Nyc Income Tax Brackets 2020

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples.

Nyc income tax brackets 2020. For your 2019 taxes which you ll file in early 2020 only individuals making. The ny tax forms are below. Fourteen states including new york allow local governments to collect an income tax. What is a local income tax.

2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. New york state income tax forms for tax year 2020 jan. The new york tax rate is mostly unchanged from last year. New york city s tax code doesn t include any deductions but the city does offer some credits of its own separate from those the state offers.

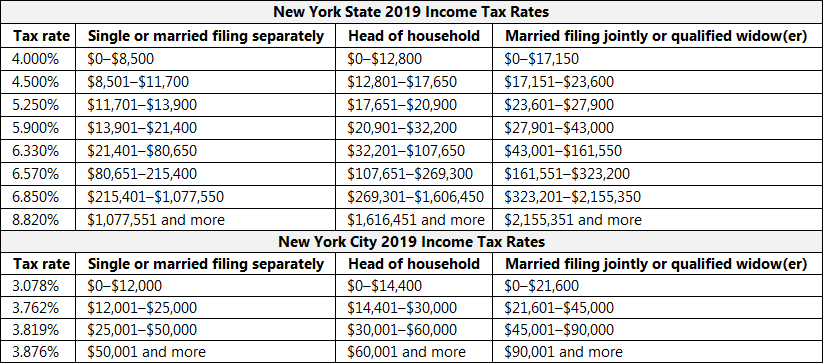

New york state income tax rate table for the 2019 2020 filing season has eight income tax brackets with ny tax rates of 4 4 5 5 25 5 9 6 21 6 49 6 85 and 8 82 for single married filing jointly married filing separately and head of household statuses. While the federal income tax and the new york income tax are progressive income taxes with multiple tax brackets all local income taxes are flat rate. Detailed new york state income tax rates and brackets are available on this page. 2020 tax year new york income tax forms.

The new york income tax has eight tax brackets with a maximum marginal income tax of 8 82 as of 2020. New york city is one of just a few cities in the u s. Income tax tables and other tax information is sourced from the new york department of taxation and finance. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

2020 new york tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. New york income tax rate 2019 2020. New york s top marginal income tax rate of 8 82 is one of the highest in the country but very few taxpayers pay that amount. 31 2020 can be e filed in conjunction with a irs income tax return.

That has a personal income tax. The new york city tax is calculated and paid on the new york state income tax return. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. This page has the latest new york brackets and tax rates plus a new york income tax calculator.

New york income taxes. New york s 2020 income tax ranges from 4 to 8 82.