Statement Of Comprehensive Income Function Of Expense Method

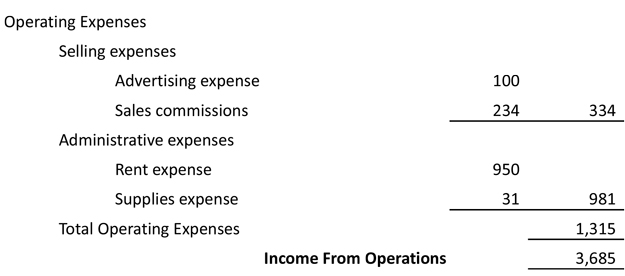

An income statement by nature method is the one in which expenses are disclosed according to their nature such as depreciation transports costs rent expense wages and salaries etc.

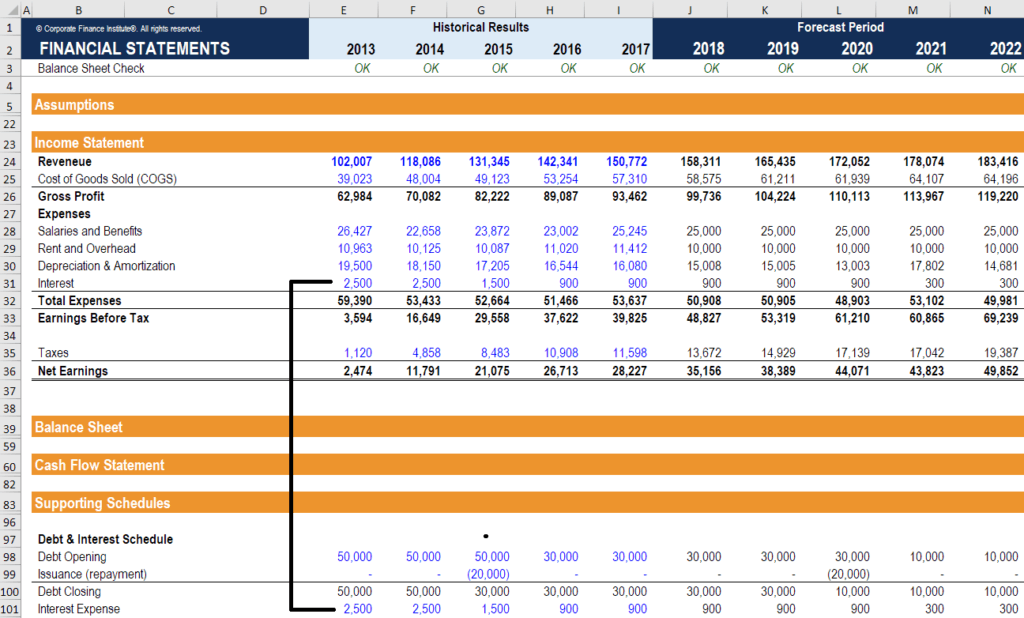

Statement of comprehensive income function of expense method. Statement of comprehensive income refers to the statement which contains the details of the revenue income expenses or loss of the company that is not realized when a company prepares the financial statements of the accounting period and the same is presented after net income on the company s income statement. There is no reallocation of these expenses to different functions of the entity i e. Share of profit loss of associates and joint ventures accounted for using equity method. Major categories of expenses under the function of expense method.

