Ohio Income Tax Extension

Oh individual income tax returns are due by april 15 or by the 15 th day of the 4 th month following the close of the taxable year for fiscal year filers.

Ohio income tax extension. The new deadline is july 15 an extension of approximately three months from the original deadline of april 15. The department also distributes revenue to local governments libraries and school districts. Extended deadline with ohio tax extension. Modified 2019 tax return due date.

Tax commissioner jeff mcclain today announced that ohio will be following the federal government and irs in extending the deadline to file and pay the state income tax. Typically this extension will give you until october 15 of the current year to file your ohio income tax return for the previous calendar year. There is a 50 additional fee for late registrations. Ohio law change affects servicemembers receiving disability severance february 26 2020.

The state of ohio. If you cannot file by this date you can get an ohio tax extension. Except as set forth in the military tax provisions there is no extension for paying the tax. Ohio offers a 6 month extension for individuals that have an approved federal extension which moves the filing deadline.

Ohio personal income tax returns are due by the 15 th day of the 4 th month after the end of the tax year usually april 15 for calendar year taxpayers. In order to get an ohio personal extension you must first obtain a federal tax extension irs form 4868. Ohio income tax return extension. Also you have the ability to view payments made within the past 61 months.

Keep up to date on our tax school events by subscribing to our osu tax school listserv. Allows you to electronically make ohio individual income and school district income tax payments. Include with your ohio income tax return a copy of your irs extension confirmation number or a printed copy of the irs acknowledgement. This includes extension and estimated payments original and amended return payments billing and assessment payments.

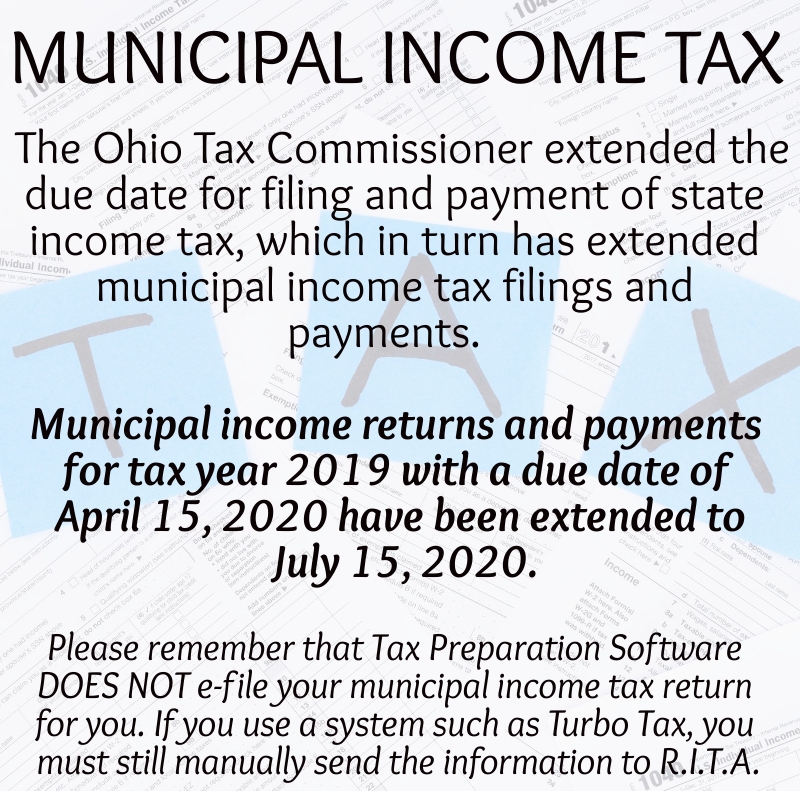

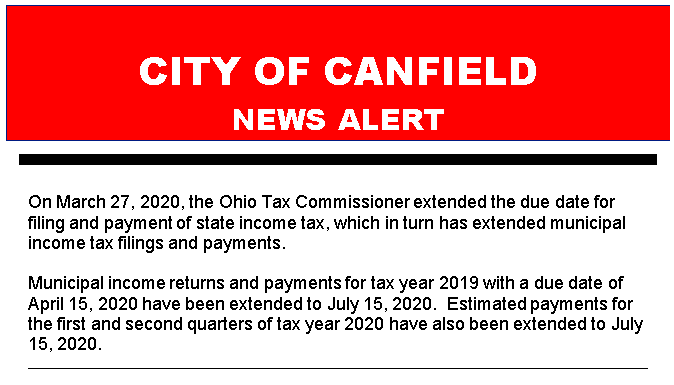

However the ohio department of taxation automatically grants a 6 month extension if you file a federal extension. Ohio extending income tax filing and payment deadline march 27 2020. Due to the coronavirus covid 19 all ohio individual and school district income tax returns it 1040 sd 100 payments with returns and estimated payments with due dates from april 15 2020 through june 15 2020 were extended without interest or penalty until july 15 2020. The new deadline is july 15 an extension of approximately three months from the original deadline of april 15.

July 15 2020 ohio filing due date. Ohio does not have a separate state extension form. An extension to file your return is not an extension of time to pay your taxes.