Arrange The Following Income Statement Items So They Are In The Proper Order Of An Income Statement

Sales cost of goods sold.

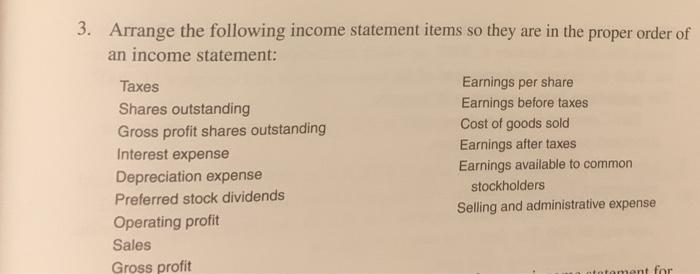

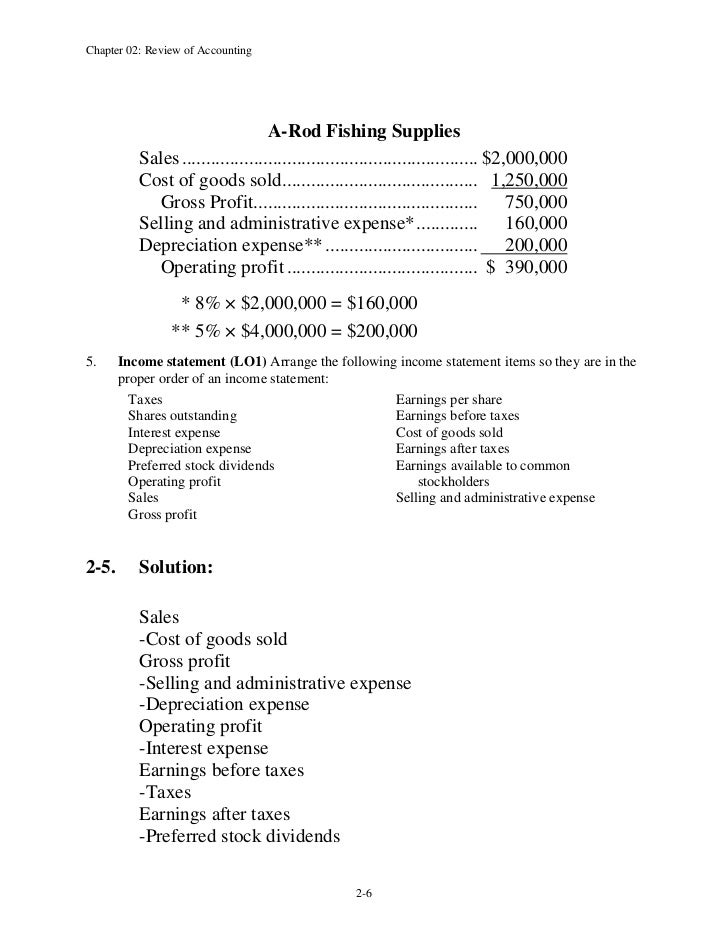

Arrange the following income statement items so they are in the proper order of an income statement. Taxes earnings per share shares outstanding earnings before taxes gross profit shares outstanding cost of goods sold interest expense earnings after taxes depreciation expense earnings available to common preferred stock dividends stockholders. Arrange the following income statement items so they are in the proper order of an income statement. Income statement lo1 arrange the following income statement items so they are in the proper order of an income statement. Arrange the following income statement items so they are in the proper order of an income statement.

2 5 arrange the following income statementitems so they are in the propefr order of an income statement. Cost of goods sold. Arrange the following income statement items so they are in the proper order of an income statement. In determining operating profit or loss select the operating expense first followed by the non cash expense taxes earnings per share shares outstanding earnings before taxes interest expense cost of goods sold depreciation expense earnings after taxes.

Arrange the following income statement items so they are in the proper order of an income statement. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. Depreciation expense earnings available to common preferred stock dividends stockholders 4. Give this income statement compute the following.

The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Taxes earnings per share shares outstanding earnings before taxes interest expense cost of goods sold depreciation expense earnings after taxes preferred stock dividends earnings available to common stockholders operating profit sales selling and administrative expense gross profit answer. Gross profit shares outstanding. Degree of operating leverage.

Taxes earnings per share shares outstanding earnings before taxes interest expense cost of goods sold depreciation expense earnings after taxes preferred stock dividends earnings available to common operating profit stockholders sales selling and administrative expense. Gross profit shares outstanding cost of goods sold interest expense earnings after taxes 5. Earnings per share earnings before taxes. Arrange the following income statement items so they are in the proper order of an income statement.

2 15 arrange the following items in proper balance sheet presentation. Problem 2 5 income statement lo1 arrange the following income statement items so they are in the proper order of an income statement. Arrange the following income statement items so they are in the proper order of an income statement.