Income Tax Rate 2020 Philippines

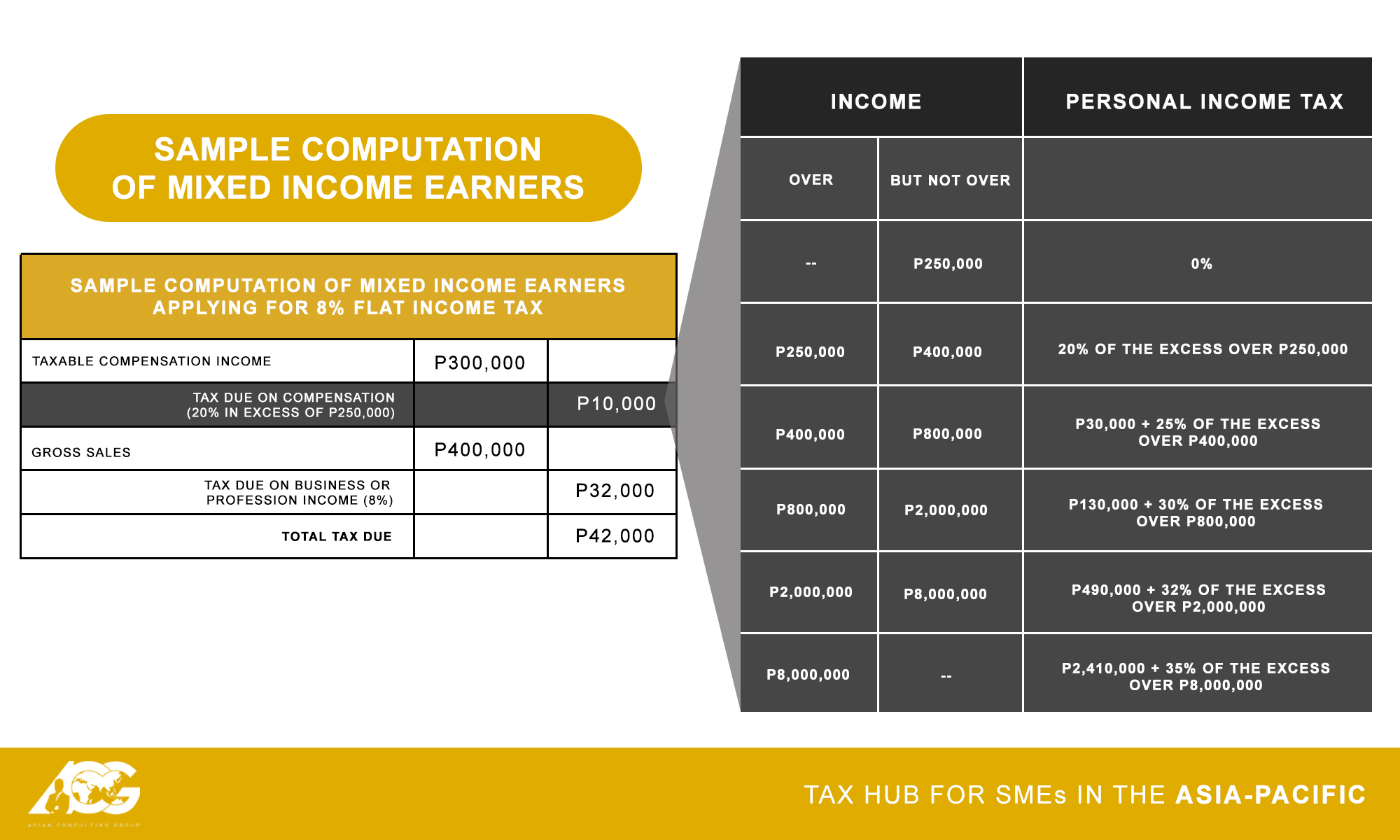

Sample income tax computation for the taxable year 2020.

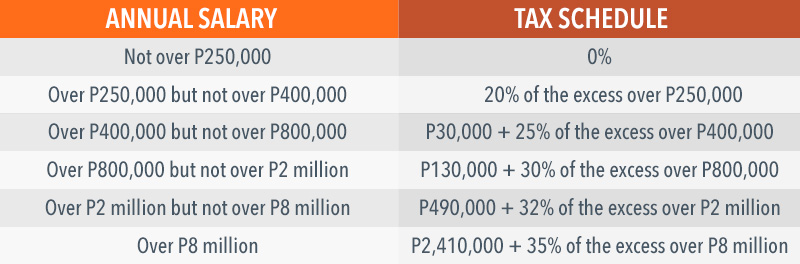

Income tax rate 2020 philippines. Those earning an annual salary of p250 000 or below will no longer pay income tax zero income tax. Salaries vary drastically between different careers. Graduated income tax rates for january 1 2023 and onwards. A person working in philippines typically earns around 44 600 php per month.

