Fixed Income Yield To Maturity

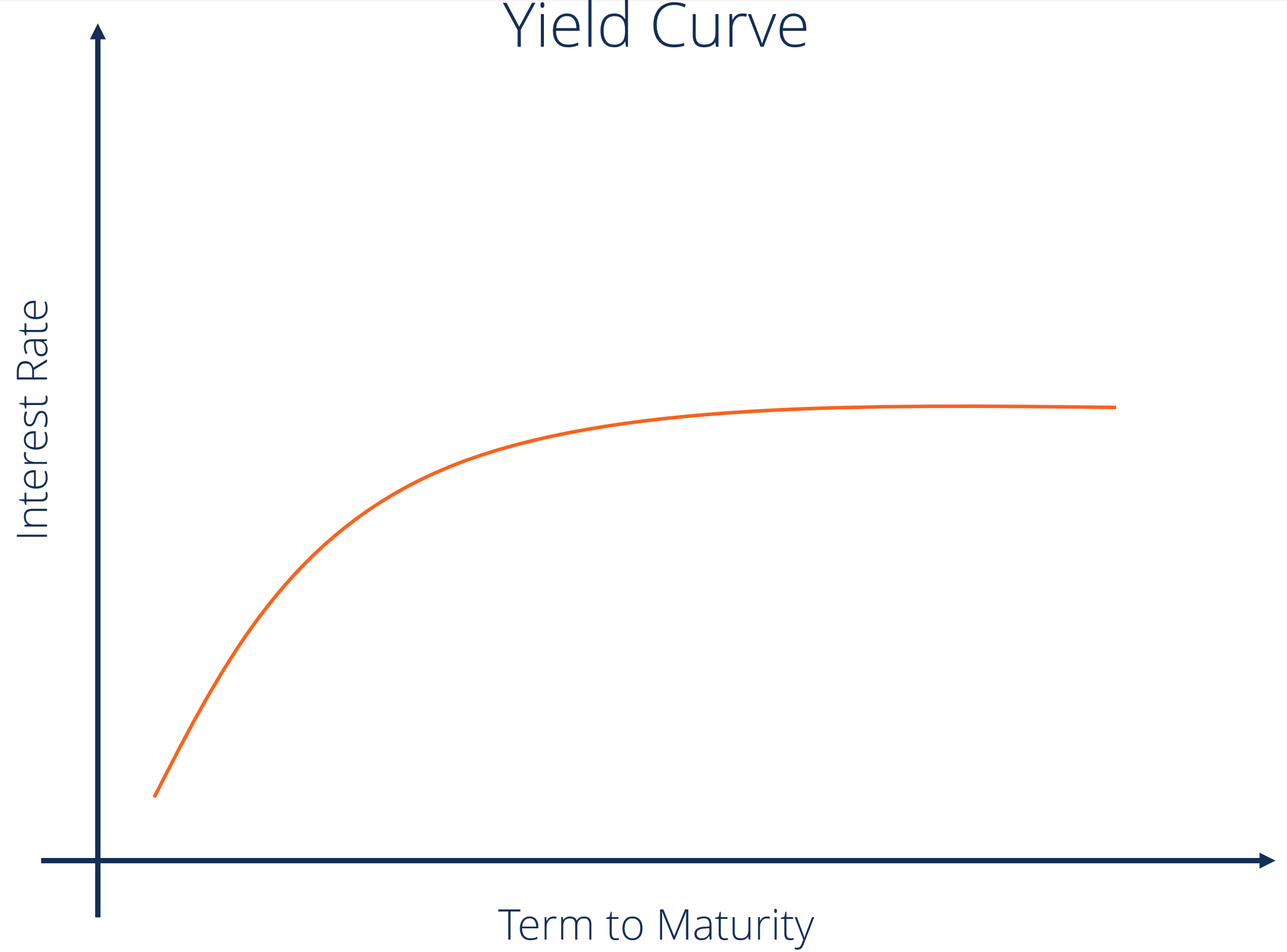

Yield to maturity ytm otherwise referred to as redemption or book yield is the speculative rate of return or interest rate of a fixed rate security such as a bond.

Fixed income yield to maturity. This practice referred to as burning the yield is done. Repurchase agreements and foreign currency risk some funds are subject to risk associated with fixed income investments like credit risk interest rate risk. It is used to calculate the return of a bond in the condition that the investor buys and sells the bond before its maturity. It is also referred to as the redemption yield or the book yield.

Uses of yield to maturity ytm yield to maturity can be quite useful for estimating whether buying a bond is a good investment. But it becomes popular around 2016 given their ability to pay out regular income and attractive yields. Is by itself a whole area of financial or investing study. I will mainly talk about fixed maturity bond fund today as it is the most common fmp.

An investor will determine a required yield the return on a bond. Annuity perpetuity coupon rate covariance current yield par value yield to maturity. The ytm is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured. The yield to maturity ytm of a bond is the annualized return that a bond investor would receive from holding the bond until maturity.

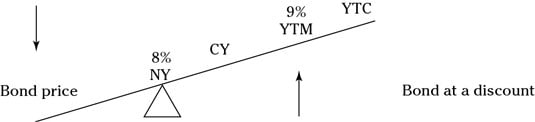

The yield to maturity ytm is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. Refers to the yield of a callable bond on the call date. In general terms they can be defined as loans made by investors to an issuer with. It is the sum of all of its remaining coupon payments.

The illegal practice of underwriters marking up the prices on bonds for the purpose of reducing the yield on the bond. Fixed maturity plan fmp does just that. Annual income of the bond divided by the current price of the bond. Fmp also know as fixed maturity portfolio or fixed maturity fund fmf is not a new investment product.

The yield to maturity ytm book yield or redemption yield of a bond or other fixed interest security such as gilts is the theoretical internal rate of return irr overall interest rate earned by an investor who buys the bond today at the market price assuming that the bond is held until maturity and that all coupon and principal payments are made on schedule.

:max_bytes(150000):strip_icc()/YieldToMaturity-bde8b386997642308405d1a07b2397c8.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

/16c2bc813fac68e26f0f7aea199a1cc9-dfac742897bb40eea19f17122bebf07e.jpg)

:max_bytes(150000):strip_icc()/InvertedYieldCurve2-d9c2792ee73047e0980f238d065630b8.png)