Expanded Income Statement Categories

The expanded accounting equation allows you to see separately 1 the impact on equity from net income increased by revenues decreased by expenses and 2 the effect of transactions with.

Expanded income statement categories. So here s our expanded income statement that we saw before. The most common categories are o sales expenses and general and admin expenses o sales expenses and general expenses o sales expenses and general and admin revenues o sales revenues and general and admin expenses save and continue. And i hope to see you next time. Now let s look at cost of goods sold.

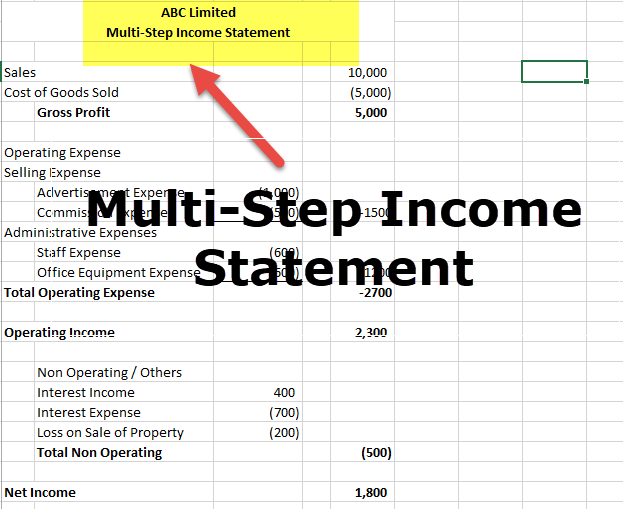

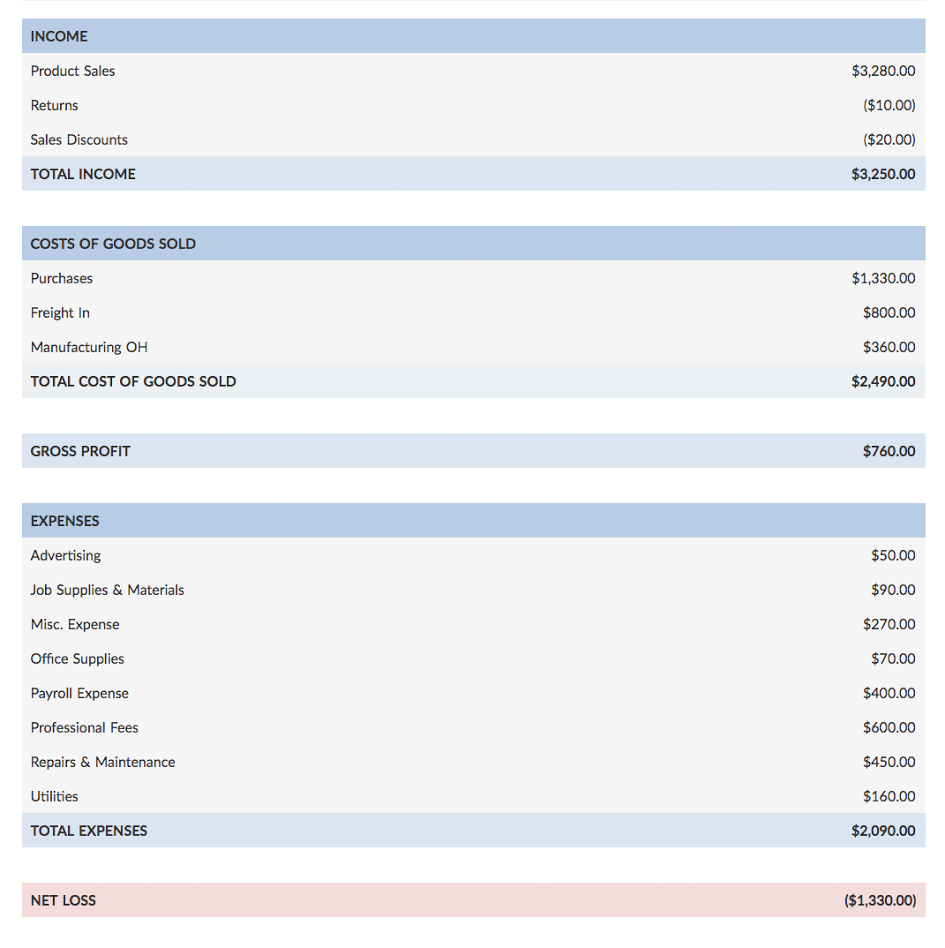

An alternative to the single step income statement is the multiple step income statement because it uses multiple subtractions in computing the net income shown on the bottom line. Income statements are 2 types single step income statement and multiple step income statement for finding net profit or loss an accounting period. An expanded income statement is generally divided by the different categories of expenses. Now let s look at another component of the expanded income statement.

The income statement reports on the revenues expenses and profits of an organization. The most common categories are. Question tutorials question 3 o mark this question an expanded income statement is generally divided by the different categories of expenses. The expanded accounting equation for a corporation is.

There are several types of income statement formats available which can be used to present this information in different ways. Common stock dividends revenues and expenses. Note that this expanded accounting equation breaks down equity into four categories. An expanded income statement is generally divided by the different categories of expenses.

And within the expanded income statement we looked at the expanded income statement calculations. So when you see cost of goods sold on the expanded income statement there s actually a couple additional calculations that go into that final number. This considers each element of contributed capital and retained earnings individually to better illustrate each one s impact on changes in equity. Sales expenses and general expenses.

I hope everybody enjoyed this video. The most common categories are. Assets liabilities paid in capital revenues expenses dividends treasury stock. So we looked at expanding our sales calculation our cost of goods sold calculation and then our cost of goods purchased calculation within that cost of goods sold.

Income statement shows net profit or net loss arising out of activities of a particular accounting period of any business organization.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)