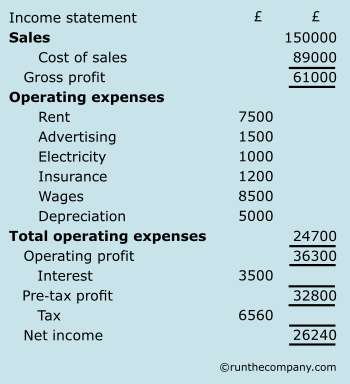

The income statement also reports operating expenses often shown as selling general and administrative expenses. Figure 1 7 income statement schedules for custom furniture company. Which of the following is one of the integrity standards of management accounting. It is compiled from a number of other budgets the accuracy of which may vary based on the realism of the inputs to the budget model.

Determine the amounts of the missing items identifying them by letter. Cost of goods sold. Income statement for a manufacturing company. Therefore the income statement will be a basic breakdown of income and expenses.

19 the income statement for a manufacturing company usually contains a detailed computation of the a. Finished goods inventory june 1 116 600 38 880 e cost of goods manufactured 825 900 c. Two items are omitted from each of the following three lists of cost of goods sold data from a manufacturing company income statement. Since service based companies do not sell a product the income statement will not contain cost of goods sold.

The budgeted income statement contains all of the line items found in a normal income statement except that it is a projection of what the income statement will look like during future budget periods. Budgeted income statement definition. Since it is critical that managerial decision makers. Gadget company income statement for the 4th quarter year 1 sales 17 123 428.

The computation of the return on investment ratio is an excellent benchmark. The income statement for a manufacturing company usually contains a detailed computation of the. Therefore depreciation expense which is an operating expense is usually high. Accounting financial managerial accounting income statement for a manufacturing company two items are omitted from each of the following three lists of cost of goods sold data from a manufacturing company income statement.

Cost of goods sold. C this is actual manufacturing overhead for the period and includes indirect materials indirect labor factory rent factory utilities and other factory related. Total cost of materials used. Overhead was computed to be 789 600.

Then subtract all operating expenses. The profit margin percentage is a good measure of the adequacy of net income to sales. Direct labor amounted to 412 000.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)