Statement Of Comprehensive Income Depreciation Expense

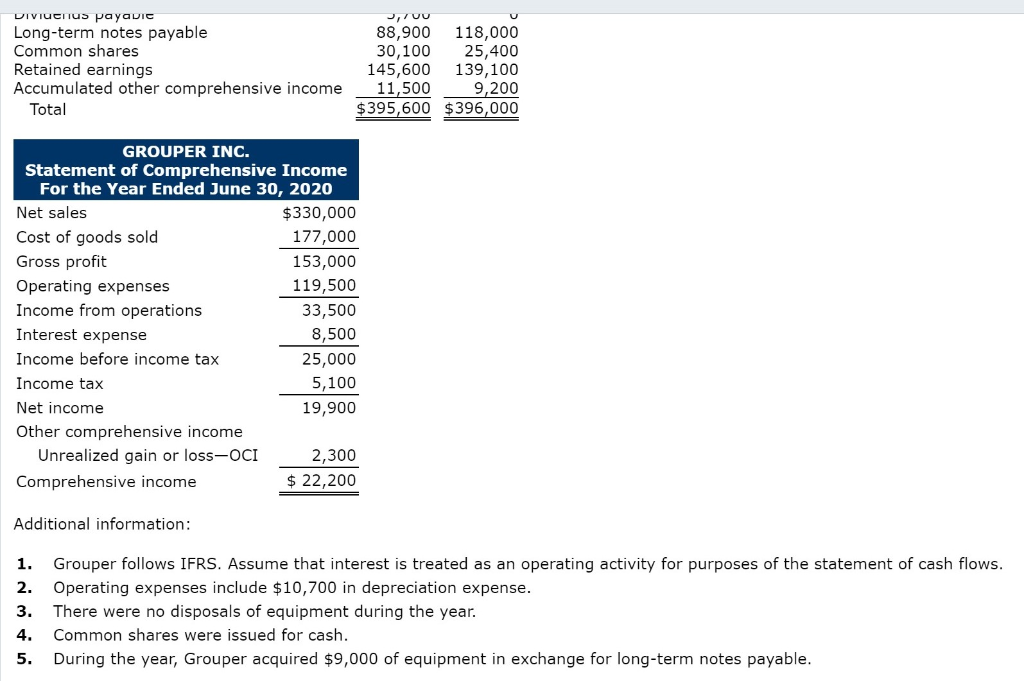

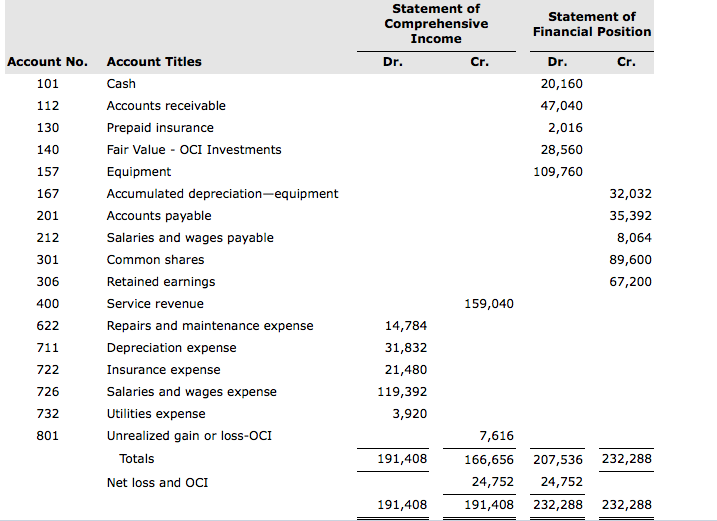

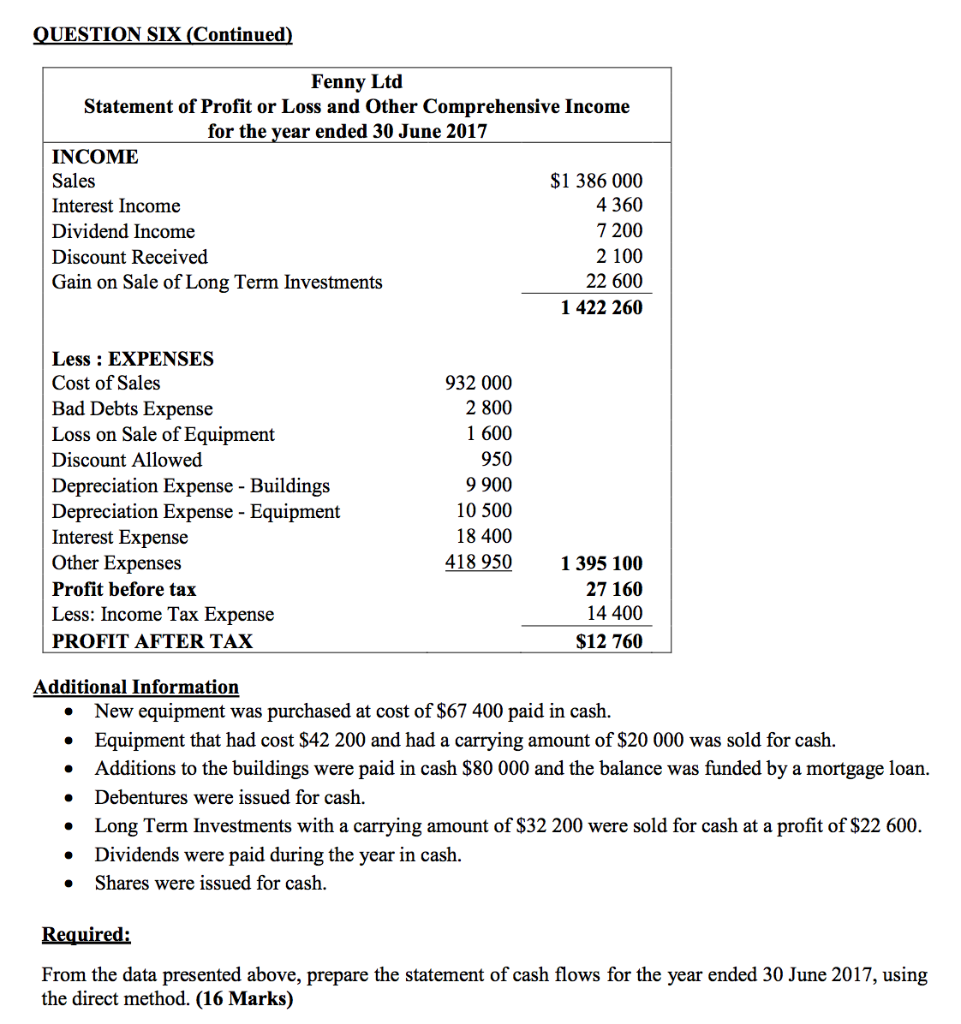

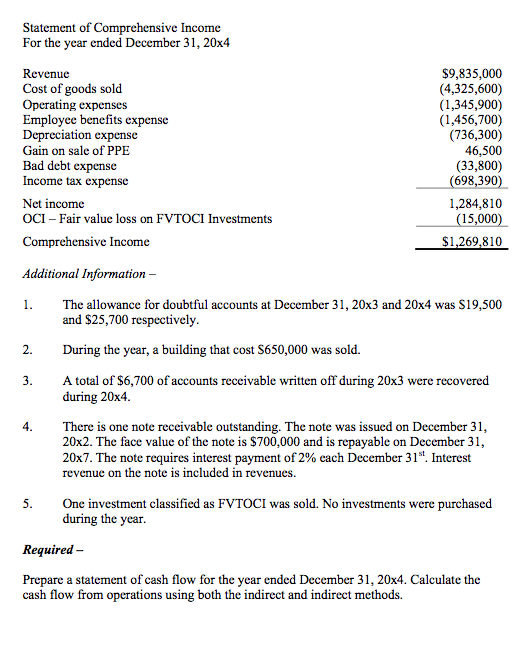

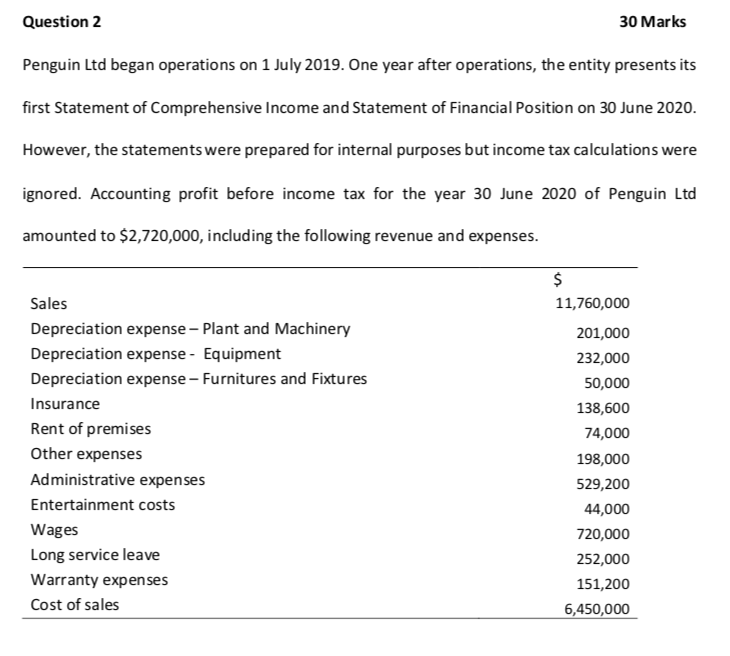

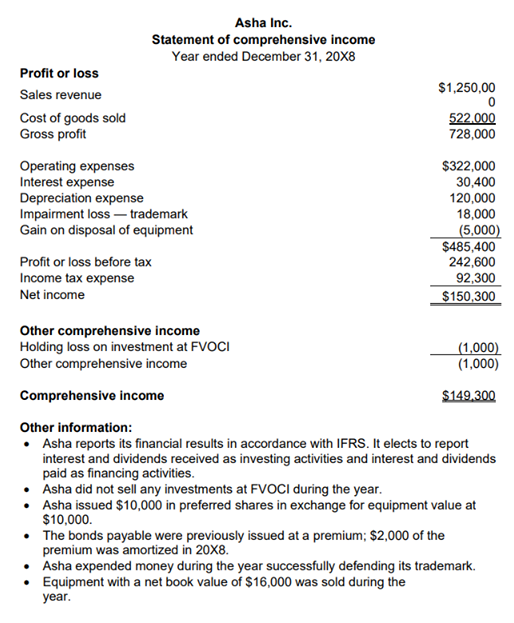

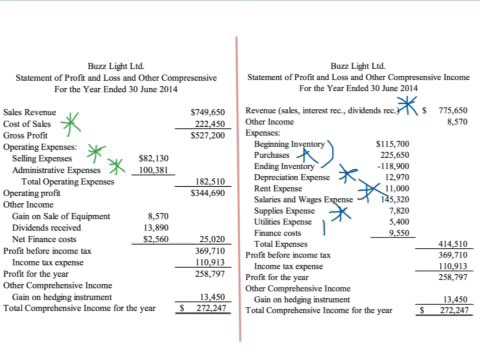

A statement of comprehensive income that begins with profit or loss bottom line of the income statement and displays the items of other comprehensive income for the reporting period ias 1 p 81 so the statement of comprehensive income aggregates income statement profit and loss statement and other comprehensive income which isn t reflected.

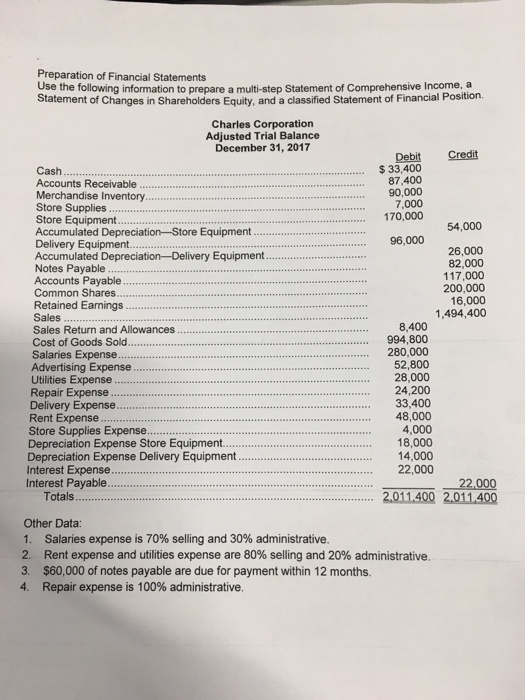

Statement of comprehensive income depreciation expense. Depreciation expense is an income statement item. It is accounted for when companies record the loss in value of their fixed assets through depreciation. E g depreciation on. There are different.