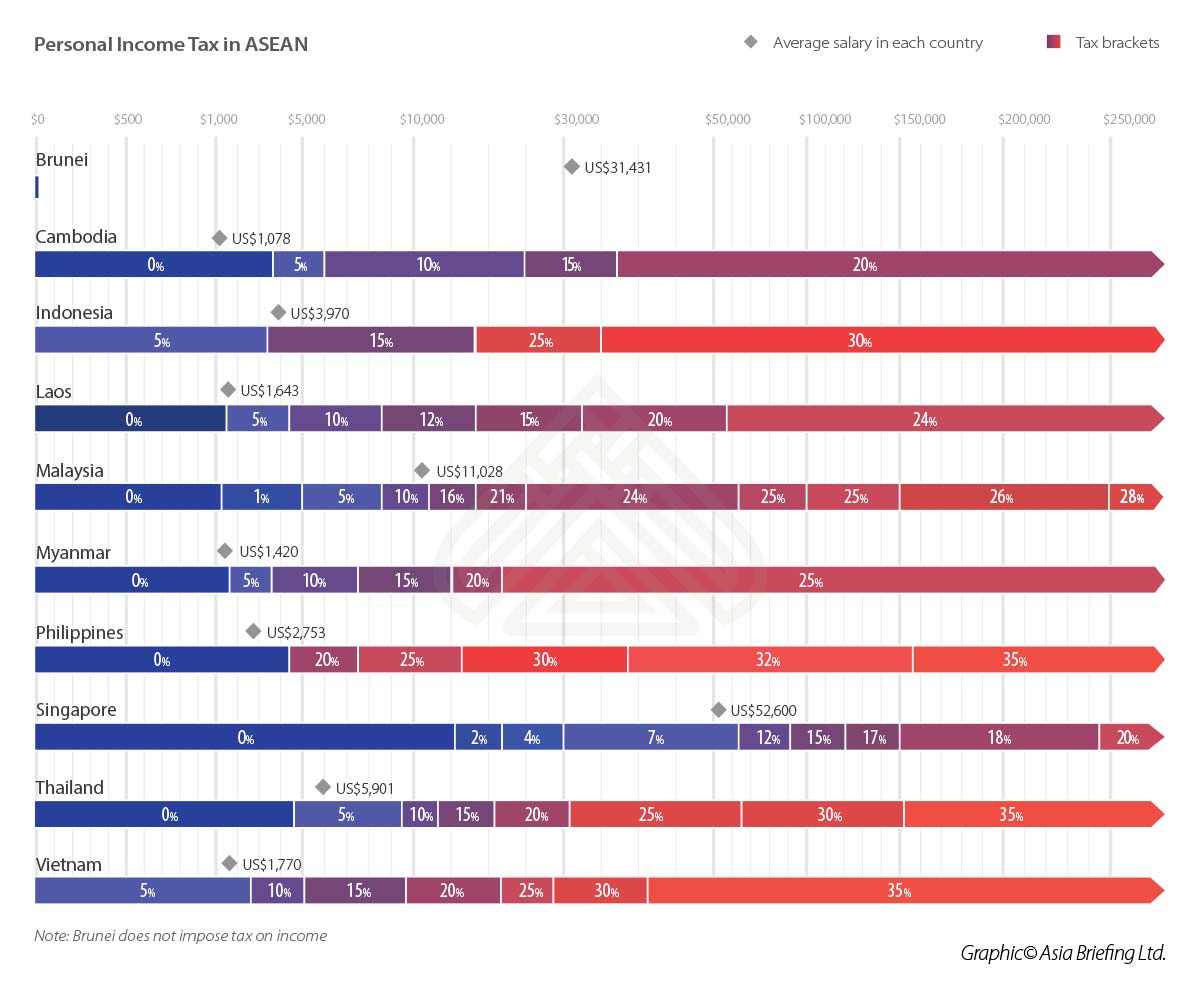

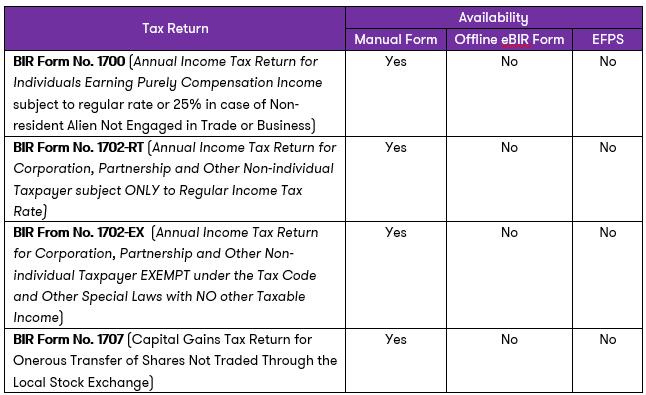

Please enter your total monthly salary. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. The tax caculator philipines 2020 is using the lastest bir income tax table as well as sss philhealth and pag ibig monthy contribution tables for the computation. Income tax rates in the philippines.