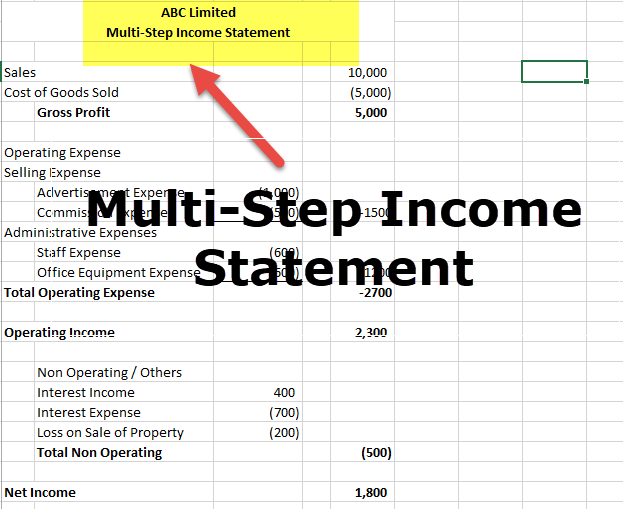

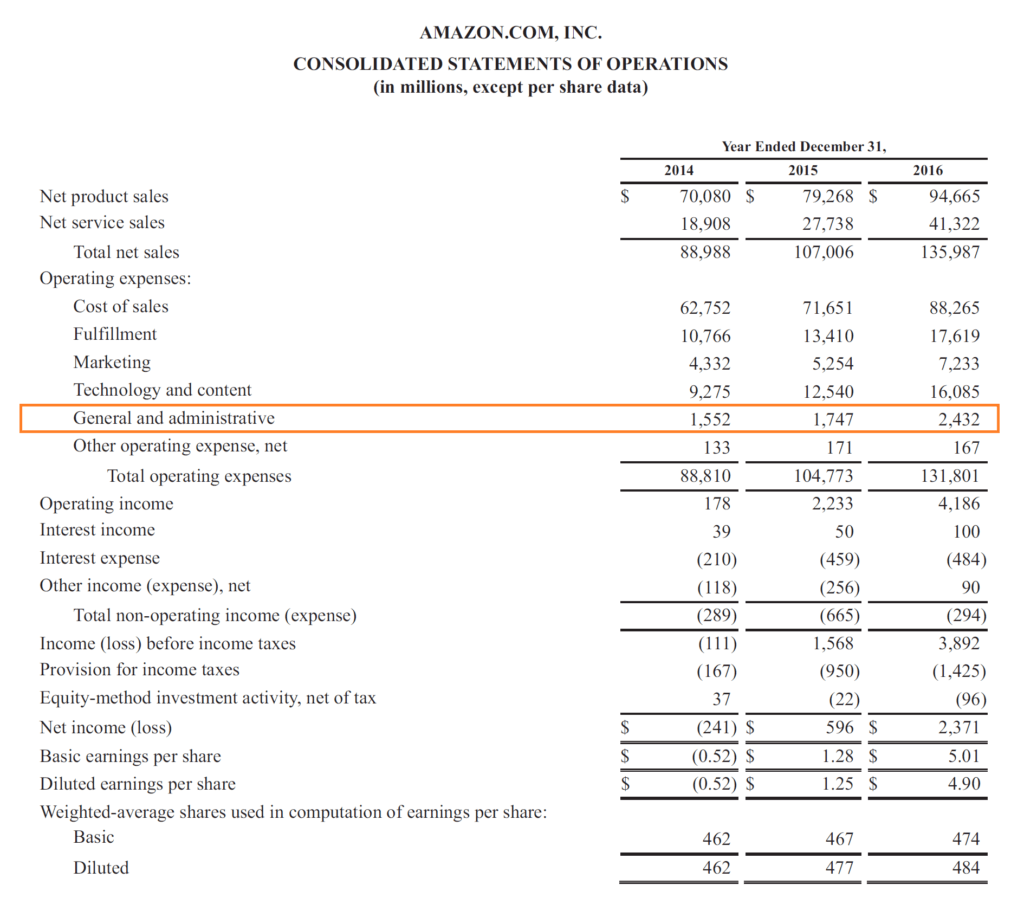

Statement of comprehensive income profit or loss by function of expense profit or loss. A statement of comprehensive income that shows expenses by their function is referred to as prepared using a multi step approach. Cost of goods sold selling costs administrative costs and other expenses. While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement.

Other income expense from subsidiaries jointly controlled entities and associates. Using the nature of expense method and the function of expense method identify the information to be presented on the face of the statement of comprehensive income as provided in pas 1 describe the nature of the statement of changes in equity identify the information to be presented on the face of the statement of changes in equity as provided in pas 1 describe the nature of discontinued. Profit loss year 2020. Most large and medium sized businesses use the function method of expense disclosure.

A statement of comprehensive income contains two main things. The use of function method to disclose expenses still requires us to disclose the individual expenses by nature method under each function either on the face of the income statement or in the notes to the income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)