Income Tax Rate Ohio 2020

Please note that as of 2016 taxable business income is taxed at a flat rate of 3.

Income tax rate ohio 2020. Before the official 2020 ohio income tax rates are released provisional 2020 tax rates are based on ohio s 2019 income tax brackets. The bid was enacted in 2015 3 and was intended as an economic development tool. The 2020 state personal income tax brackets are updated from the ohio and tax foundation data. Income tax tables and other tax information is sourced from the ohio department of taxation.

Ohio income tax rate 2019 2020. Ohio state corporate income tax 2020 1 0 ohio corporate income tax brackets tax bracket gross taxable income. This page has the latest ohio brackets and tax rates plus a ohio income tax calculator. The tax brackets have been indexed for inflation per ohio revised code section 5747 025.

2020 tax year ohio income tax forms. The following are the ohio individual income tax tables for 2005 through 2020. The oh 2020 tax forms are below. For the 2019 tax year which you file in early 2020 the top rate is 4 797.

Ohio state tax forms for tax year 2020 jan. Current law provides sole proprietors and investors in pass. Effective january 1 2020 hb 166 provides that income from certain trades or businesses is not eligible for ohio s business income deduction bid. Ohio tax forms are sourced from the ohio income tax forms page and are updated on a yearly basis.

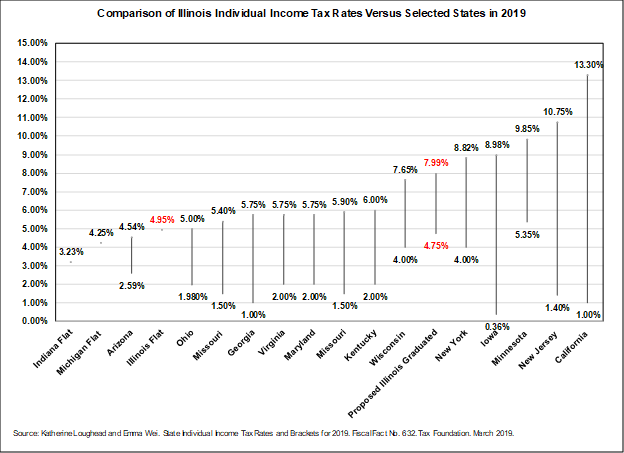

In addition to the ohio corporate income tax ohio corporations must also pay the federal corporate income. Top state income tax rates range from a high of 13 3 percent in california to 1 percent in tennessee according to the tax foundation study which was published in february. Income taxes accounted for 37 percent of state tax revenues in fiscal year 2017 the analysis said. Marginal corporate income tax rate.

The top ohio tax rate has decreased from 4 997 last year to 4 797 this year. Please make sure. Taxpayers with 22 150 or less of income are not subject to income tax for 2020. Details on how to only prepare and print an ohio 2020 tax return.

Starting in 2005 ohio s state income taxes saw a gradual decrease each year. 7 500 25 of the amount over 50 000. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. 31 2020 can be e filed along with a irs income tax return until october 15 2021.

Ohio s 2020 income tax ranges from 2 85 to 4 8.