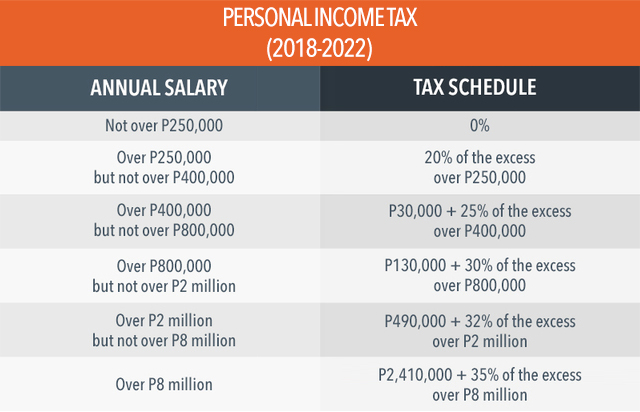

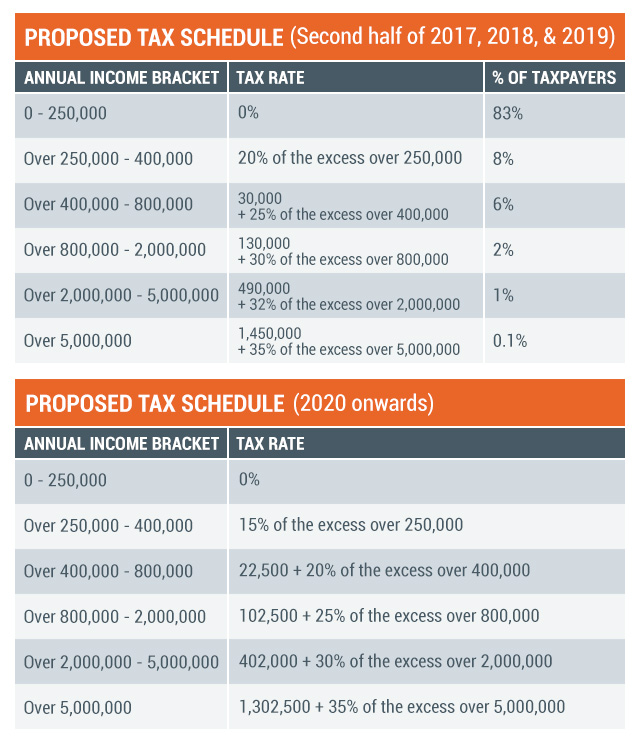

Kpmg s corporate tax table provides a view of corporate tax rates around the world. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. Follow these simple steps to calculate your salary after tax in philippines using the philippines salary calculator 2020 which is updated with the 2020 21 tax tables. In the approved tax reform bill under train from the initial implementation in the year 2018 until the year 2022.

Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000. Salaries range from 11 300 php lowest average to 199 000 php highest average actual maximum salary is higher. The corporate tax rate in philippines stands at 30 percent. Philippines personal income tax rate was 35 in 2020.

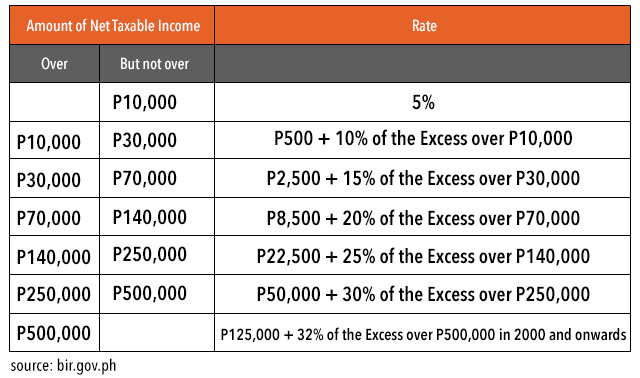

Income tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the tax code of 1997 tax code as amended less the deductions if any authorized for such types of income by the tax code as amended or other. Graduated income tax rates until december 31 2022. Use our interactive tax rates tool to compare tax rates by country or region. Tax rates for income subject to final tax.

This is the average monthly salary including housing transport and other benefits. Those earning annual incomes between p400 000 and p800. How to calculate your salary after tax in philippines. How to use bir tax calculator 2020 step 1.

How to compute your income tax based on graduated rates.