The quarterly income statements. Physical assets such as machines equipment or vehicles degrade over time and reduce in value incrementally. The formula of depreciation expense is used to find how much value of the asset can be deducted as an expense through the income statement. Interest is found.

Transportation out sales commissions depreciation sales income tax expense interest expense 2 690 7 980 6 480 96 500 7 580 1 860 4 900 3 960 63 570 17 230. Depreciation expense and accumulated depreciation. It is a non cash expense forming part of profit and loss statements. For a business entity performance is measured in terms of profit.

Although depreciation only relates to fixed assets other noncash items also affect the income statement. Depreciation on the income statement. Prepare an income statement from the data below. Depreciation may be defined as the decrease in the value of the asset due to wear and tear over a period of time.

An important component of financial statements of an entity is statement of comprehensive income. One of the most important components of the statement of comprehensive income is the income statement. But don t depend solely on it. Capitalized property plant and equipment pp e are also included in long term assets except for the portion designated to be expensed or depreciated.

Depreciation expense flows through an income statement and this is where accumulated depreciation connects to a statement of profit and loss the other name for an income statement or p l. After reading this article you will learn about the format of income statement. Officers salaries depreciation cost of goods sold rental revenue selling expense. The main purpose of this statement is performance measurement.

It is used to provide a summary of all the sources of revenue and expenses including payable taxes and interest charges interest expense interest expense arises out of a company that finances through debt or capital leases. The depreciation reported on the income statement is the amount of depreciation expense that is appropriate for the period of time indicated in the heading of the income statement. Amortization is the income statement expense that relates to intangible assets such as copyrights and patents. Using our example the monthly income statements will report 1 000 of depreciation expense.